- United Arab Emirates

- /

- Insurance

- /

- ADX:AWNIC

Revenues Tell The Story For Al Wathba National Insurance Company PJSC (ADX:AWNIC) As Its Stock Soars 31%

The Al Wathba National Insurance Company PJSC (ADX:AWNIC) share price has done very well over the last month, posting an excellent gain of 31%. Unfortunately, despite the strong performance over the last month, the full year gain of 3.1% isn't as attractive.

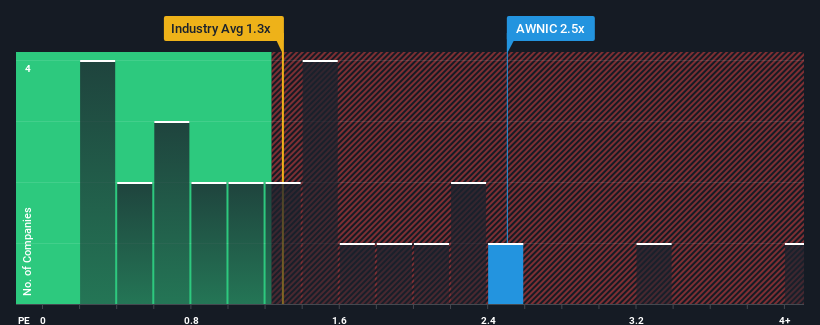

Since its price has surged higher, you could be forgiven for thinking Al Wathba National Insurance Company PJSC is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.5x, considering almost half the companies in the United Arab Emirates' Insurance industry have P/S ratios below 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Al Wathba National Insurance Company PJSC

How Al Wathba National Insurance Company PJSC Has Been Performing

Al Wathba National Insurance Company PJSC certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Al Wathba National Insurance Company PJSC's earnings, revenue and cash flow.How Is Al Wathba National Insurance Company PJSC's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Al Wathba National Insurance Company PJSC's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 34% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 94% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 0.4% shows it's noticeably more attractive.

In light of this, it's understandable that Al Wathba National Insurance Company PJSC's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Al Wathba National Insurance Company PJSC's P/S Mean For Investors?

The large bounce in Al Wathba National Insurance Company PJSC's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Al Wathba National Insurance Company PJSC revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Al Wathba National Insurance Company PJSC (of which 1 can't be ignored!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:AWNIC

Al Wathba National Insurance Company PJSC

Engages in general insurance and reinsurance business in the United Arab Emirates and internationally.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives