- United Arab Emirates

- /

- Basic Materials

- /

- DFM:NCC

Exploring Undiscovered Gems With Potential In January 2025

Reviewed by Simply Wall St

As global markets experience a surge in optimism fueled by hopes for softer tariffs and advancements in artificial intelligence, major indices like the S&P 500 have reached new heights, while small-cap stocks lag behind their larger counterparts. Amidst this backdrop of political and economic shifts, investors are keenly searching for undiscovered gems—stocks that demonstrate strong fundamentals and potential resilience to navigate the evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Xili Intelligent TechnologyLtd | NA | 10.32% | 5.63% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | 7.88% | 10.55% | ★★★★★★ |

| Beijing WKW Automotive PartsLtd | 14.05% | -0.88% | 72.94% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Nacity Property Service GroupLtd | NA | 8.88% | 3.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

National Cement Company (Public Shareholding) (DFM:NCC)

Simply Wall St Value Rating: ★★★★★★

Overview: National Cement Company (Public Shareholding Co.) engages in the manufacturing and sale of cement and related products both within the United Arab Emirates and internationally, with a market capitalization of AED1.24 billion.

Operations: NCC generates revenue primarily from the sale of cement, amounting to AED186.07 million. The company's financial performance can be assessed by examining its gross profit margin, which reflects its efficiency in managing production costs relative to sales.

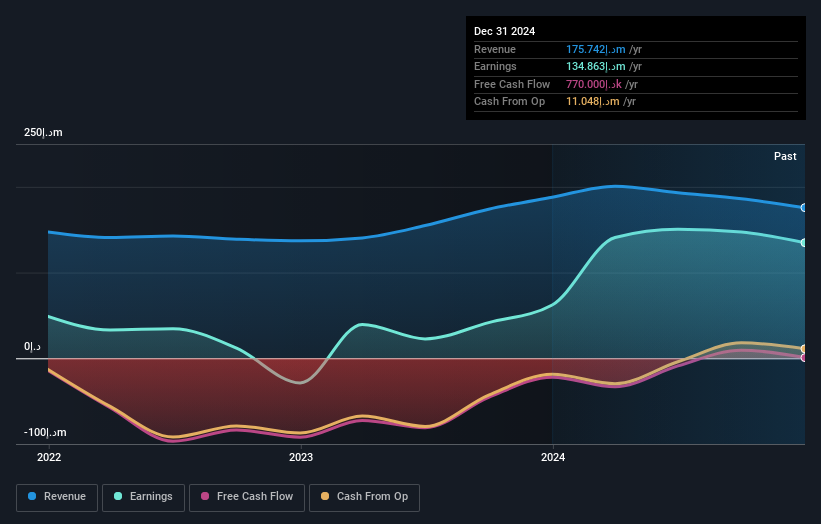

National Cement Company, a smaller player in the market, stands out with its impressive earnings growth of 253.8% over the past year, significantly outperforming the Basic Materials industry average of 26.5%. Despite a volatile share price recently, NCC's debt-free status is notable compared to five years ago when it had a debt-to-equity ratio of 21.9%. The company's P/E ratio of 8.4x suggests it may be undervalued relative to the AE market's average of 13.6x. However, recent reports show third-quarter sales at AED 41.88 million and net income at AED 6.67 million, both lower than last year's figures for the same period.

CNSIG Inner Mongolia Chemical IndustryLtd (SHSE:600328)

Simply Wall St Value Rating: ★★★★★☆

Overview: CNSIG Inner Mongolia Chemical Industry Co., Ltd. operates in the chemical industry and has a market capitalization of CN¥11.07 billion.

Operations: CNSIG Inner Mongolia Chemical Industry Co., Ltd. generates revenue primarily from its chemical products, with significant contributions from various product lines within the sector. The company focuses on optimizing its cost structure to enhance profitability, reflected in its financial performance metrics. Notably, the net profit margin has shown a trend worth examining for insights into operational efficiency and profitability dynamics over time.

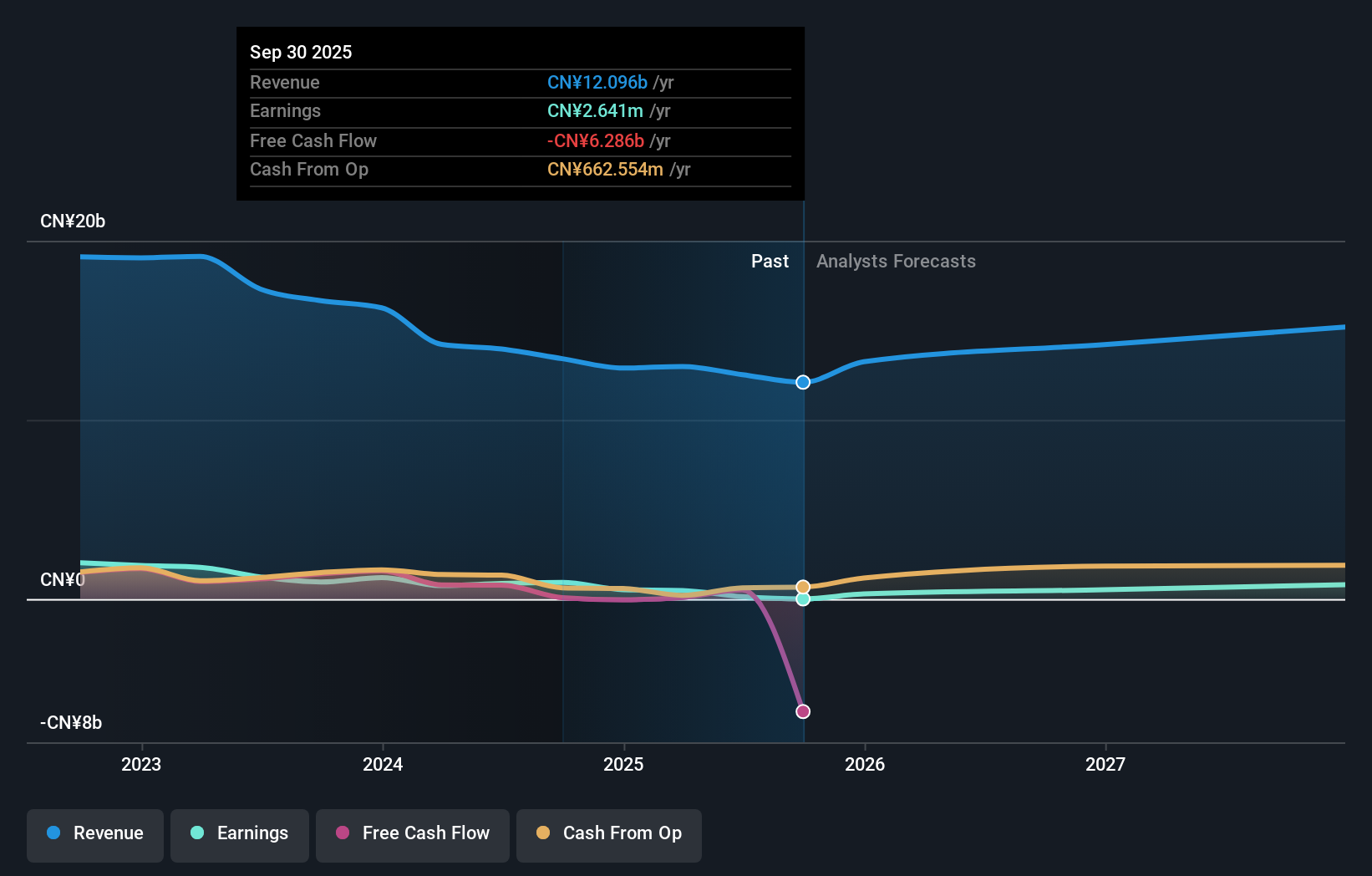

CNSIG Inner Mongolia Chemical Industry, a small player in the chemical sector, is trading at an attractive price-to-earnings ratio of 12.5x compared to the CN market average of 34.7x. Despite experiencing a negative earnings growth of 7% over the past year, its financial health appears robust with interest payments well covered by EBIT at 49.9x and a reduced debt-to-equity ratio from 53.4% to 6.3% over five years. The company recently repurchased shares worth CNY 3.16 million as part of a larger buyback plan aimed at enhancing shareholder value and employee incentives, signaling confidence in its future prospects.

Qingdao Baheal Medical (SZSE:301015)

Simply Wall St Value Rating: ★★★★★★

Overview: Qingdao Baheal Medical INC. focuses on the research, development, production, and sale of pharmaceutical products with a market capitalization of CN¥12.24 billion.

Operations: Qingdao Baheal Medical INC. generates revenue primarily from the sale of pharmaceutical products. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management over time.

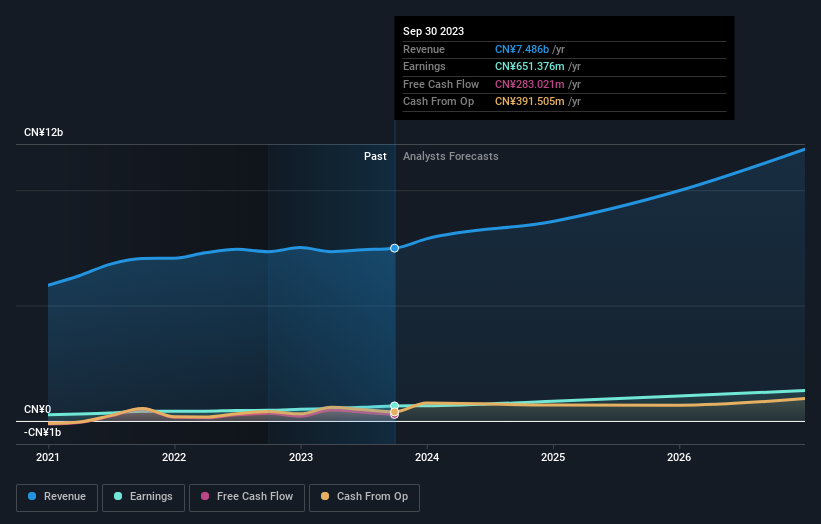

Qingdao Baheal Medical has shown impressive earnings growth of 53.5% over the past year, outpacing the healthcare industry's -5.7%. The company seems to be managing its debt well, with a net debt to equity ratio of 7%, considered satisfactory, and interest payments are comfortably covered by EBIT at 24.2 times. Trading at a price-to-earnings ratio of 17.4x, it appears undervalued compared to the CN market average of 34.7x. Recent shareholder meetings indicate active governance engagement, potentially setting the stage for continued strategic development and growth in earnings projected at 20.71% annually moving forward.

- Unlock comprehensive insights into our analysis of Qingdao Baheal Medical stock in this health report.

Explore historical data to track Qingdao Baheal Medical's performance over time in our Past section.

Taking Advantage

- Navigate through the entire inventory of 4671 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Cement Company (Public Shareholding) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:NCC

National Cement Company (Public Shareholding)

Manufactures and sells cement and cement related products in the United Arab Emirates and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives