- United Arab Emirates

- /

- Specialty Stores

- /

- ADX:ADNOCDIST

Investors Met With Slowing Returns on Capital At Abu Dhabi National Oil Company for Distribution PJSC (ADX:ADNOCDIST)

What trends should we look for it we want to identify stocks that can multiply in value over the long term? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Looking at Abu Dhabi National Oil Company for Distribution PJSC (ADX:ADNOCDIST), it does have a high ROCE right now, but lets see how returns are trending.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Abu Dhabi National Oil Company for Distribution PJSC, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

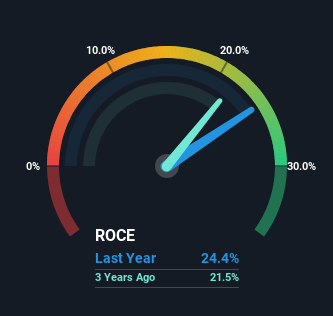

0.24 = د.إ2.6b ÷ (د.إ16b - د.إ5.8b) (Based on the trailing twelve months to June 2023).

So, Abu Dhabi National Oil Company for Distribution PJSC has an ROCE of 24%. That's a fantastic return and not only that, it outpaces the average of 10% earned by companies in a similar industry.

View our latest analysis for Abu Dhabi National Oil Company for Distribution PJSC

In the above chart we have measured Abu Dhabi National Oil Company for Distribution PJSC's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Abu Dhabi National Oil Company for Distribution PJSC here for free.

So How Is Abu Dhabi National Oil Company for Distribution PJSC's ROCE Trending?

Over the past five years, Abu Dhabi National Oil Company for Distribution PJSC's ROCE and capital employed have both remained mostly flat. This tells us the company isn't reinvesting in itself, so it's plausible that it's past the growth phase. So while the current operations are delivering respectable returns, unless capital employed increases we'd be hard-pressed to believe it's a multi-bagger going forward. That being the case, it makes sense that Abu Dhabi National Oil Company for Distribution PJSC has been paying out 88% of its earnings to its shareholders. These mature businesses typically have reliable earnings and not many places to reinvest them, so the next best option is to put the earnings into shareholders pockets.

What We Can Learn From Abu Dhabi National Oil Company for Distribution PJSC's ROCE

In summary, Abu Dhabi National Oil Company for Distribution PJSC isn't compounding its earnings but is generating decent returns on the same amount of capital employed. Although the market must be expecting these trends to improve because the stock has gained 99% over the last five years. But if the trajectory of these underlying trends continue, we think the likelihood of it being a multi-bagger from here isn't high.

If you'd like to know about the risks facing Abu Dhabi National Oil Company for Distribution PJSC, we've discovered 2 warning signs that you should be aware of.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

If you're looking to trade Abu Dhabi National Oil Company for Distribution PJSC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:ADNOCDIST

Abu Dhabi National Oil Company for Distribution PJSC

Abu Dhabi National Oil Company for Distribution PJSC, together with its subsidiaries, markets petroleum products, natural gas, and ancillary products in the United Arab Emirates.

Adequate balance sheet with limited growth.