- United Arab Emirates

- /

- Insurance

- /

- ADX:ALAIN

Fewer Investors Than Expected Jumping On Al Ain Ahlia Insurance Company P.S.C. (ADX:ALAIN)

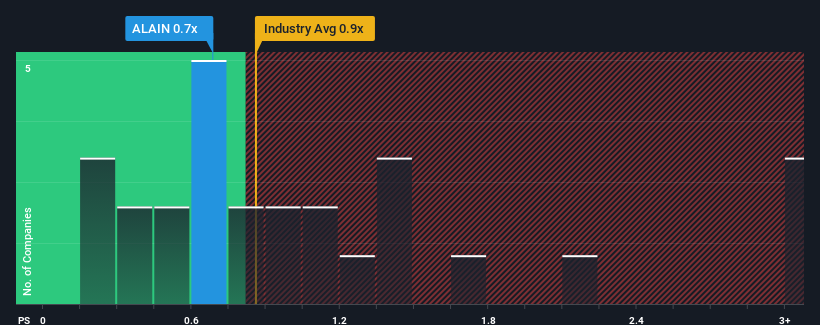

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Insurance industry in the United Arab Emirates, you could be forgiven for feeling indifferent about Al Ain Ahlia Insurance Company P.S.C.'s (ADX:ALAIN) P/S ratio of 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Al Ain Ahlia Insurance Company P.S.C

What Does Al Ain Ahlia Insurance Company P.S.C's P/S Mean For Shareholders?

Recent times have been quite advantageous for Al Ain Ahlia Insurance Company P.S.C as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Al Ain Ahlia Insurance Company P.S.C's earnings, revenue and cash flow.How Is Al Ain Ahlia Insurance Company P.S.C's Revenue Growth Trending?

In order to justify its P/S ratio, Al Ain Ahlia Insurance Company P.S.C would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 69% gain to the company's top line. The latest three year period has also seen an excellent 63% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 9.1% shows it's a great look while it lasts.

With this in mind, we find it intriguing that Al Ain Ahlia Insurance Company P.S.C's P/S matches its industry peers. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Al Ain Ahlia Insurance Company P.S.C's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As mentioned previously, Al Ain Ahlia Insurance Company P.S.C currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 2 warning signs for Al Ain Ahlia Insurance Company P.S.C (1 is a bit unpleasant!) that we have uncovered.

If these risks are making you reconsider your opinion on Al Ain Ahlia Insurance Company P.S.C, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:ALAIN

Al Ain Ahlia Insurance Company P.S.C

Provides insurance and reinsurance services in the United Arab Emirates.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives