- United Arab Emirates

- /

- Specialty Stores

- /

- ADX:ADNOCDIST

Analyst Forecasts Just Became More Bearish On Abu Dhabi National Oil Company for Distribution PJSC (ADX:ADNOCDIST)

The latest analyst coverage could presage a bad day for Abu Dhabi National Oil Company for Distribution PJSC (ADX:ADNOCDIST), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

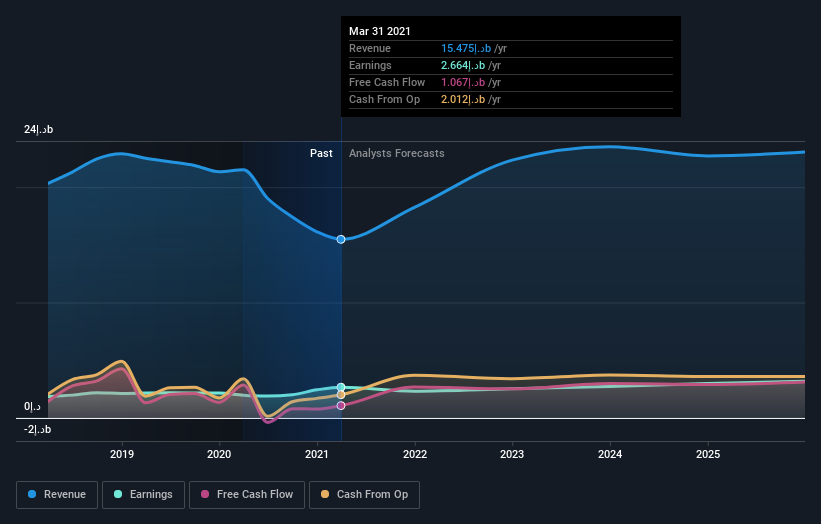

Following the downgrade, the latest consensus from Abu Dhabi National Oil Company for Distribution PJSC's eight analysts is for revenues of د.إ18b in 2021, which would reflect a solid 18% improvement in sales compared to the last 12 months. Statutory earnings per share are anticipated to drop 13% to د.إ0.18 in the same period. Previously, the analysts had been modelling revenues of د.إ21b and earnings per share (EPS) of د.إ0.19 in 2021. It looks like analyst sentiment has fallen somewhat in this update, with a measurable cut to revenue estimates and a small dip in earnings per share numbers as well.

View our latest analysis for Abu Dhabi National Oil Company for Distribution PJSC

Analysts made no major changes to their price target of د.إ4.11, suggesting the downgrades are not expected to have a long-term impact on Abu Dhabi National Oil Company for Distribution PJSC's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Abu Dhabi National Oil Company for Distribution PJSC, with the most bullish analyst valuing it at د.إ4.90 and the most bearish at د.إ3.35 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Abu Dhabi National Oil Company for Distribution PJSC shareholders.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. One thing stands out from these estimates, which is that Abu Dhabi National Oil Company for Distribution PJSC is forecast to grow faster in the future than it has in the past, with revenues expected to display 25% annualised growth until the end of 2021. If achieved, this would be a much better result than the 9.7% annual decline over the past three years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 14% annually. Not only are Abu Dhabi National Oil Company for Distribution PJSC's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on Abu Dhabi National Oil Company for Distribution PJSC after today.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Abu Dhabi National Oil Company for Distribution PJSC's financials, such as concerns around earnings quality. Learn more, and discover the 1 other warning sign we've identified, for free on our platform here.

We also provide an overview of the Abu Dhabi National Oil Company for Distribution PJSC Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Abu Dhabi National Oil Company for Distribution PJSC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ADX:ADNOCDIST

Abu Dhabi National Oil Company for Distribution PJSC

Abu Dhabi National Oil Company for Distribution PJSC, together with its subsidiaries, markets petroleum products, natural gas, and ancillary products in the United Arab Emirates.

Adequate balance sheet with limited growth.