- Turkey

- /

- Electric Utilities

- /

- IBSE:ODAS

3 Middle Eastern Penny Stocks With Market Caps Of US$200M

Reviewed by Simply Wall St

Most Gulf markets have recently seen gains driven by strong corporate earnings, although concerns about tariffs and U.S. monetary policy continue to linger. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant investment area with the potential for growth. These stocks often offer an appealing mix of affordability and opportunity, especially when backed by solid financials, which can mitigate some risks typically associated with this segment of the market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.07 | SAR1.63B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR4.26 | SAR511.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.673 | ₪187.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.915 | ₪2.84B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.093 | ₪155.6M | ✅ 2 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.571 | AED2.45B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.668 | AED406.31M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED434.28M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.05 | AED2.1B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.46 | AED10.46B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 98 stocks from our Middle Eastern Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Al Seer Marine Supplies and Equipment Company PJSC (ADX:ASM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Seer Marine Supplies and Equipment Company PJSC operates in the management, maintenance, crewing, and operation of yachts in the United Arab Emirates with a market cap of AED2.79 billion.

Operations: The company's revenue is derived from three main segments: IDT generating AED64.18 million, Yachting contributing AED916.18 million, and Commercial Shipping bringing in AED301.05 million.

Market Cap: AED2.79B

Al Seer Marine Supplies and Equipment Company PJSC, with a market cap of AED 2.79 billion, operates in yacht management and related services. Despite generating substantial revenue from its Yachting segment (AED 916.18 million), the company remains unprofitable, with net losses increasing to AED 1,469.38 million for the year ended December 31, 2024. While its short-term assets exceed liabilities significantly (AED 6.2 billion vs AED 3.9 billion combined liabilities), operating cash flow coverage of debt is inadequate at only 6.3%. The company's debt level has risen over five years but remains within satisfactory limits relative to equity at a ratio of 36.4%.

- Click here to discover the nuances of Al Seer Marine Supplies and Equipment Company PJSC with our detailed analytical financial health report.

- Evaluate Al Seer Marine Supplies and Equipment Company PJSC's historical performance by accessing our past performance report.

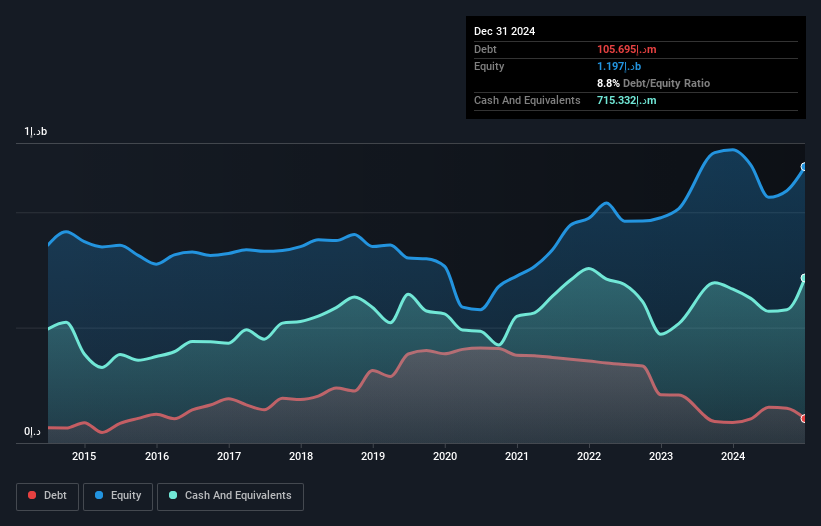

Al Wathba National Insurance Company PJSC (ADX:AWNIC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Al Wathba National Insurance Company PJSC operates in the general insurance and reinsurance sectors both within the United Arab Emirates and internationally, with a market capitalization of AED869.40 million.

Operations: The company's revenue is derived from several segments, including Motor insurance at AED180.16 million, Marine insurance at AED9.77 million, Investments generating AED98.92 million, and Fire and General Accident (excluding Motor) contributing AED47.96 million.

Market Cap: AED869.4M

Al Wathba National Insurance Company PJSC, with a market cap of AED 869.40 million, faces challenges in profitability and earnings growth. The company reported a significant decline in net income to AED 35.49 million for the fiscal year ending December 31, 2024, impacted by large one-off gains and reduced profit margins from 44.6% to 7.3%. Despite this, it maintains strong liquidity with short-term assets exceeding both long-term liabilities (AED244 million) and short-term liabilities (AED479.4 million). While dividends have decreased to AED 0.20 per share, its debt is well covered by operating cash flow at 35.8%.

- Click here and access our complete financial health analysis report to understand the dynamics of Al Wathba National Insurance Company PJSC.

- Examine Al Wathba National Insurance Company PJSC's past performance report to understand how it has performed in prior years.

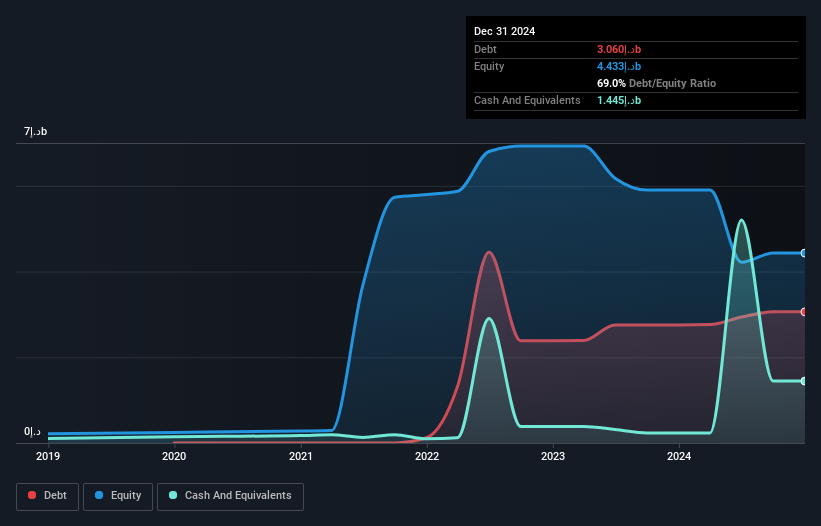

Odas Elektrik Üretim Sanayi Ticaret (IBSE:ODAS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Odas Elektrik Üretim Sanayi Ticaret A.S. operates in the energy sector, producing and selling electricity through natural gas combined cycles both in Turkey and internationally, with a market cap of TRY6.89 billion.

Operations: The company's revenue is primarily derived from its operations in Uzbekistan (TRY7.39 billion), followed by the Republic of Turkey (TRY892.02 million) and Venezuela (TRY41.38 million).

Market Cap: TRY6.89B

Odas Elektrik Üretim Sanayi Ticaret A.S., with a market cap of TRY6.89 billion, faces challenges as it is currently unprofitable, reporting a net loss of TRY2.98 billion for the year ending December 31, 2024. Despite this, the company has managed to reduce its debt significantly over five years and maintains more cash than total debt. Short-term assets exceed both short- and long-term liabilities, indicating strong liquidity. However, recent removal from the FTSE All-World Index highlights potential investor concerns amid declining sales from TRY10.74 billion to TRY7.80 billion year-on-year and negative return on equity at -12.61%.

- Unlock comprehensive insights into our analysis of Odas Elektrik Üretim Sanayi Ticaret stock in this financial health report.

- Learn about Odas Elektrik Üretim Sanayi Ticaret's historical performance here.

Where To Now?

- Discover the full array of 98 Middle Eastern Penny Stocks right here.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 21 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ODAS

Odas Elektrik Üretim Sanayi Ticaret

Produces and sells electricity by natural gas combined cycles in Turkey and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives