- United Arab Emirates

- /

- Insurance

- /

- ADX:EIC

Middle Eastern Dividend Stocks To Watch In May 2025

Reviewed by Simply Wall St

As Middle Eastern markets navigate mixed performances amid falling oil prices and weaker-than-expected U.S. economic data, investors are closely watching the region's indices for signs of stability and growth. In this climate, dividend stocks can offer a compelling option for those seeking steady income streams, especially as the Gulf economies continue to diversify beyond oil dependency.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Arab National Bank (SASE:1080) | 6.12% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.58% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.52% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.23% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.73% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.02% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 5.94% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 8.94% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.87% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.08% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our Top Middle Eastern Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Emirates Telecommunications Group Company PJSC (ADX:EAND)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Telecommunications Group Company PJSC, operating with its subsidiaries, offers telecommunications services, media, and related equipment both in the United Arab Emirates and globally, with a market cap of AED151.67 billion.

Operations: Emirates Telecommunications Group Company PJSC generates revenue through its telecommunications services, media, and related equipment offerings across the UAE and international markets.

Dividend Yield: 4.8%

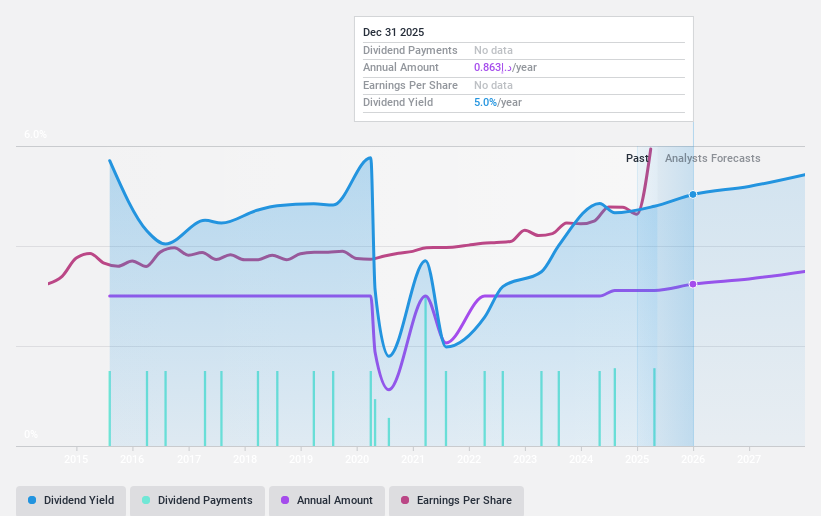

Emirates Telecommunications Group Company PJSC has demonstrated a volatile dividend history over the past decade, yet its dividends are well-covered by both earnings and cash flows, with payout ratios of 52.4% and 64.7%, respectively. Despite trading below estimated fair value, its dividend yield of 4.76% lags behind top-tier payers in the market. Recent earnings showed significant growth with net income at AED 5.35 billion for Q1 2025, supporting its progressive dividend policy approved for upcoming years.

- Click to explore a detailed breakdown of our findings in Emirates Telecommunications Group Company PJSC's dividend report.

- Our valuation report here indicates Emirates Telecommunications Group Company PJSC may be undervalued.

Emirates Insurance Company P.J.S.C (ADX:EIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Insurance Company P.J.S.C. operates in the general insurance and reinsurance sectors across the United Arab Emirates, the United States, and Europe with a market cap of AED1.11 billion.

Operations: Emirates Insurance Company P.J.S.C. generates its revenue primarily from underwriting, amounting to AED2.24 billion, and investments totaling AED88.40 million.

Dividend Yield: 6.8%

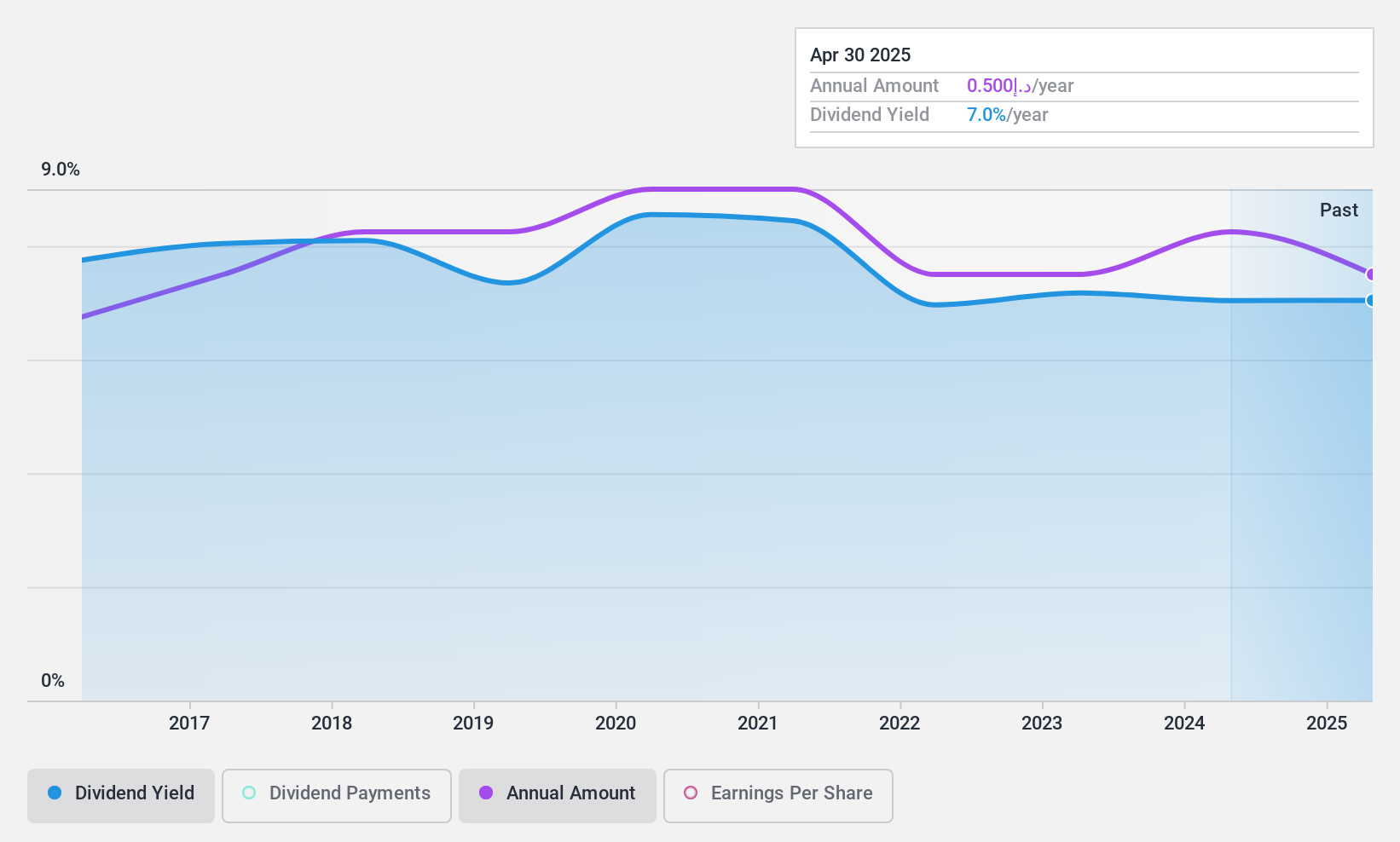

Emirates Insurance Company P.J.S.C. recently approved a cash dividend of 50 Fils per share, totaling AED 75 million for the fiscal year ending December 2024, despite a decrease in net income to AED 110.75 million from the previous year. The company's dividend yield of 6.77% ranks among the top quartile in the AE market, but its dividends are not fully supported by free cash flows or earnings, reflecting potential sustainability concerns amidst volatile share prices and an unreliable dividend history over ten years.

- Take a closer look at Emirates Insurance Company P.J.S.C's potential here in our dividend report.

- Upon reviewing our latest valuation report, Emirates Insurance Company P.J.S.C's share price might be too optimistic.

Dubai Islamic Bank P.J.S.C (DFM:DIB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Islamic Bank P.J.S.C. operates in corporate, retail, and investment banking both in the United Arab Emirates and internationally, with a market cap of AED55.14 billion.

Operations: Dubai Islamic Bank P.J.S.C. generates revenue from several segments, including Consumer Banking (AED4.50 billion), Corporate Banking (AED3.35 billion), Treasury (AED2.59 billion), and Real Estate Development (AED700.58 million).

Dividend Yield: 5.9%

Dubai Islamic Bank P.J.S.C. has demonstrated earnings growth, with net income rising to AED 1.74 billion for Q1 2025. The bank's dividends are covered by a low payout ratio of 42.5%, suggesting sustainability despite past volatility in dividend payments. However, the current yield of 5.9% is below the top quartile in the AE market, and the high level of bad loans (3.5%) could pose risks to future dividend reliability and growth potential.

- Navigate through the intricacies of Dubai Islamic Bank P.J.S.C with our comprehensive dividend report here.

- According our valuation report, there's an indication that Dubai Islamic Bank P.J.S.C's share price might be on the cheaper side.

Summing It All Up

- Reveal the 72 hidden gems among our Top Middle Eastern Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Emirates Insurance Company P.J.S.C, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Emirates Insurance Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:EIC

Emirates Insurance Company P.J.S.C

Engages in writing general insurance and reinsurance in the United Arab Emirates, the United States, and Europe.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives