- China

- /

- Basic Materials

- /

- SZSE:300135

Top Penny Stock Picks For February 2025

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, including rate adjustments by central banks and volatile corporate earnings reports, investors are keenly observing the shifts in major indices. Amidst these developments, penny stocks—often associated with smaller or newer companies—continue to capture interest due to their potential for significant returns. Despite being an outdated term, penny stocks remain relevant as they can offer hidden value when backed by solid financials. In this article, we explore three such opportunities that combine balance sheet strength with growth potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.73 | HK$42.85B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.66B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.695 | MYR411.2M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £431.2M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.14 | HK$723.66M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.24 | £159.81M | ★★★★★☆ |

Click here to see the full list of 5,713 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Gulf Pharmaceutical Industries P.S.C (ADX:JULPHAR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gulf Pharmaceutical Industries P.S.C., along with its subsidiaries, is engaged in the manufacturing and sale of medicines, drugs, and various pharmaceutical, medical, and cosmetic compounds in the UAE, other GCC countries, and internationally; it has a market cap of AED1.80 billion.

Operations: The company's revenue is primarily derived from its Planet segment, which generated AED1.14 billion, and its Manufacturing segment, contributing AED834.1 million.

Market Cap: AED1.8B

Gulf Pharmaceutical Industries P.S.C. has shown improvement in reducing its losses, reporting a net loss of AED 7.3 million for the first nine months of 2024 compared to AED 83.4 million the previous year. Despite being unprofitable, the company benefits from experienced leadership and maintains a strong financial position with short-term assets exceeding both short-term and long-term liabilities. However, its debt-to-equity ratio is high at 96.2%. The stock is trading significantly below estimated fair value but remains highly volatile, which may appeal to investors seeking potential turnaround opportunities in penny stocks with substantial risk tolerance.

- Navigate through the intricacies of Gulf Pharmaceutical Industries P.S.C with our comprehensive balance sheet health report here.

- Assess Gulf Pharmaceutical Industries P.S.C's previous results with our detailed historical performance reports.

Xinjiang Xinxin Mining Industry (SEHK:3833)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xinjiang Xinxin Mining Industry Co., Ltd. and its subsidiaries are involved in the mining, ore processing, smelting, refining, and sale of nickel, copper, and other nonferrous metals with a market cap of HK$1.97 billion.

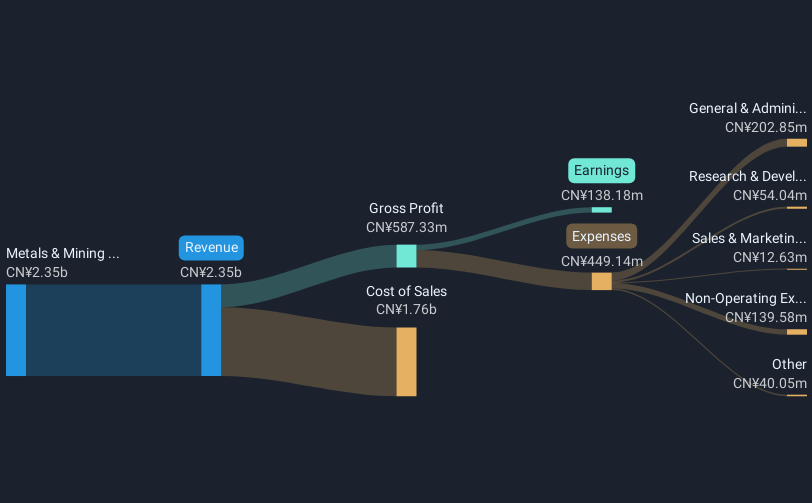

Operations: The company's revenue primarily comes from its Metals & Mining - Miscellaneous segment, which generated CN¥2.35 billion.

Market Cap: HK$1.97B

Xinjiang Xinxin Mining Industry Co., Ltd. presents a mixed picture for investors interested in penny stocks. The company's short-term assets exceed both short- and long-term liabilities, indicating solid liquidity. Its debt is well covered by operating cash flow, and interest payments are comfortably managed with EBIT coverage of 27.5 times. However, the company faces challenges with declining profit margins and negative earnings growth over the past year, compounded by a significant one-off loss affecting recent financial results. Recent board changes highlight potential strategic shifts but may also introduce uncertainty given the inexperienced management team tenure.

- Click to explore a detailed breakdown of our findings in Xinjiang Xinxin Mining Industry's financial health report.

- Explore historical data to track Xinjiang Xinxin Mining Industry's performance over time in our past results report.

Jiangsu Baoli International Investment (SZSE:300135)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jiangsu Baoli International Investment Co., Ltd. operates in the investment sector and has a market capitalization of CN¥3.83 billion.

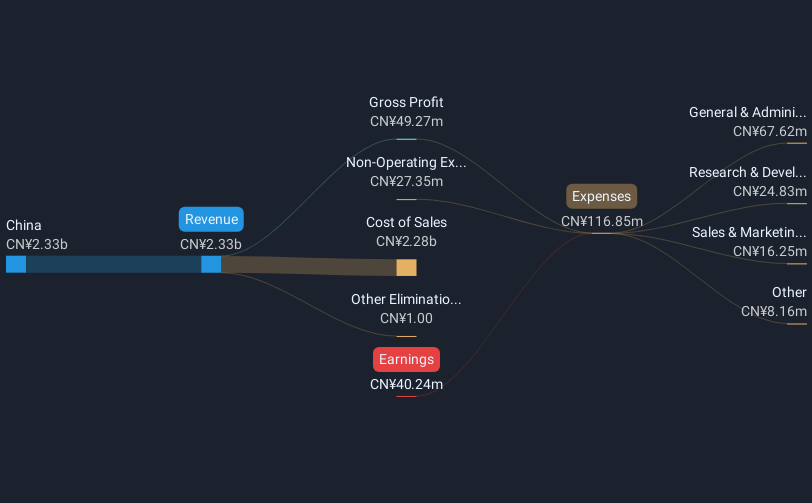

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥2.33 billion.

Market Cap: CN¥3.83B

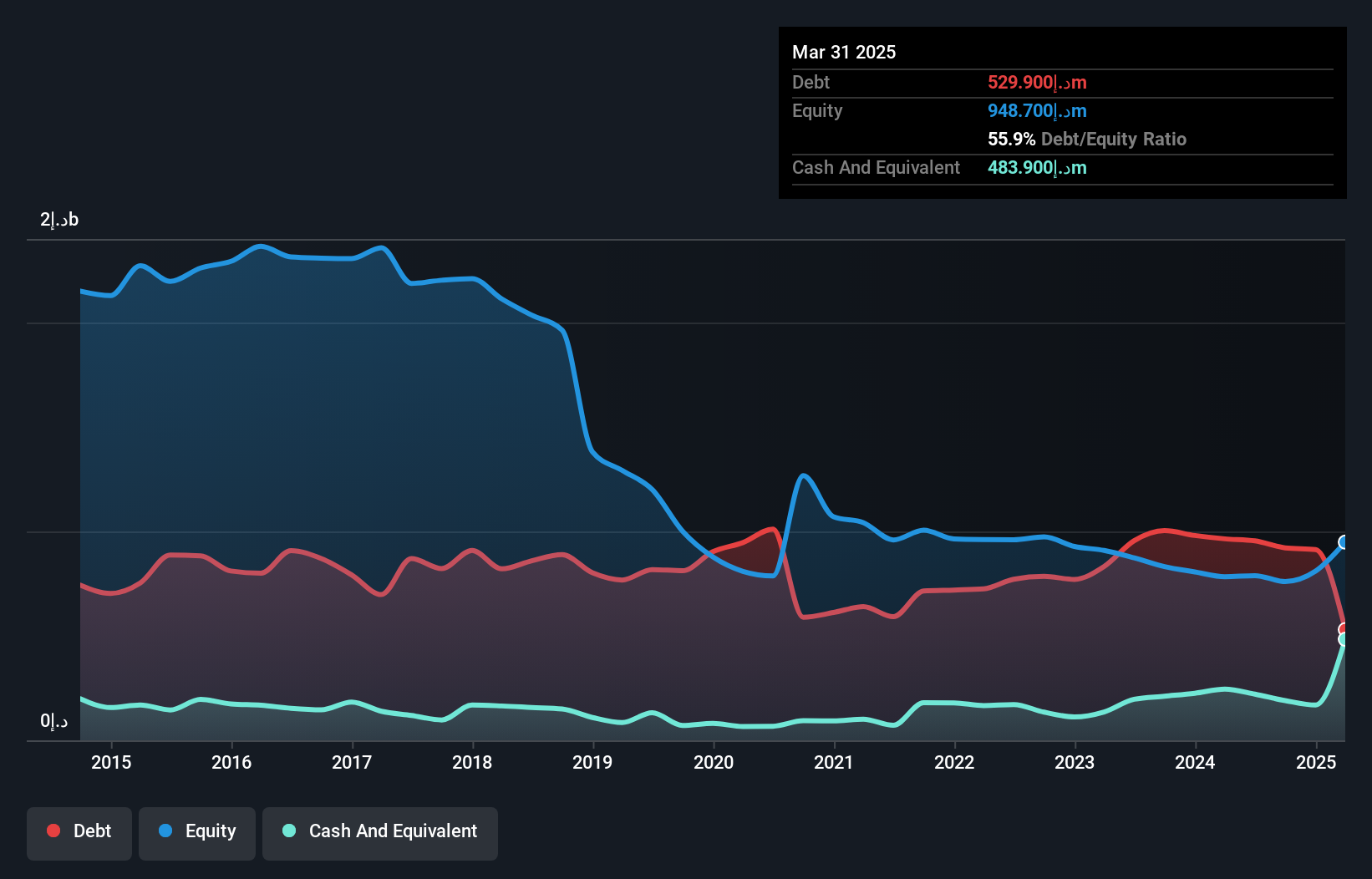

Jiangsu Baoli International Investment Co., Ltd. offers a complex scenario for penny stock investors. The company has a market capitalization of CN¥3.83 billion and generates revenue of CN¥2.33 billion, yet remains unprofitable with a negative return on equity of -4.89%. Despite this, it benefits from strong liquidity, as short-term assets exceed both short- and long-term liabilities significantly. Its debt-to-equity ratio has improved over five years but remains high at 42%. Recent M&A activity involving the sale of a 22.57% stake suggests strategic shifts that could impact future performance amidst its volatile share price history.

- Click here and access our complete financial health analysis report to understand the dynamics of Jiangsu Baoli International Investment.

- Gain insights into Jiangsu Baoli International Investment's past trends and performance with our report on the company's historical track record.

Next Steps

- Unlock more gems! Our Penny Stocks screener has unearthed 5,710 more companies for you to explore.Click here to unveil our expertly curated list of 5,713 Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300135

Jiangsu Baoli International Investment

Jiangsu Baoli International Investment Co., Ltd.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives