- United Arab Emirates

- /

- Insurance

- /

- ADX:FIDELITYUNITED

Risks To Shareholder Returns Are Elevated At These Prices For United Fidelity Insurance Company (PSC) (ADX:FIDELITYUNITED)

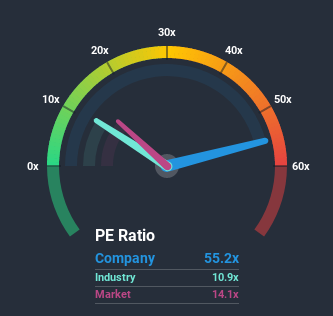

When close to half the companies in the United Arab Emirates have price-to-earnings ratios (or "P/E's") below 14x, you may consider United Fidelity Insurance Company (PSC) (ADX:FIDELITYUNITED) as a stock to avoid entirely with its 55.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's exceedingly strong of late, United Fidelity Insurance Company (PSC) has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for United Fidelity Insurance Company (PSC)

How Is United Fidelity Insurance Company (PSC)'s Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like United Fidelity Insurance Company (PSC)'s to be considered reasonable.

Retrospectively, the last year delivered an exceptional 156% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 16% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that United Fidelity Insurance Company (PSC) is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that United Fidelity Insurance Company (PSC) currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for United Fidelity Insurance Company (PSC) that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

If you decide to trade United Fidelity Insurance Company (PSC), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ADX:FIDELITYUNITED

United Fidelity Insurance Company (P.S.C.)

Engages in writing various classes of general and life insurance in the United Arab Emirates.

Mediocre balance sheet low.

Market Insights

Community Narratives