As global markets navigate a period of mixed performance, with large-cap stocks generally outperforming their smaller-cap counterparts and expectations rising for a Federal Reserve rate cut, investors are keenly observing the dynamics impacting small-cap companies. The Russell 2000 Index's recent underperformance highlights the challenges faced by smaller firms amid economic shifts such as stalled inflation progress and a cooling labor market. In this environment, identifying promising small-cap stocks involves looking for those with solid fundamentals that can withstand broader market pressures while capitalizing on niche opportunities within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xiangtan Electrochemical ScientificLtd | 44.62% | 13.70% | 36.55% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hunan Investment GroupLtd | 7.09% | 33.04% | 20.37% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Sukoon Insurance PJSC (DFM:SUKOON)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sukoon Insurance PJSC offers insurance solutions to individuals and businesses in the United Arab Emirates, with a market capitalization of approximately AED 1.85 billion.

Operations: Sukoon Insurance PJSC generates revenue primarily from its Non-Life Insurance segment, contributing AED 800.53 million, and Life Insurance segment, with AED 19.56 million. The company also reports unallocated net investment income of AED 198.03 million and incurs unallocated net insurance finance expenses amounting to AED -27.14 million.

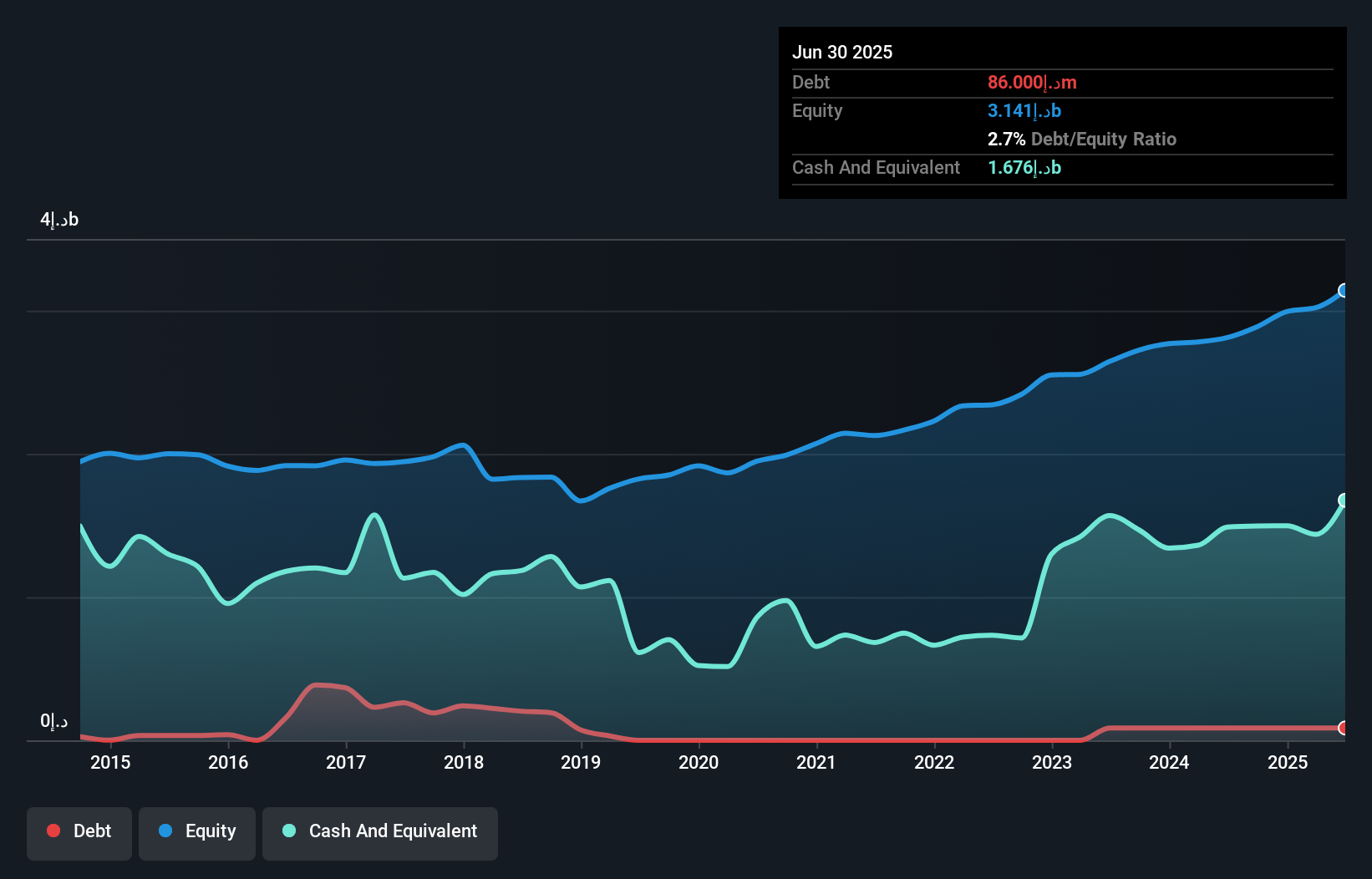

Sukoon Insurance PJSC, a smaller player in the insurance sector, shows a solid financial footing with more cash than total debt and an impressive EBIT coverage of interest payments at 46.9 times. Its price-to-earnings ratio of 7.6x is attractive compared to the AE market average of 12.7x, suggesting potential undervaluation. However, liquidity concerns arise due to highly illiquid shares and a slight increase in the debt-to-equity ratio from 0% to 3% over five years. Despite these challenges, Sukoon's earnings growth outpaces industry averages with high-quality earnings and positive free cash flow contributing positively to its outlook.

AgeSA Hayat ve Emeklilik Anonim Sirketi (IBSE:AGESA)

Simply Wall St Value Rating: ★★★★★☆

Overview: AgeSA Hayat ve Emeklilik Anonim Sirketi operates in the pension and life insurance sector mainly in Turkey, with a market capitalization of TRY26.42 billion.

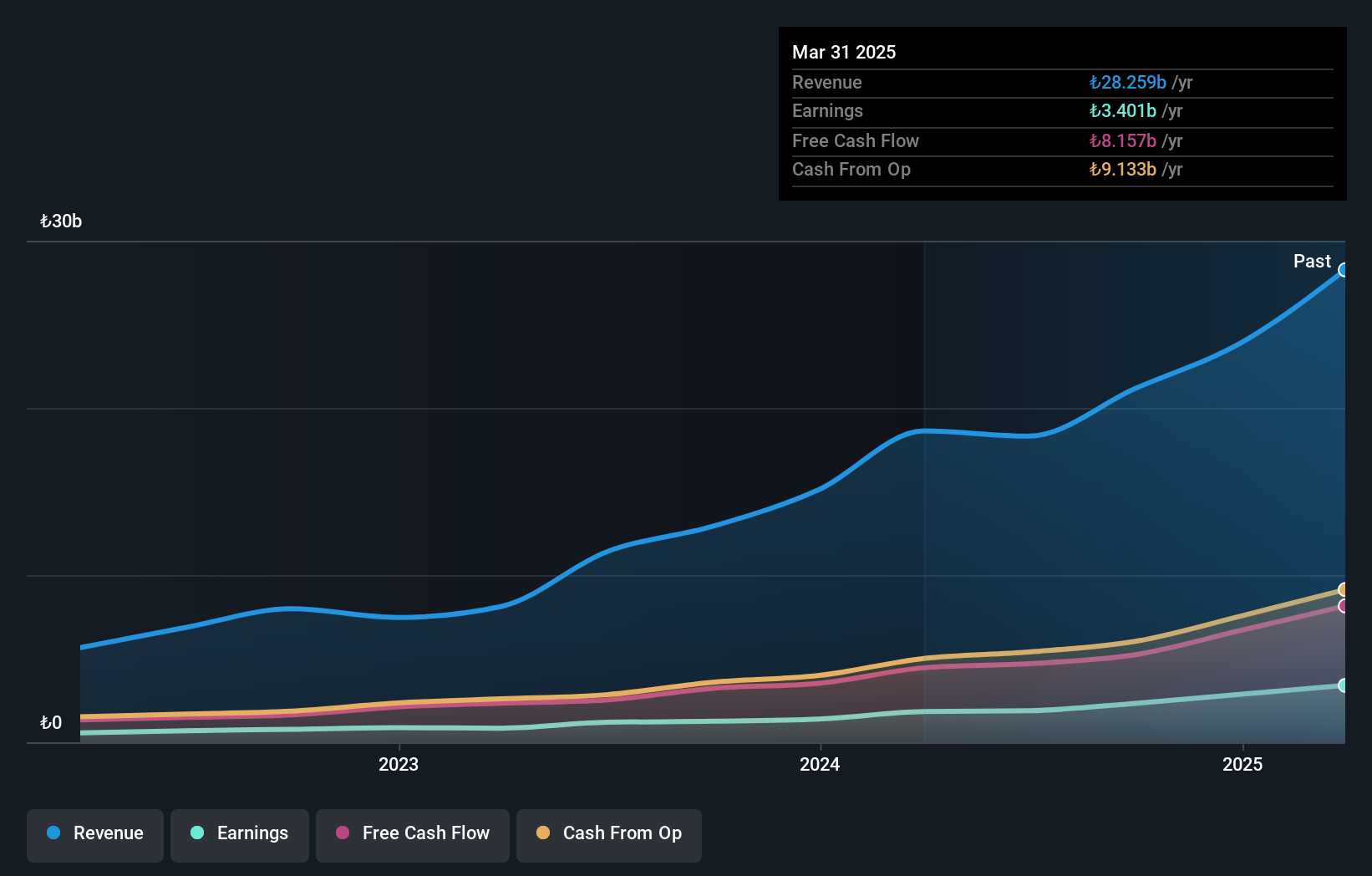

Operations: AgeSA generates revenue primarily from its life insurance and pension segments, with notable contributions of TRY3.65 billion from Life Insurance - Pension and TRY3.14 billion from Life Insurance - Retirement. The company also incurs a negative contribution of TRY741.43 million in the Life Insurance - Cumulative Life segment, impacting overall profitability.

AgeSA Hayat ve Emeklilik Anonim Sirketi, a notable player in the insurance sector, has shown impressive financial performance. With a price-to-earnings ratio of 11.7x, it stands below the TR market average of 16.3x, indicating potential value. The company reported an 88% earnings growth over the past year, surpassing industry growth of 79%. Notably debt-free for five years and boasting high-quality earnings, AgeSA's net income for Q3 reached TRY 715.55 million compared to TRY 274 million last year. This robust performance is further highlighted by its inclusion in the S&P Global BMI Index as of September 2024.

Junjin Construction and RobotLtd (KOSE:A079900)

Simply Wall St Value Rating: ★★★★★☆

Overview: Junjin Construction and Robot Co., Ltd. is a company that specializes in the manufacturing and sale of construction equipment both within South Korea and on an international scale, with a market cap of ₩381 billion.

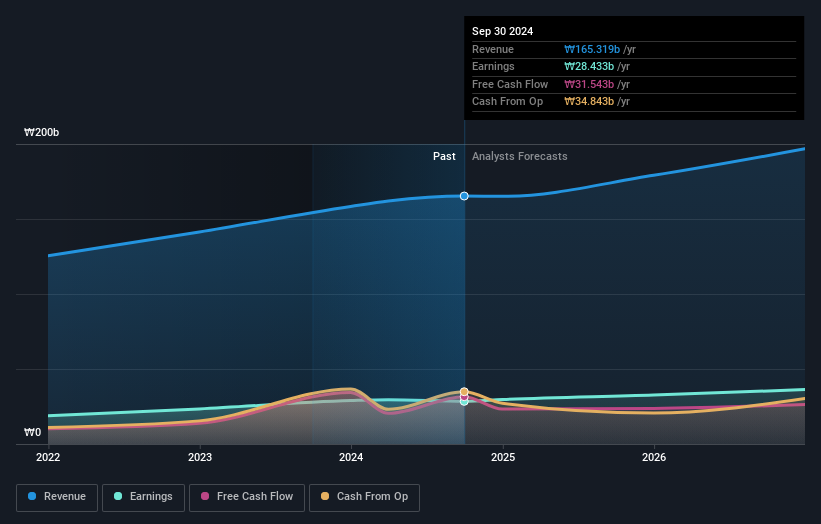

Operations: Junjin Construction & Robot Co., Ltd. generates its revenue primarily from the construction machinery and equipment segment, amounting to ₩165.32 billion.

Junjin Construction, with its niche in the construction sector, has shown a steady increase in levered free cash flow over recent years, reaching US$31.54 million by September 2024. Capital expenditures have been controlled at approximately US$1.75 million, suggesting efficient operational management. The company repurchased shares recently, indicating confidence from within and potentially enhancing shareholder value. Meanwhile, RobotLtd stands out for its robust earnings growth of 20% annually over five years and maintains a competitive edge despite not surpassing industry growth last year at 3%. Its debt to equity ratio rose from 8% to 13%, reflecting strategic financial adjustments amidst volatile share prices lately.

Summing It All Up

- Click this link to deep-dive into the 4509 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AGESA

AgeSA Hayat ve Emeklilik Anonim Sirketi

Engages in the pension and life insurance business primarily in Turkey.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives