- United Arab Emirates

- /

- Real Estate

- /

- ADX:ESHRAQ

Loss-making Eshraq Investments PJSC (ADX:ESHRAQ) has seen earnings and shareholder returns follow the same downward trajectory over past -32%

While not a mind-blowing move, it is good to see that the Eshraq Investments PJSC (ADX:ESHRAQ) share price has gained 12% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 32% in the last three years, falling well short of the market return.

On a more encouraging note the company has added د.إ99m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for Eshraq Investments PJSC

Because Eshraq Investments PJSC made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years Eshraq Investments PJSC saw its revenue shrink by 7.3% per year. That's not what investors generally want to see. The stock has disappointed holders over the last three years, falling 10%, annualized. And with no profits, and weak revenue, are you surprised? Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

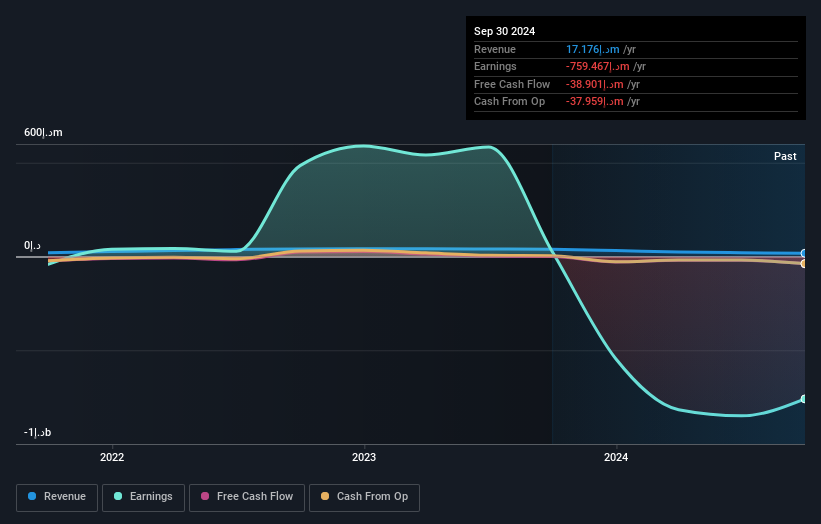

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Eshraq Investments PJSC stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Eshraq Investments PJSC has rewarded shareholders with a total shareholder return of 26% in the last twelve months. That gain is better than the annual TSR over five years, which is 4%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Eshraq Investments PJSC (1 doesn't sit too well with us) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Emirian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Eshraq Investments PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:ESHRAQ

Flawless balance sheet low.

Market Insights

Community Narratives