- United Arab Emirates

- /

- Other Utilities

- /

- DFM:DEWA

Dubai Electricity and Water Authority (PJSC) (DFM:DEWA) Has Affirmed Its Dividend Of AED0.062

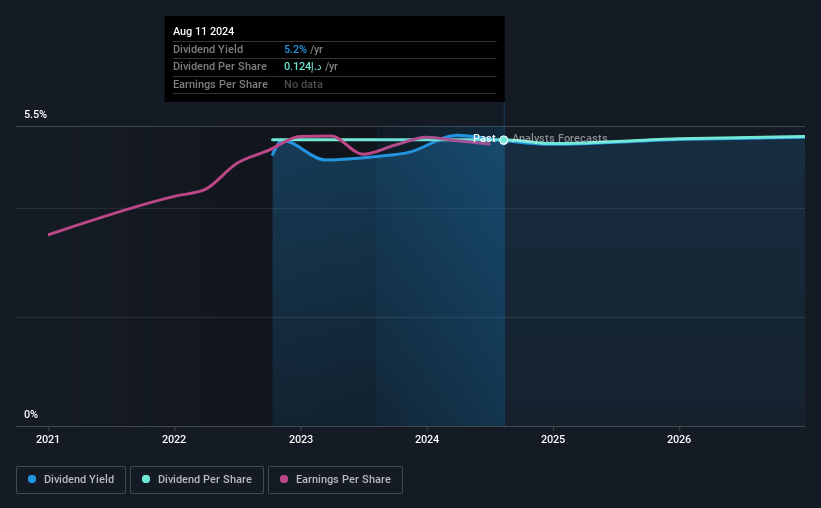

The board of Dubai Electricity and Water Authority (PJSC) (DFM:DEWA) has announced that it will pay a dividend on the 1st of January, with investors receiving AED0.062 per share. This means the dividend yield will be fairly typical at 5.2%.

See our latest analysis for Dubai Electricity and Water Authority (PJSC)

Dubai Electricity and Water Authority (PJSC)'s Payment Has Solid Earnings Coverage

Unless the payments are sustainable, the dividend yield doesn't mean too much. Before this announcement, Dubai Electricity and Water Authority (PJSC) was paying out 82% of earnings, but a comparatively small 66% of free cash flows. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

Earnings per share is forecast to rise by 4.2% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 79%, which is on the higher side, but certainly still feasible.

Dubai Electricity and Water Authority (PJSC) Is Still Building Its Track Record

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The last annual payment of AED0.124 was flat on the annual payment from2 years ago. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dubai Electricity and Water Authority (PJSC)'s Dividend Might Lack Growth

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Dubai Electricity and Water Authority (PJSC) has impressed us by growing EPS at 14% per year over the past three years. The payout ratio is very much on the higher end, which could mean that the growth rate will slow down in the future, and that could flow through to the dividend as well.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We don't think Dubai Electricity and Water Authority (PJSC) is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for Dubai Electricity and Water Authority (PJSC) that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:DEWA

Dubai Electricity and Water Authority (PJSC)

Generates, transmits, and distributes electricity for residential, commercial, industrial, and government customers primarily in Dubai.

Good value with mediocre balance sheet.