- United Arab Emirates

- /

- Insurance

- /

- ADX:DHAFRA

How Much Of Al Dhafra Insurance Company P.S.C. (ADX:DHAFRA) Do Insiders Own?

If you want to know who really controls Al Dhafra Insurance Company P.S.C. (ADX:DHAFRA), then you'll have to look at the makeup of its share registry. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

Al Dhafra Insurance Company P.S.C is not a large company by global standards. It has a market capitalization of د.إ390m, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutions don't own shares in the company. Let's delve deeper into each type of owner, to discover more about Al Dhafra Insurance Company P.S.C.

View our latest analysis for Al Dhafra Insurance Company P.S.C

What Does The Lack Of Institutional Ownership Tell Us About Al Dhafra Insurance Company P.S.C?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

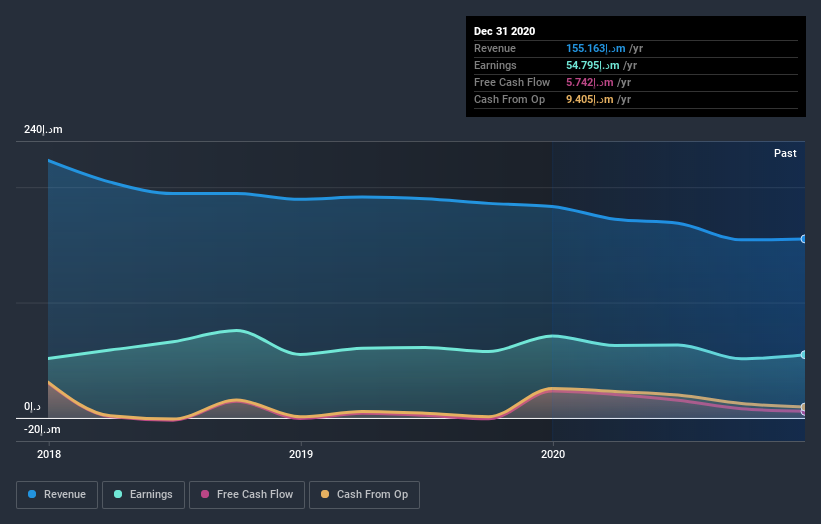

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of Al Dhafra Insurance Company P.S.C, for yourself, below.

Al Dhafra Insurance Company P.S.C is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is Ghobash Trading and Investment Company with 21% of shares outstanding. Aisha Al Dhahiri is the second largest shareholder owning 13% of common stock, and Ataya Enterprises (L.L.C) holds about 6.6% of the company stock.

On looking further, we found that 52% of the shares are owned by the top 5 shareholders. In other words, these shareholders have a meaningful say in the decisions of the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Al Dhafra Insurance Company P.S.C

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own a reasonable proportion of Al Dhafra Insurance Company P.S.C.. It has a market capitalization of just د.إ390m, and insiders have د.إ134m worth of shares in their own names. I would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, with a 33% stake in the company, will not easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

We can see that Private Companies own 33%, of the shares on issue. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Al Dhafra Insurance Company P.S.C (of which 1 shouldn't be ignored!) you should know about.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade Al Dhafra Insurance Company P.S.C, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ADX:DHAFRA

Al Dhafra Insurance Company P.S.C

Engages in the insurance and reinsurance business in the United Arab Emirates, other GCC countries, and internationally.

Flawless balance sheet second-rate dividend payer.