Not Many Are Piling Into Emirates Integrated Telecommunications Company PJSC (DFM:DU) Just Yet

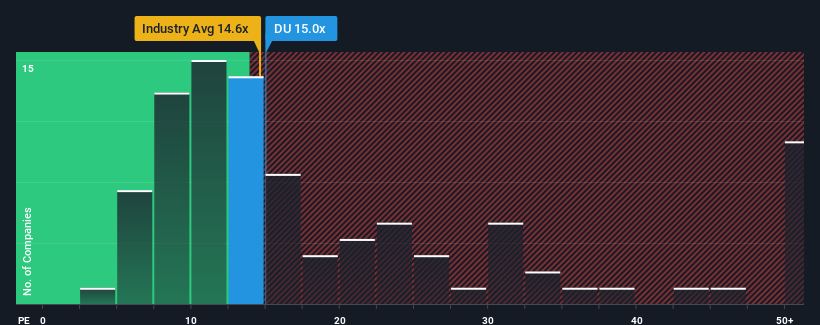

It's not a stretch to say that Emirates Integrated Telecommunications Company PJSC's (DFM:DU) price-to-earnings (or "P/E") ratio of 15x right now seems quite "middle-of-the-road" compared to the market in the United Arab Emirates, where the median P/E ratio is around 15x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Emirates Integrated Telecommunications Company PJSC certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Emirates Integrated Telecommunications Company PJSC

Is There Some Growth For Emirates Integrated Telecommunications Company PJSC?

In order to justify its P/E ratio, Emirates Integrated Telecommunications Company PJSC would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 24% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 15% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 8.6% per annum during the coming three years according to the three analysts following the company. That's shaping up to be materially higher than the 6.5% per annum growth forecast for the broader market.

In light of this, it's curious that Emirates Integrated Telecommunications Company PJSC's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Emirates Integrated Telecommunications Company PJSC's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Emirates Integrated Telecommunications Company PJSC you should be aware of.

Of course, you might also be able to find a better stock than Emirates Integrated Telecommunications Company PJSC. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Emirates Integrated Telecommunications Company PJSC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Emirates Integrated Telecommunications Company PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:DU

Emirates Integrated Telecommunications Company PJSC

Provides mobile, fixed services, broadband connectivity, and IPTV solutions to homes and businesses in the United Arab Emirates.

Outstanding track record with excellent balance sheet.