- China

- /

- Electrical

- /

- SZSE:002323

3 Promising Penny Stocks With Market Caps Over US$400M

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with notable fluctuations in major indices and economic indicators, investors are exploring diverse opportunities. Penny stocks, despite their vintage label, continue to attract attention for their potential value and growth prospects. By focusing on those with strong financial foundations, investors might uncover promising opportunities among smaller or newer companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.69B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £434.2M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.045 | £770.58M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.84 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.97 | £153.01M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

Click here to see the full list of 5,812 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Union Properties (DFM:UPP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Union Properties Public Joint Stock Company, along with its subsidiaries, focuses on investing in, developing, managing, maintaining, and selling real estate properties mainly in the United Arab Emirates and has a market capitalization of approximately AED1.76 billion.

Operations: The company's revenue is derived from three main segments: Contracting (AED33.26 million), Real Estate (AED47.46 million), and Goods and Services (AED452.07 million).

Market Cap: AED1.76B

Union Properties has shown significant earnings growth, with a 983% increase over the past year, far surpassing industry averages. The company's net profit margins have improved to 16.5%, and it trades at a favorable price-to-earnings ratio of 2.1x compared to the AE market average. Despite its high return on equity of 30%, Union Properties faces challenges with negative operating cash flow and insufficient EBIT coverage for interest payments. While short-term assets exceed liabilities, indicating some financial stability, future earnings are forecasted to decline significantly over the next few years.

- Click here to discover the nuances of Union Properties with our detailed analytical financial health report.

- Explore Union Properties' analyst forecasts in our growth report.

Boyaa Interactive International (SEHK:434)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boyaa Interactive International Limited is an investment holding company that develops and operates online card and board games in China and internationally, with a market cap of HK$3.44 billion.

Operations: The company generates revenue from the PRC (Including Hong Kong) amounting to CN¥418.46 million.

Market Cap: HK$3.44B

Boyaa Interactive International has demonstrated substantial earnings growth, with a 116.5% increase over the past year, outpacing the entertainment industry. The company is debt-free and maintains strong financial health, as its short-term assets of CN¥1.7 billion far exceed liabilities. Despite recent volatility in share price and a low return on equity of 13.3%, Boyaa's net profit margins have improved significantly to 58.4%. Recent earnings reports indicate a mixed performance with quarterly losses but notable nine-month profits driven by digital asset gains and gaming revenue optimization efforts.

- Take a closer look at Boyaa Interactive International's potential here in our financial health report.

- Evaluate Boyaa Interactive International's historical performance by accessing our past performance report.

Shandong Yabo Technology (SZSE:002323)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shandong Yabo Technology Co., Ltd focuses on the design, research, and development of new materials for metal roof and wall enclosure systems and has a market cap of CN¥2.30 billion.

Operations: Shandong Yabo Technology Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥2.3B

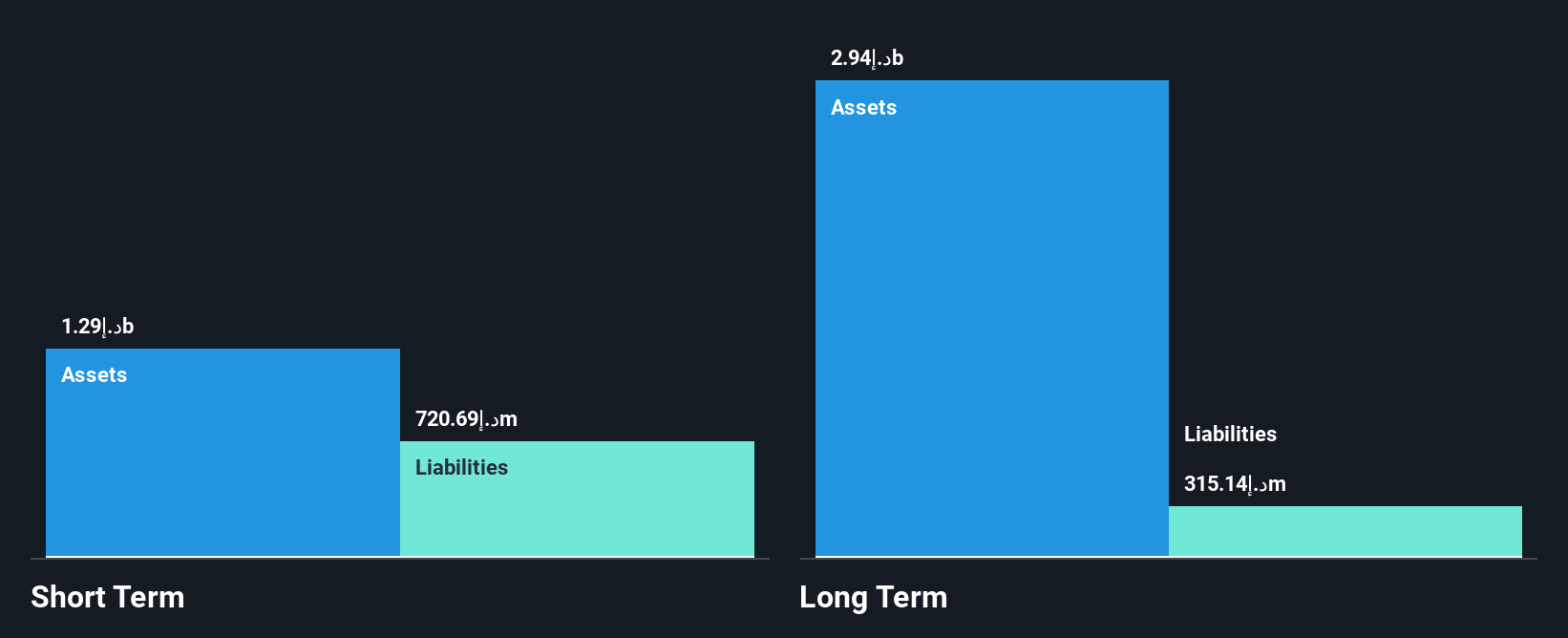

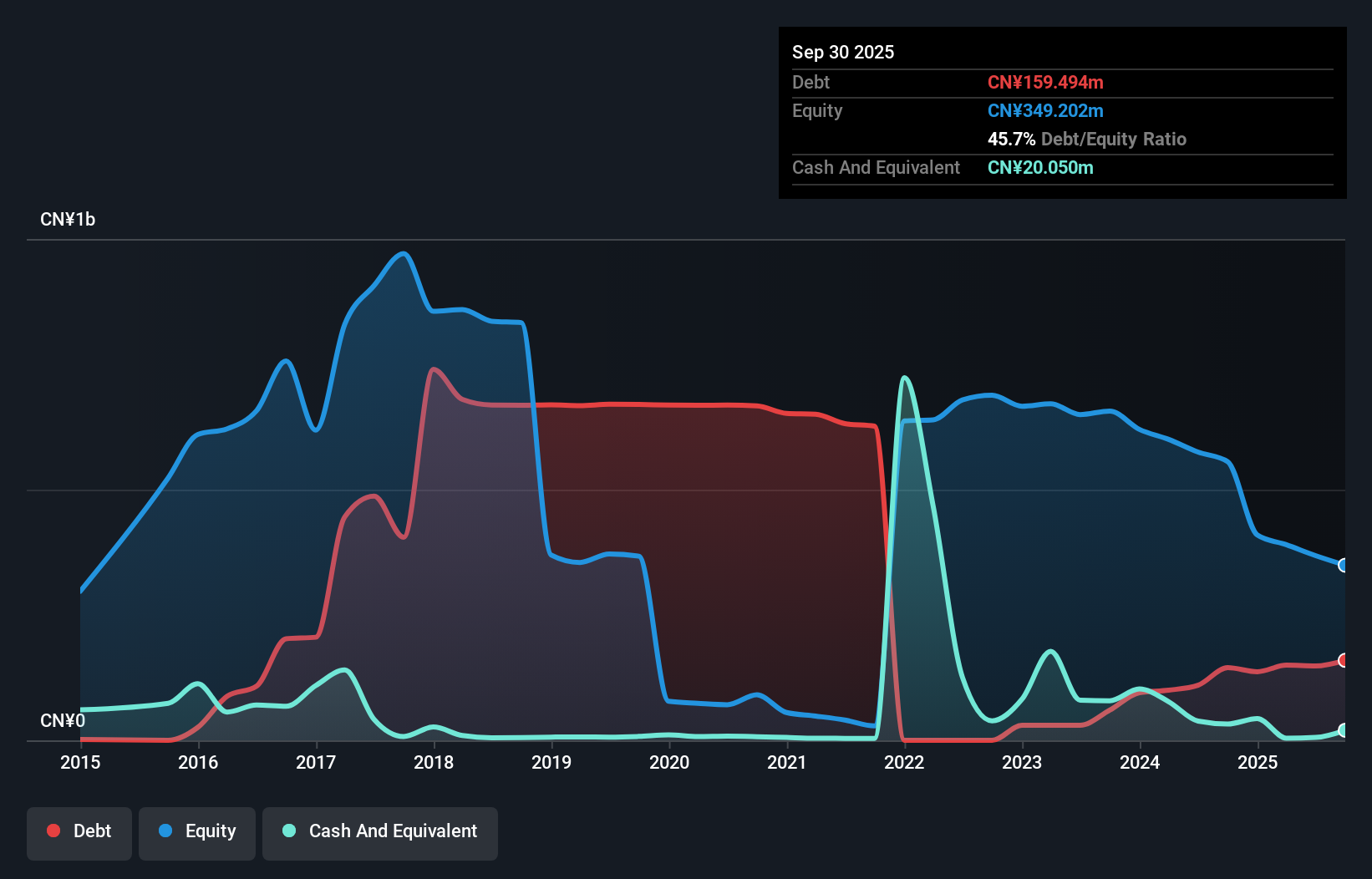

Shandong Yabo Technology Co., Ltd has faced financial challenges, with sales declining to CN¥188.47 million for the nine months ending September 2024, compared to CN¥481.63 million a year ago, resulting in a net loss of CN¥63.99 million. Despite this, the company has managed its debt effectively, reducing its debt-to-equity ratio from 182.4% to 26.1% over five years and maintaining a satisfactory net debt-to-equity ratio of 20.2%. Short-term assets exceed both short and long-term liabilities significantly; however, it faces a cash runway of less than one year amidst ongoing volatility in share price performance.

- Unlock comprehensive insights into our analysis of Shandong Yabo Technology stock in this financial health report.

- Explore historical data to track Shandong Yabo Technology's performance over time in our past results report.

Next Steps

- Embark on your investment journey to our 5,812 Penny Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002323

Shandong Yabo Technology

Engages in the design, research, and development of new materials for metal roof and wall enclosure systems.

Adequate balance sheet very low.