- United Arab Emirates

- /

- Transportation

- /

- DFM:DTC

We Think That There Are More Issues For Dubai Taxi Company P.J.S.C (DFM:DTC) Than Just Sluggish Earnings

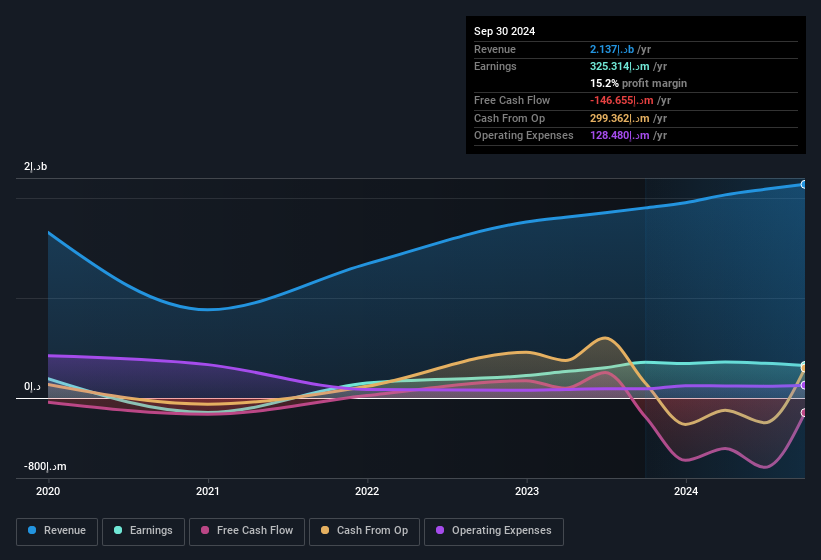

The subdued market reaction suggests that Dubai Taxi Company P.J.S.C.'s (DFM:DTC) recent earnings didn't contain any surprises. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

See our latest analysis for Dubai Taxi Company P.J.S.C

Zooming In On Dubai Taxi Company P.J.S.C's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

For the year to September 2024, Dubai Taxi Company P.J.S.C had an accrual ratio of 0.52. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of د.إ325.3m, a look at free cash flow indicates it actually burnt through د.إ147m in the last year. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of د.إ147m, this year, indicates high risk.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Dubai Taxi Company P.J.S.C's Profit Performance

As we have made quite clear, we're a bit worried that Dubai Taxi Company P.J.S.C didn't back up the last year's profit with free cashflow. As a result, we think it may well be the case that Dubai Taxi Company P.J.S.C's underlying earnings power is lower than its statutory profit. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So while earnings quality is important, it's equally important to consider the risks facing Dubai Taxi Company P.J.S.C at this point in time. For instance, we've identified 2 warning signs for Dubai Taxi Company P.J.S.C (1 is a bit unpleasant) you should be familiar with.

This note has only looked at a single factor that sheds light on the nature of Dubai Taxi Company P.J.S.C's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:DTC

Dubai Taxi Company P.J.S.C

A taxi company, provides transportation services in the United Arab Emirates.

Moderate growth potential with imperfect balance sheet.