- United Arab Emirates

- /

- Insurance

- /

- ADX:TKFL

Slammed 27% Abu Dhabi National Takaful Company PSC (ADX:TKFL) Screens Well Here But There Might Be A Catch

The Abu Dhabi National Takaful Company PSC (ADX:TKFL) share price has fared very poorly over the last month, falling by a substantial 27%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 14% share price drop.

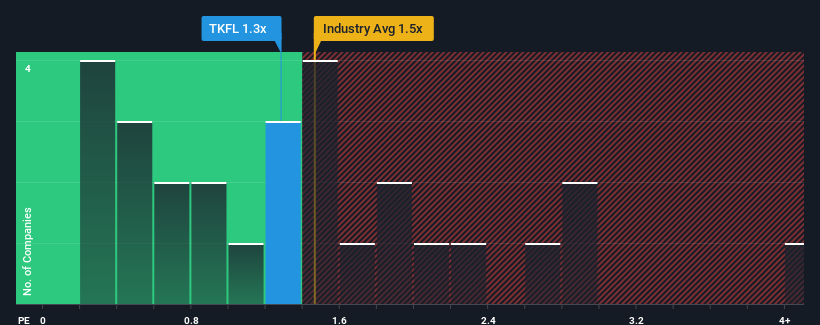

In spite of the heavy fall in price, it's still not a stretch to say that Abu Dhabi National Takaful Company PSC's price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Insurance industry in the United Arab Emirates, where the median P/S ratio is around 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Abu Dhabi National Takaful Company PSC

What Does Abu Dhabi National Takaful Company PSC's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Abu Dhabi National Takaful Company PSC over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Abu Dhabi National Takaful Company PSC will help you shine a light on its historical performance.How Is Abu Dhabi National Takaful Company PSC's Revenue Growth Trending?

Abu Dhabi National Takaful Company PSC's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 34%. Even so, admirably revenue has lifted 60% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to decline by 0.3% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's peculiar that Abu Dhabi National Takaful Company PSC's P/S sits in line with the majority of other companies. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

Abu Dhabi National Takaful Company PSC's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As mentioned previously, Abu Dhabi National Takaful Company PSC currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You need to take note of risks, for example - Abu Dhabi National Takaful Company PSC has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If these risks are making you reconsider your opinion on Abu Dhabi National Takaful Company PSC, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:TKFL

Abu Dhabi National Takaful Company PSC

Provides takaful insurance solutions in the United Arab Emirates and internationally.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.