- United Arab Emirates

- /

- Insurance

- /

- ADX:UNION

Market Might Still Lack Some Conviction On Union Insurance Company P.J.S.C. (ADX:UNION) Even After 30% Share Price Boost

Those holding Union Insurance Company P.J.S.C. (ADX:UNION) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, despite the strong performance over the last month, the full year gain of 2.8% isn't as attractive.

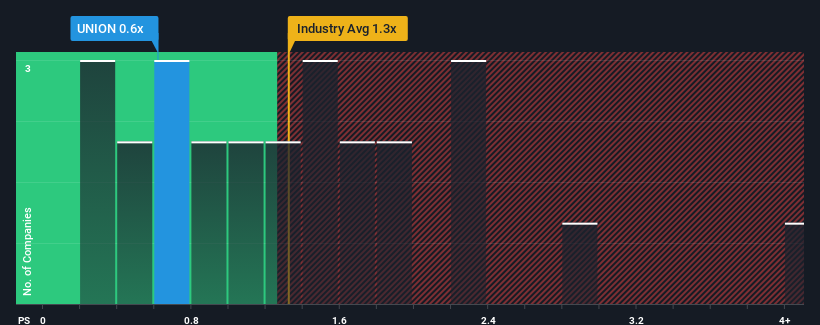

In spite of the firm bounce in price, when close to half the companies operating in the United Arab Emirates' Insurance industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Union Insurance Company P.J.S.C as an enticing stock to check out with its 0.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Union Insurance Company P.J.S.C

How Has Union Insurance Company P.J.S.C Performed Recently?

We'd have to say that with no tangible growth over the last year, Union Insurance Company P.J.S.C's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. Those who are bullish on Union Insurance Company P.J.S.C will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Union Insurance Company P.J.S.C, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Union Insurance Company P.J.S.C's Revenue Growth Trending?

In order to justify its P/S ratio, Union Insurance Company P.J.S.C would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 13% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to shrink 14% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

In light of this, the fact Union Insurance Company P.J.S.C's P/S sits below the majority of other companies is peculiar but certainly not shocking. There's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. There is still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

The latest share price surge wasn't enough to lift Union Insurance Company P.J.S.C's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look into numbers has shown it's somewhat unexpected that Union Insurance Company P.J.S.C has a lower P/S than the industry average, given its recent three-year revenue performance which was better than anticipated for an industry facing challenges. When we see better than average revenue growth but a lower than average P/S, we must assume that potential risks are what might be placing significant pressure on the P/S ratio. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Union Insurance Company P.J.S.C that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:UNION

Union Insurance Company P.J.S.C

Union Insurance Company P.J.S.C. underwrites insurance products in the United Arab Emirates, Gulf Cooperation Council, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives