- United Arab Emirates

- /

- Insurance

- /

- ADX:SICO

Middle Eastern Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced mixed performances, with Saudi Arabia's bourse facing declines due to weak earnings, while Dubai and Abu Dhabi indices showed modest gains. For investors looking beyond the major players, penny stocks—often representing smaller or newer companies—can still present intriguing opportunities. Despite the term's outdated connotation, these stocks can offer potential growth when backed by strong financial health and stability.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Financial Health Rating |

| Alarum Technologies (TASE:ALAR) | ₪2.442 | ₪169.33M | ★★★★★★ |

| Oil Refineries (TASE:ORL) | ₪1.07 | ₪3.32B | ★★★★★★ |

| Thob Al Aseel (SASE:4012) | SAR4.11 | SAR1.65B | ★★★★★★ |

| Tgi Infrastructures (TASE:TGI) | ₪2.37 | ₪176.19M | ★★★★★☆ |

| Yesil Yapi Endüstrisi (IBSE:YYAPI) | TRY1.46 | TRY1.24B | ★★★★★☆ |

| Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC) | TRY1.91 | TRY534.8M | ★★★★★★ |

| Dubai Investments PJSC (DFM:DIC) | AED2.29 | AED9.69B | ★★★★★☆ |

| Peninsula Group (TASE:PEN) | ₪2.399 | ₪533.56M | ★★★★☆☆ |

| Orad (TASE:ORAD) | ₪0.768 | ₪71.66M | ★★★★★★ |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.628 | AED381.98M | ★★★★★★ |

Click here to see the full list of 90 stocks from our Middle Eastern Penny Stocks screener.

Let's dive into some prime choices out of the screener.

United Fidelity Insurance Company (P.S.C.) (ADX:FIDELITYUNITED)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Fidelity Insurance Company (P.S.C.) operates in the United Arab Emirates, providing underwriting services for a range of general and life insurance products to both personal and corporate clients, with a market cap of AED256 million.

Operations: The company's revenue is derived from three primary segments: Consumer insurance generating AED220.22 million, Commercial insurance contributing AED239.58 million, and Employee Benefits amounting to AED167.80 million.

Market Cap: AED256M

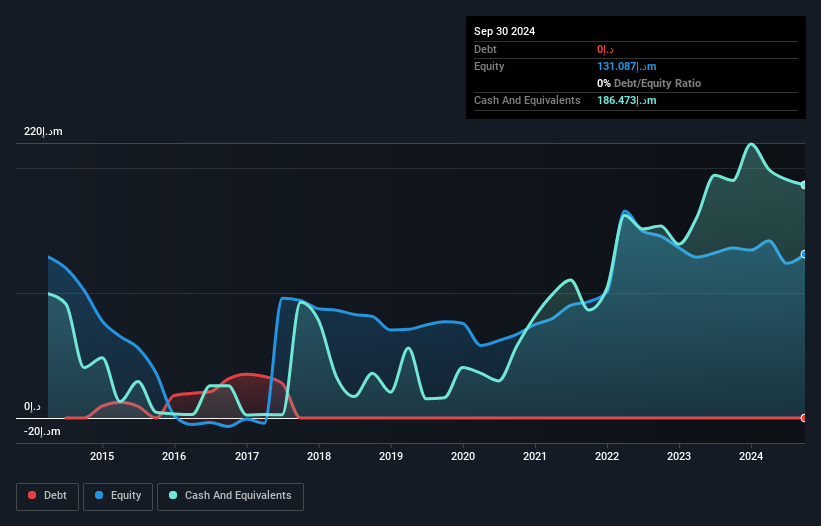

United Fidelity Insurance Company (P.S.C.) in the UAE, with a market cap of AED256 million, remains unprofitable despite generating significant revenue across its consumer, commercial, and employee benefits segments. The company is debt-free but faces challenges as its short-term assets of AED657 million fall short of covering liabilities at AED693.2 million. While it has a cash runway exceeding three years based on current free cash flow levels, earnings have declined significantly over the past five years by 49.8% annually. The board's experience is notable with an average tenure of 7.5 years, providing some stability amidst financial challenges.

- Take a closer look at United Fidelity Insurance Company (P.S.C.)'s potential here in our financial health report.

- Evaluate United Fidelity Insurance Company (P.S.C.)'s historical performance by accessing our past performance report.

Sharjah Insurance Company P.S.C (ADX:SICO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sharjah Insurance Company P.S.C. provides general and life insurance products in the United Arab Emirates and internationally, with a market cap of AED247.50 million.

Operations: The company generates revenue from various underwriting segments, including Fire (AED7.44 million), Marine (AED0.78 million), and Motor and Engineering (AED18.45 million).

Market Cap: AED247.5M

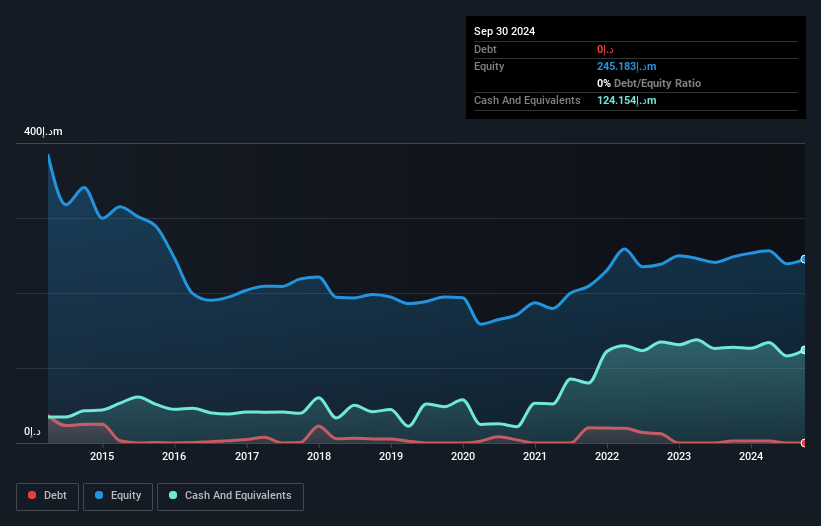

Sharjah Insurance Company P.S.C., with a market cap of AED247.50 million, operates without debt, which eliminates concerns over interest payments and debt coverage. The company has experienced earnings growth of 5.5% annually over the past five years but faced a significant decline in earnings last year by 94.9%. Despite short-term assets (AED247M) comfortably covering both short-term (AED103.9M) and long-term liabilities (AED2.6M), profit margins have decreased from 51.6% to 3.6%. The board's average tenure of 3.8 years suggests seasoned governance; however, recent financial performance raises caution for potential investors in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Sharjah Insurance Company P.S.C.

- Learn about Sharjah Insurance Company P.S.C's historical performance here.

Orad (TASE:ORAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orad Ltd operates in the fields of security and perimeter protection, safety and fire detection, infrastructures, electromechanical systems, automation, communications and control, and solar energy systems both in Israel and internationally with a market cap of ₪71.66 million.

Operations: The company's revenue is primarily derived from its Low Voltage segment, which accounts for ₪156.43 million, followed by the Solar Energy segment contributing ₪18.92 million.

Market Cap: ₪71.66M

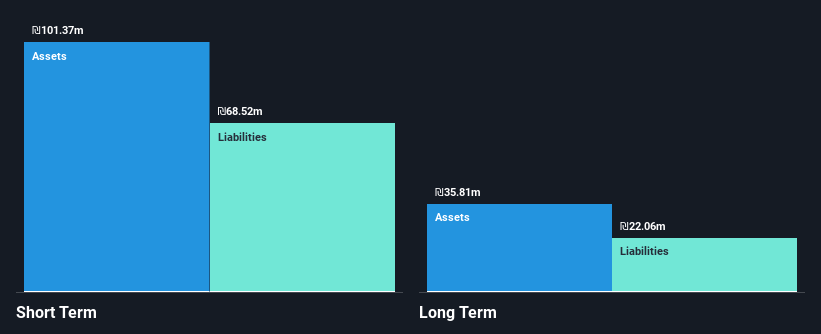

Orad Ltd, with a market cap of ₪71.66 million, has seen its debt significantly reduced over the past five years, now maintaining a satisfactory net debt to equity ratio of 31.7%. The company's operating cash flow comfortably covers its debt obligations at 154.4%, and short-term assets exceed both short-term and long-term liabilities. Despite stable management tenure and high-quality earnings, recent earnings growth has been negative, with net profit margins slightly declining to 4%. A recent acquisition saw a 50.02% stake sold for ILS 19.8 million, potentially impacting future strategic direction amidst volatile share prices.

- Dive into the specifics of Orad here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Orad's track record.

Make It Happen

- Investigate our full lineup of 90 Middle Eastern Penny Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:SICO

Sharjah Insurance Company P.S.C

Engages in the provision of general and life insurance products in the United Arab Emirates and internationally.

Flawless balance sheet slight.

Market Insights

Community Narratives