Investors Continue Waiting On Sidelines For Emirates Integrated Telecommunications Company PJSC (DFM:DU)

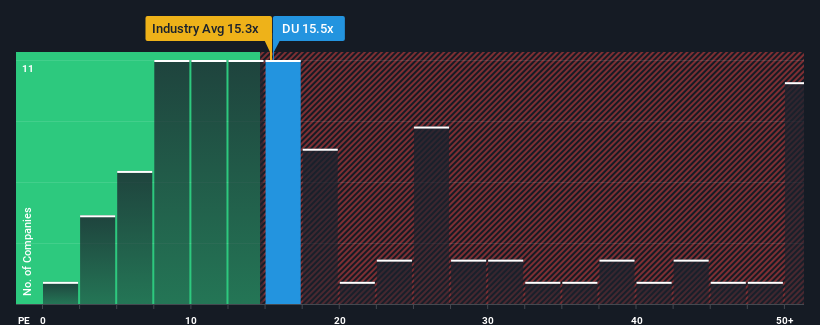

It's not a stretch to say that Emirates Integrated Telecommunications Company PJSC's (DFM:DU) price-to-earnings (or "P/E") ratio of 15.5x right now seems quite "middle-of-the-road" compared to the market in the United Arab Emirates, where the median P/E ratio is around 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Emirates Integrated Telecommunications Company PJSC as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Emirates Integrated Telecommunications Company PJSC

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Emirates Integrated Telecommunications Company PJSC's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 37% last year. EPS has also lifted 16% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 8.4% each year as estimated by the six analysts watching the company. With the market only predicted to deliver 6.2% per year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Emirates Integrated Telecommunications Company PJSC is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Emirates Integrated Telecommunications Company PJSC's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 1 warning sign for Emirates Integrated Telecommunications Company PJSC that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Emirates Integrated Telecommunications Company PJSC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Emirates Integrated Telecommunications Company PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:DU

Emirates Integrated Telecommunications Company PJSC

Provides mobile, fixed services, broadband connectivity, and IPTV solutions to homes and businesses in the United Arab Emirates.

Outstanding track record with excellent balance sheet.