- United Arab Emirates

- /

- Basic Materials

- /

- ADX:APEX

Apex Investment PSC (ADX:APEX) Looks Just Right With A 28% Price Jump

The Apex Investment PSC (ADX:APEX) share price has done very well over the last month, posting an excellent gain of 28%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.0% in the last twelve months.

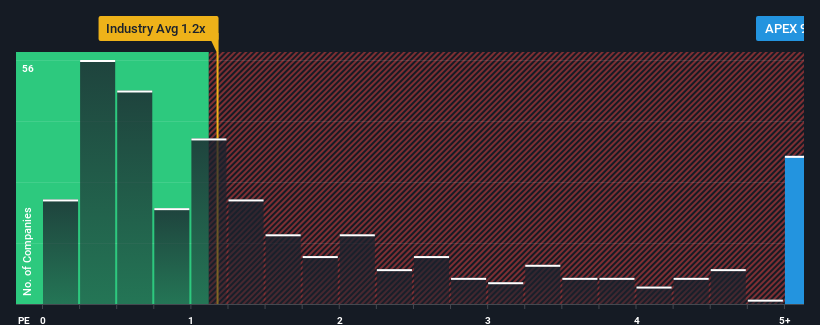

After such a large jump in price, given around half the companies in the United Arab Emirates' Basic Materials industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider Apex Investment PSC as a stock to avoid entirely with its 9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Apex Investment PSC

How Apex Investment PSC Has Been Performing

The revenue growth achieved at Apex Investment PSC over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Apex Investment PSC will help you shine a light on its historical performance.How Is Apex Investment PSC's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Apex Investment PSC's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to shrink 2.3% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this in mind, it's clear to us why Apex Investment PSC's P/S exceeds that of its industry peers. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

What We Can Learn From Apex Investment PSC's P/S?

Apex Investment PSC's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Apex Investment PSC revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

You should always think about risks. Case in point, we've spotted 1 warning sign for Apex Investment PSC you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:APEX

Apex Investment PSC

Manufactures, distributes, and sells clinkers and cement products in the United Arab Emirates and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)