- United Arab Emirates

- /

- Basic Materials

- /

- ADX:FCI

Why Investors Shouldn't Be Surprised By Fujairah Cement Industries P.J.S.C.'s (ADX:FCI) Low P/S

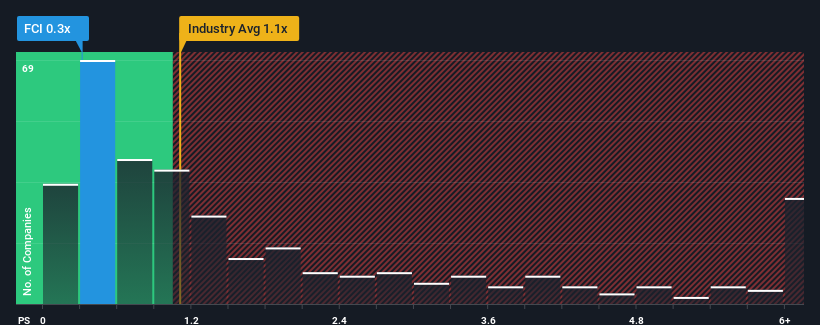

You may think that with a price-to-sales (or "P/S") ratio of 0.3x Fujairah Cement Industries P.J.S.C. (ADX:FCI) is a stock worth checking out, seeing as almost half of all the Basic Materials companies in the United Arab Emirates have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Fujairah Cement Industries P.J.S.C

What Does Fujairah Cement Industries P.J.S.C's P/S Mean For Shareholders?

For example, consider that Fujairah Cement Industries P.J.S.C's financial performance has been pretty ordinary lately as revenue growth is non-existent. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Fujairah Cement Industries P.J.S.C's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Fujairah Cement Industries P.J.S.C?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Fujairah Cement Industries P.J.S.C's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 16% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 1.6% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why Fujairah Cement Industries P.J.S.C's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Fujairah Cement Industries P.J.S.C's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Fujairah Cement Industries P.J.S.C revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Fujairah Cement Industries P.J.S.C (1 is a bit unpleasant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Fujairah Cement Industries P.J.S.C, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Fujairah Cement Industries PJSC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:FCI

Fujairah Cement Industries PJSC

Together with its subsidiary, manufactures and sells clinkers and hydraulic cement, and ready mixed and dry mix concrete and mortars in the United Arab Emirates and internationally.

Moderate with weak fundamentals.

Market Insights

Community Narratives