- United Arab Emirates

- /

- Insurance

- /

- DFM:TAKAFUL-EM

Benign Growth For Takaful Emarat - Insurance (PSC) (DFM:TAKAFUL-EM) Underpins Its Share Price

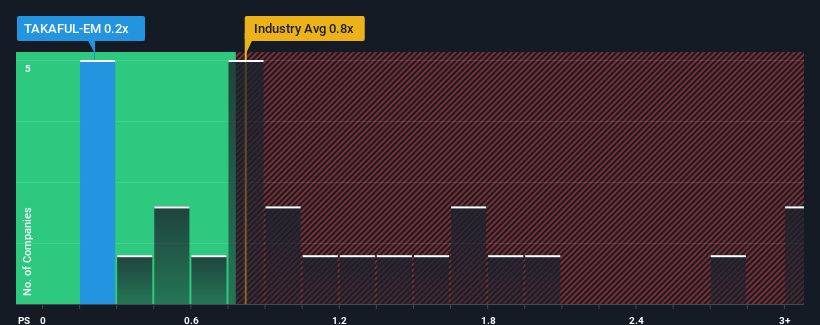

When you see that almost half of the companies in the Insurance industry in the United Arab Emirates have price-to-sales ratios (or "P/S") above 0.8x, Takaful Emarat - Insurance (PSC) (DFM:TAKAFUL-EM) looks to be giving off some buy signals with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Takaful Emarat - Insurance (PSC)

How Has Takaful Emarat - Insurance (PSC) Performed Recently?

Recent times have been quite advantageous for Takaful Emarat - Insurance (PSC) as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on Takaful Emarat - Insurance (PSC) will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Takaful Emarat - Insurance (PSC)'s earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Takaful Emarat - Insurance (PSC)?

The only time you'd be truly comfortable seeing a P/S as low as Takaful Emarat - Insurance (PSC)'s is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 112% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 28% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 7.6% shows the industry is more attractive on an annualised basis regardless.

With this in consideration, it's no surprise that Takaful Emarat - Insurance (PSC)'s P/S falls short of its industry peers. Nonetheless, with revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares heavily.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear that Takaful Emarat - Insurance (PSC) trades at a low P/S relative to the wider industry on the weakness of its recent three-year revenue being even worse than the forecasts for a struggling industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Although, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 4 warning signs for Takaful Emarat - Insurance (PSC) (2 are a bit unpleasant!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Takaful Emarat - Insurance (PSC) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:TAKAFUL-EM

Takaful Emarat - Insurance (PSC)

Engages in the takaful insurance activities in the United Arab Emirates.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives