- Saudi Arabia

- /

- Telecom Services and Carriers

- /

- SASE:7010

Middle Eastern Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As most Gulf bourses experience gains driven by investor focus on corporate earnings and rising oil prices, the Middle Eastern market presents intriguing opportunities for dividend-seeking investors. In such a dynamic environment, selecting dividend stocks with strong financials and consistent payout histories can be a prudent strategy to enhance portfolio stability and income potential.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.35% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.18% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.14% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.32% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.55% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.45% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.19% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.17% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.13% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.31% | ★★★★★☆ |

Click here to see the full list of 69 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Emirates Insurance Company P.J.S.C (ADX:EIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Insurance Company P.J.S.C. operates in the general insurance and reinsurance sectors across the United Arab Emirates, the United States, and Europe, with a market cap of AED1.09 billion.

Operations: Emirates Insurance Company P.J.S.C. generates revenue through two main segments: underwriting, which contributes AED2.36 billion, and investments, adding AED88.37 million.

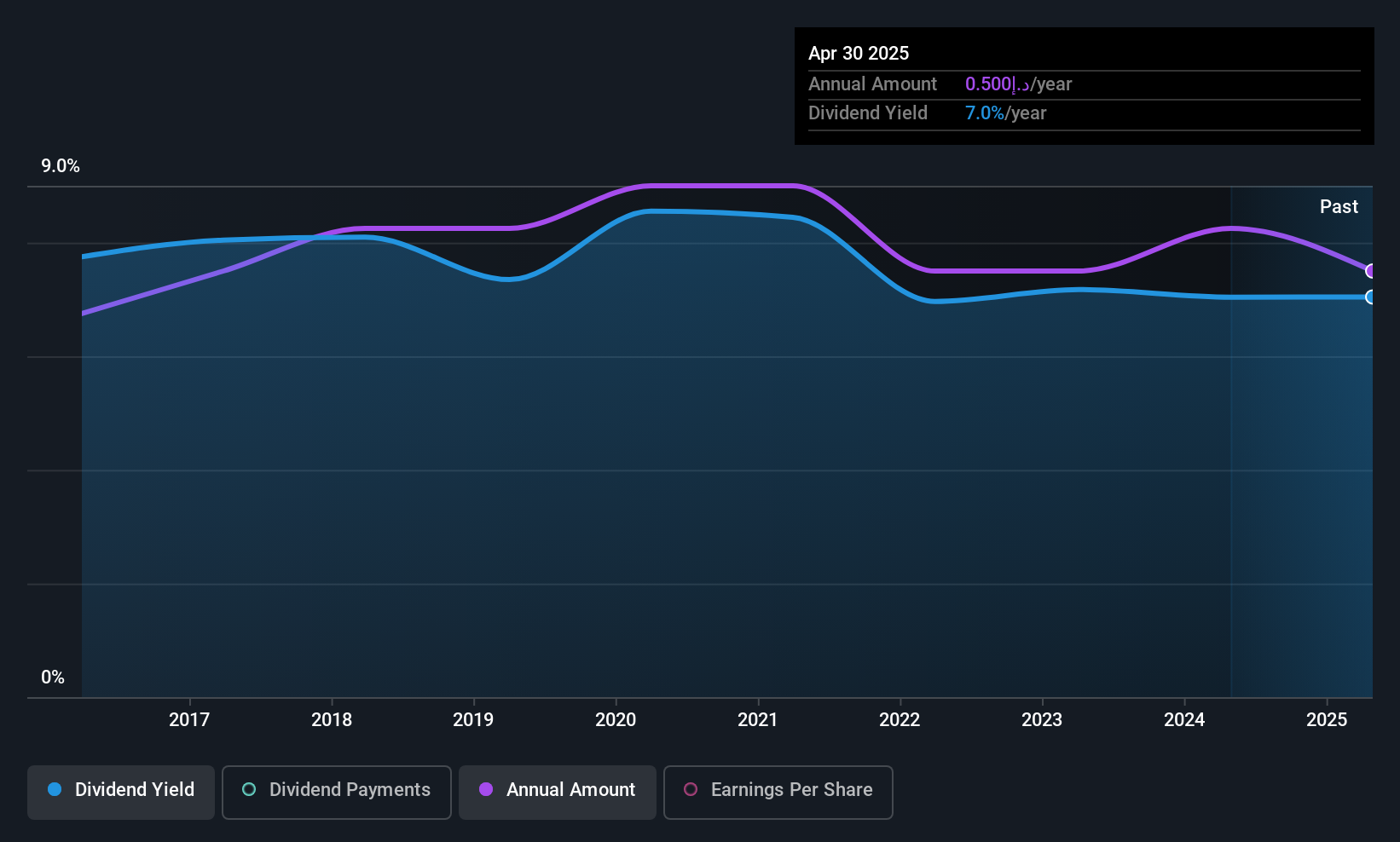

Dividend Yield: 6.9%

Emirates Insurance Company P.J.S.C. recently reported significant earnings growth, with Q2 net income rising to AED 35.31 million from AED 11.6 million a year ago, indicating improved profitability. However, its dividend of 6.87%, while in the top tier of the AE market, is not well supported by cash flows given a high cash payout ratio of 188.4%. The dividends have been stable but not growing over the past decade, and past payments have shown unreliability due to volatility or lack of growth.

- Dive into the specifics of Emirates Insurance Company P.J.S.C here with our thorough dividend report.

- The analysis detailed in our Emirates Insurance Company P.J.S.C valuation report hints at an inflated share price compared to its estimated value.

National Central Cooling Company PJSC (DFM:TABREED)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: National Central Cooling Company PJSC, known as Tabreed, operates by supplying chilled water in the United Arab Emirates and internationally, with a market cap of AED8.50 billion.

Operations: Tabreed generates revenue primarily from its Chilled Water segment, which accounts for AED2.38 billion, and its Value Chain Business segment, contributing AED142.84 million.

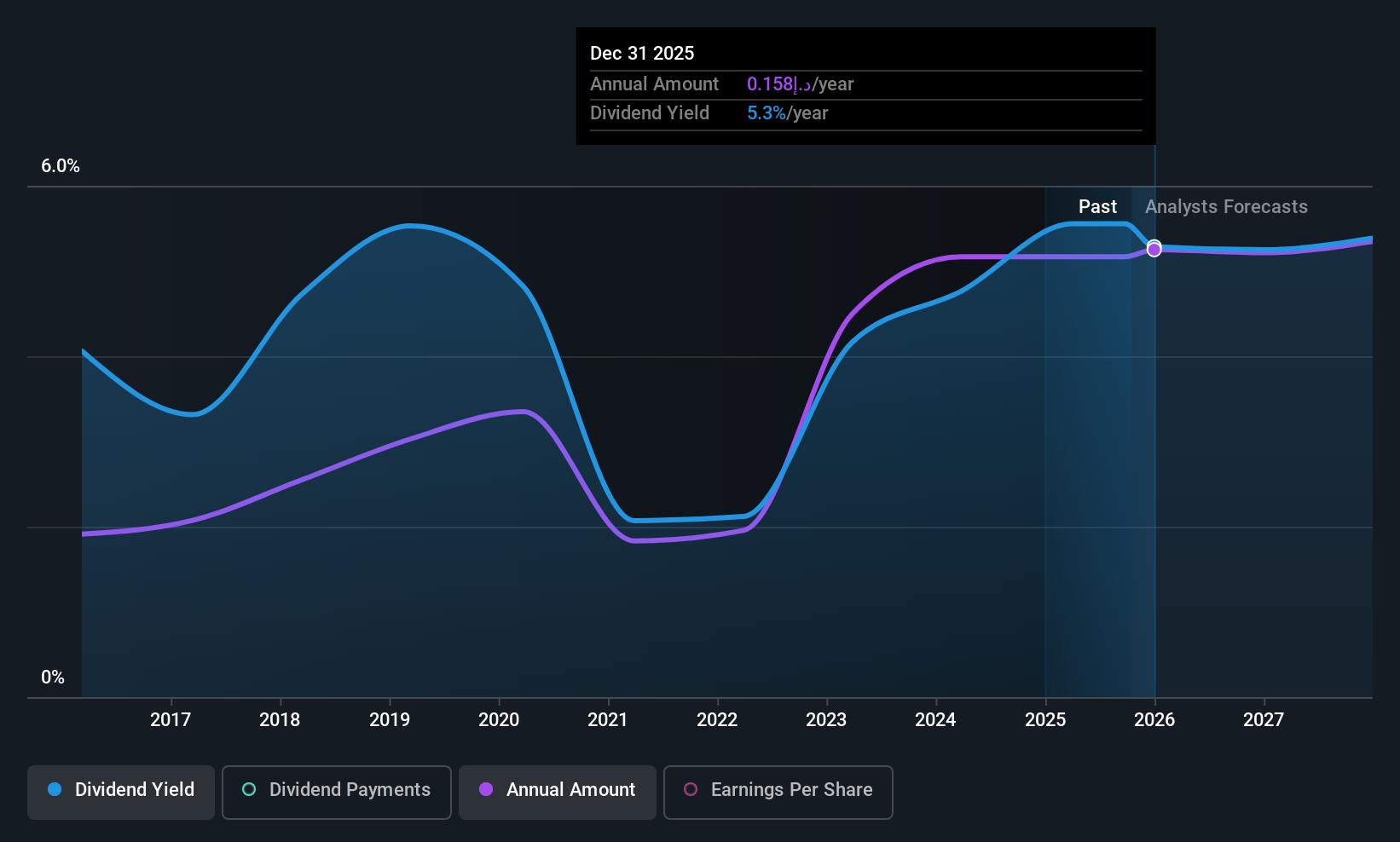

Dividend Yield: 5.2%

National Central Cooling Company PJSC offers a dividend yield of 5.18%, below the top 25% in the AE market, but its payments are covered by earnings and cash flows, with payout ratios of 76.4% and 47.6%, respectively. Despite trading at good value and showing recent earnings growth to AED 160.28 million for Q2, its dividend history is volatile over the past decade, reflecting instability in payment consistency despite some growth.

- Take a closer look at National Central Cooling Company PJSC's potential here in our dividend report.

- Upon reviewing our latest valuation report, National Central Cooling Company PJSC's share price might be too pessimistic.

Saudi Telecom (SASE:7010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Saudi Telecom Company, along with its subsidiaries, offers telecommunications, information, media, and digital payment services both in Saudi Arabia and internationally, with a market cap of SAR224.44 billion.

Operations: Saudi Telecom Company's revenue is primarily derived from its Saudi Telecom Company segment (SAR50.17 billion), followed by Saudi Telecom Channels Company (SAR14.85 billion), Arabian Internet and Communications Services Company (SAR12.21 billion), Digital Centers for Data and Telecommunications (SAR2 billion), STC Bahrain BSC (C) (SAR1.97 billion), Kuwait Telecommunications Company (SAR4.21 billion), Advanced Technology and Cybersecurity Company (\Sirar\) (SAR805.48 million), Public Telecommunications Company (\Specialized\) (SAR383.86 million), STC Bank (SAR1.35 billion), Iot services, and SCCC contributions.

Dividend Yield: 9.4%

Saudi Telecom offers a 9.35% dividend yield, ranking in the top 25% of Saudi Arabian payers, but its dividends aren't well-covered by cash flow with a high payout ratio of 354.1%. Despite this, earnings do cover payouts at an 85.1% ratio. The company's dividends have been stable and growing over the past decade. Recent strategic partnerships and financing agreements suggest potential for revenue growth, though sustainability remains a concern given current cash flow coverage issues.

- Get an in-depth perspective on Saudi Telecom's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Saudi Telecom's current price could be inflated.

Taking Advantage

- Gain an insight into the universe of 69 Top Middle Eastern Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:7010

Saudi Telecom

Provides telecommunications, information, media, and digital payment services in the Kingdom of Saudi Arabia and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives