What Response Plus Holding PJSC's (ADX:RPM) P/E Is Not Telling You

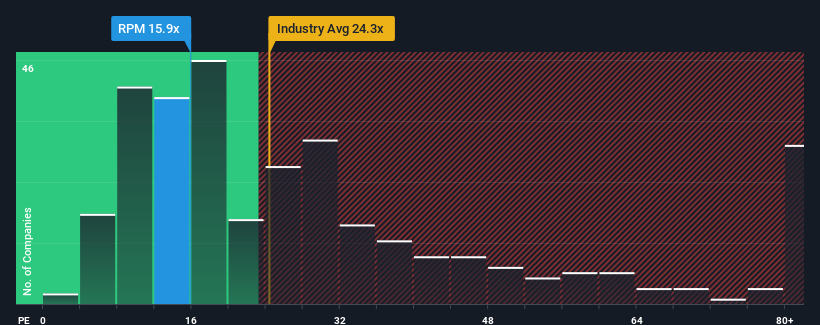

When close to half the companies in the United Arab Emirates have price-to-earnings ratios (or "P/E's") below 12x, you may consider Response Plus Holding PJSC (ADX:RPM) as a stock to potentially avoid with its 15.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings growth that's exceedingly strong of late, Response Plus Holding PJSC has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Response Plus Holding PJSC

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Response Plus Holding PJSC's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 68%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 0.9% shows it's about the same on an annualised basis.

In light of this, it's curious that Response Plus Holding PJSC's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Response Plus Holding PJSC's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Response Plus Holding PJSC currently trades on a higher than expected P/E since its recent three-year growth is only in line with the wider market forecast. When we see average earnings with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Response Plus Holding PJSC that you should be aware of.

If these risks are making you reconsider your opinion on Response Plus Holding PJSC, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:RPM

Response Plus Holding PJSC

Provides healthcare services in the United Arab Emirates, the Kingdom of Saudi Arabia, Norway, the United Kingdom, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success