- United Arab Emirates

- /

- Banks

- /

- ADX:CBI

Middle Eastern Penny Stocks: Commercial Bank International P.S.C And 2 Other Noteworthy Picks

Reviewed by Simply Wall St

Most Gulf bourses have been on the rise, buoyed by higher oil prices and anticipation surrounding the U.S. Federal Reserve's policy meeting. In such a climate, investors often seek out opportunities in less conventional areas of the market, such as penny stocks. Although the term 'penny stocks' may seem outdated, these investments can still offer significant potential for growth when backed by strong financials and robust business models.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.56 | SAR1.42B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.12B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.39 | AED703.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.20 | AED369.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.33 | AED14.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.802 | AED3.39B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.83 | AED504.85M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.695 | ₪211.55M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 75 stocks from our Middle Eastern Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Commercial Bank International P.S.C (ADX:CBI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Commercial Bank International P.S.C., along with its subsidiaries, offers a range of banking products and services to individuals and businesses in the UAE and internationally, with a market cap of AED1.72 billion.

Operations: The company's revenue is primarily derived from its Real Estate segment at AED264.95 million, followed by Wholesale Banking at AED229.94 million, Treasury operations contributing AED54.20 million, and Retail Banking generating AED54.02 million.

Market Cap: AED1.72B

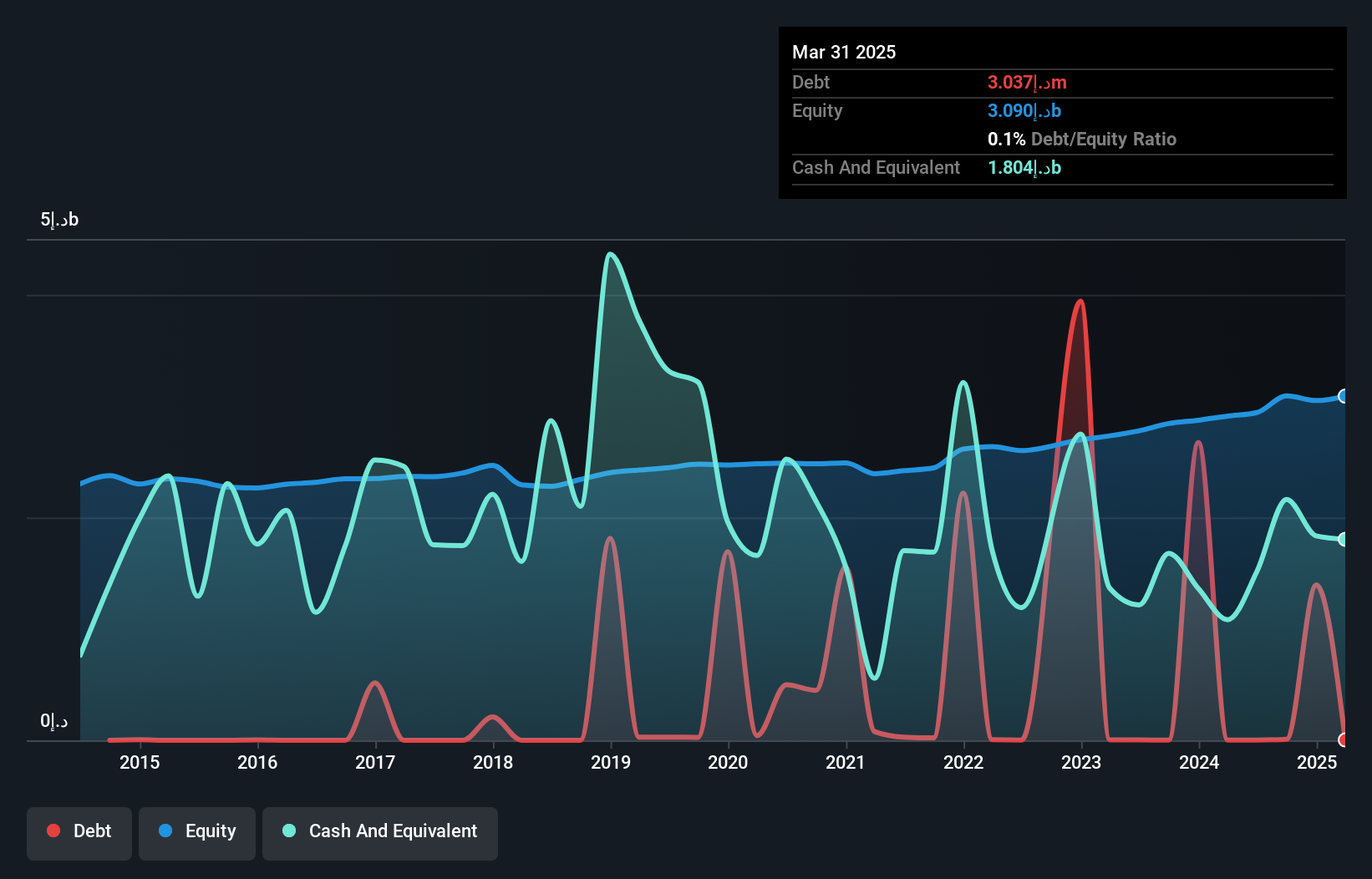

Commercial Bank International P.S.C. has demonstrated consistent earnings growth, with a 34.2% annual increase over the past five years, although recent growth of 13.1% lags behind its historical average and industry peers. The bank's management and board are experienced, contributing to stable operations despite a high level of bad loans at 15.7%. Its financial structure is supported by low-risk funding sources, primarily customer deposits, reflected in an appropriate Loans to Deposits ratio of 84%. Despite having a lower Return on Equity at 6.6%, CBI remains attractively valued with a Price-To-Earnings ratio below the market average.

- Get an in-depth perspective on Commercial Bank International P.S.C's performance by reading our balance sheet health report here.

- Gain insights into Commercial Bank International P.S.C's past trends and performance with our report on the company's historical track record.

Islamic Arab Insurance (Salama) PJSC (DFM:SALAMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Islamic Arab Insurance Co. (Salama) PJSC, along with its subsidiaries, offers general, family, health, and auto takaful solutions across Africa and Asia with a market cap of AED364.49 million.

Operations: Salama generates its revenue primarily from General Takaful at AED802.4 million and Family Takaful at AED230.75 million.

Market Cap: AED364.49M

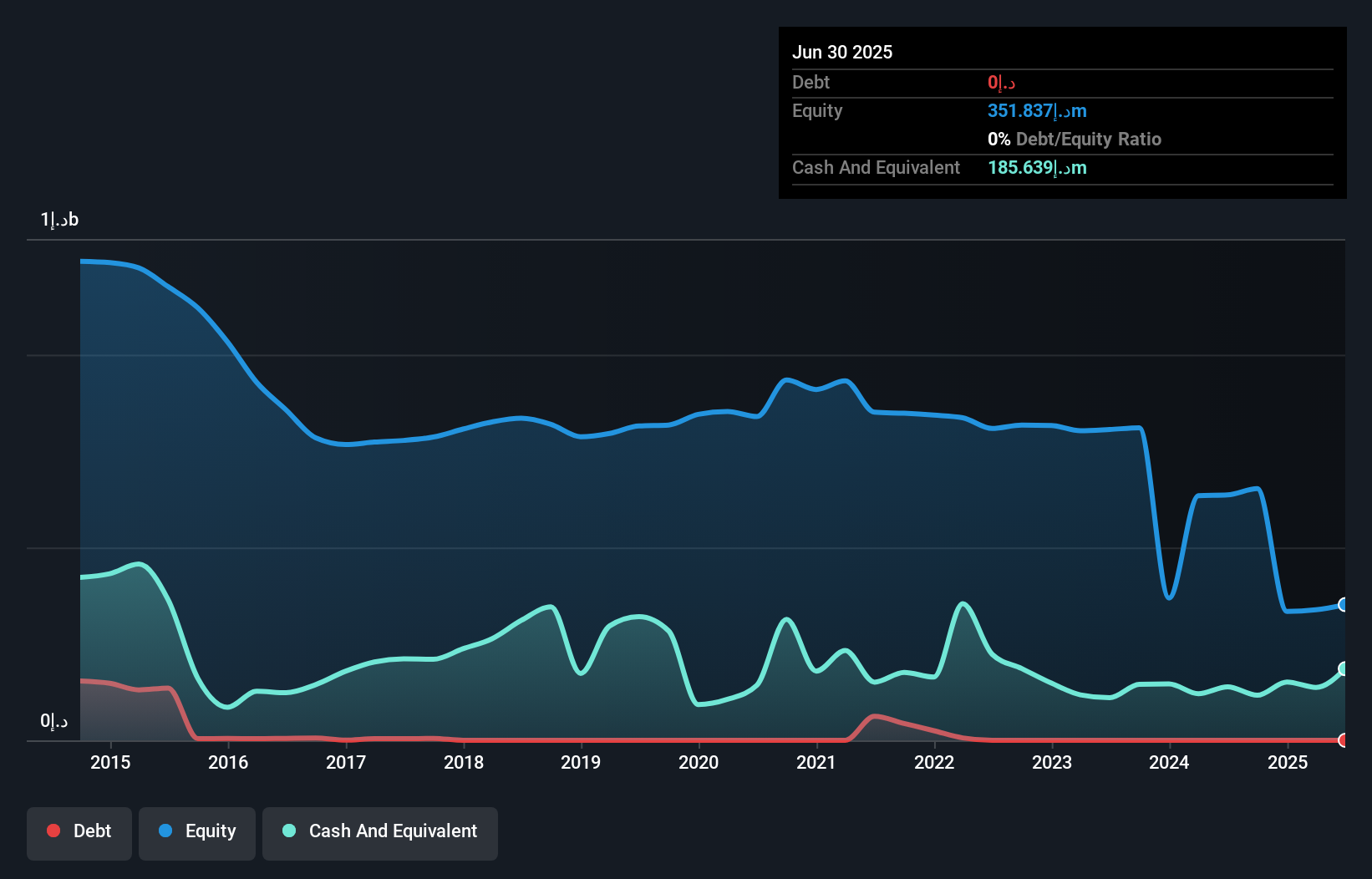

Islamic Arab Insurance Co. (Salama) PJSC, with a market cap of AED364.49 million, has recently turned profitable, reporting a net income of AED6.67 million for Q2 2025 compared to AED0.685 million the previous year. Despite this progress, Salama faces challenges with short-term assets of AED934.7 million not covering long-term liabilities of AED2.3 billion and a low Return on Equity at 3.5%. The company is debt-free, eliminating concerns over interest payments but has experienced board instability with ongoing restructuring efforts aimed at capital reduction and governance improvements as discussed in recent meetings.

- Jump into the full analysis health report here for a deeper understanding of Islamic Arab Insurance (Salama) PJSC.

- Examine Islamic Arab Insurance (Salama) PJSC's past performance report to understand how it has performed in prior years.

Elbit Medical Technologies (TASE:EMTC-M)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elbit Medical Technologies Ltd is an investment holding company involved in the research, development, production, and marketing of therapeutic medical systems globally, with a market cap of ₪17.33 million.

Operations: Elbit Medical Technologies Ltd does not report specific revenue segments.

Market Cap: ₪17.33M

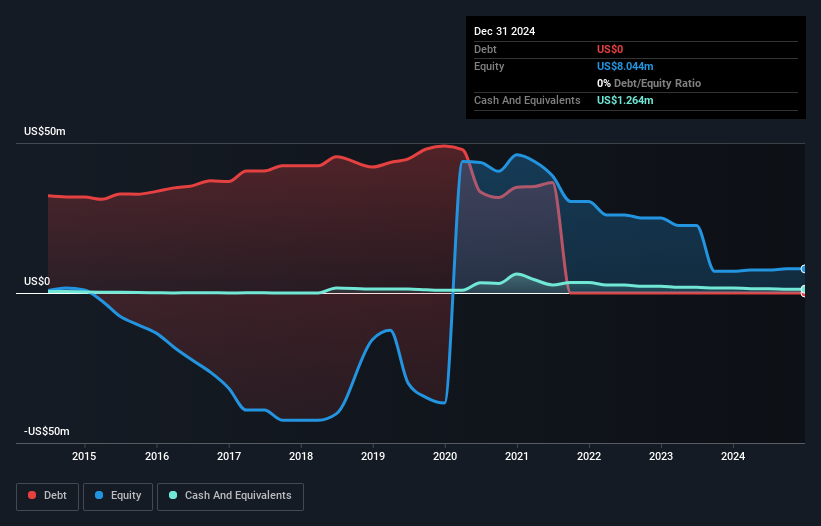

Elbit Medical Technologies Ltd, with a market cap of ₪17.33 million, is pre-revenue, reporting only US$0.154 million for the first half of 2025, down from US$0.741 million a year ago. The company has no debt and its short-term assets of $1.1M comfortably cover its short-term liabilities of $169K. Despite becoming profitable in the last year due to a significant one-off gain of $641K, it faces challenges with high share price volatility and low Return on Equity at 3.5%. The board's average tenure is 6.3 years, indicating experienced governance amidst fluctuating earnings performance over recent years.

- Click here and access our complete financial health analysis report to understand the dynamics of Elbit Medical Technologies.

- Review our historical performance report to gain insights into Elbit Medical Technologies' track record.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 72 Middle Eastern Penny Stocks now.

- Ready For A Different Approach? AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:CBI

Commercial Bank International P.S.C

Provides banking products and services to individuals and businesses in the United Arab Emirates and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives