- United Arab Emirates

- /

- Healthcare Services

- /

- ADX:PUREHEALTH

3 Global Stocks Estimated To Be Trading At Discounts Of Up To 34.2%

Reviewed by Simply Wall St

As global markets experience a mix of easing trade tensions and economic uncertainties, investors are keenly observing opportunities that may arise from these shifting dynamics. In this environment, identifying undervalued stocks can be particularly appealing, as they offer the potential for growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Andritz (WBAG:ANDR) | €57.10 | €112.70 | 49.3% |

| Alexander Marine (TWSE:8478) | NT$142.50 | NT$279.84 | 49.1% |

| LPP (WSE:LPP) | PLN15400.00 | PLN30438.15 | 49.4% |

| TF Bank (OM:TFBANK) | SEK343.00 | SEK682.12 | 49.7% |

| Etteplan Oyj (HLSE:ETTE) | €11.45 | €22.84 | 49.9% |

| Jerónimo Martins SGPS (ENXTLS:JMT) | €21.30 | €42.16 | 49.5% |

| Fodelia Oyj (HLSE:FODELIA) | €7.02 | €13.91 | 49.5% |

| Expert.ai (BIT:EXAI) | €1.294 | €2.59 | 50% |

| Swire Properties (SEHK:1972) | HK$16.50 | HK$32.60 | 49.4% |

| Longino & Cardenal (BIT:LON) | €1.35 | €2.67 | 49.4% |

Let's review some notable picks from our screened stocks.

Pure Health Holding PJSC (ADX:PUREHEALTH)

Overview: Pure Health Holding PJSC operates as a healthcare services provider in the United Arab Emirates with a market capitalization of AED32.22 billion.

Operations: The company generates revenue from several segments, including Diagnostic Services (AED1.06 billion), Technology and Others (AED468.57 million), Health Insurance Services (AED6.84 billion), Hospital and Other Healthcare Related Services (AED19.65 billion), and Procurement and Supply of Medical Related Products (AED5.20 billion).

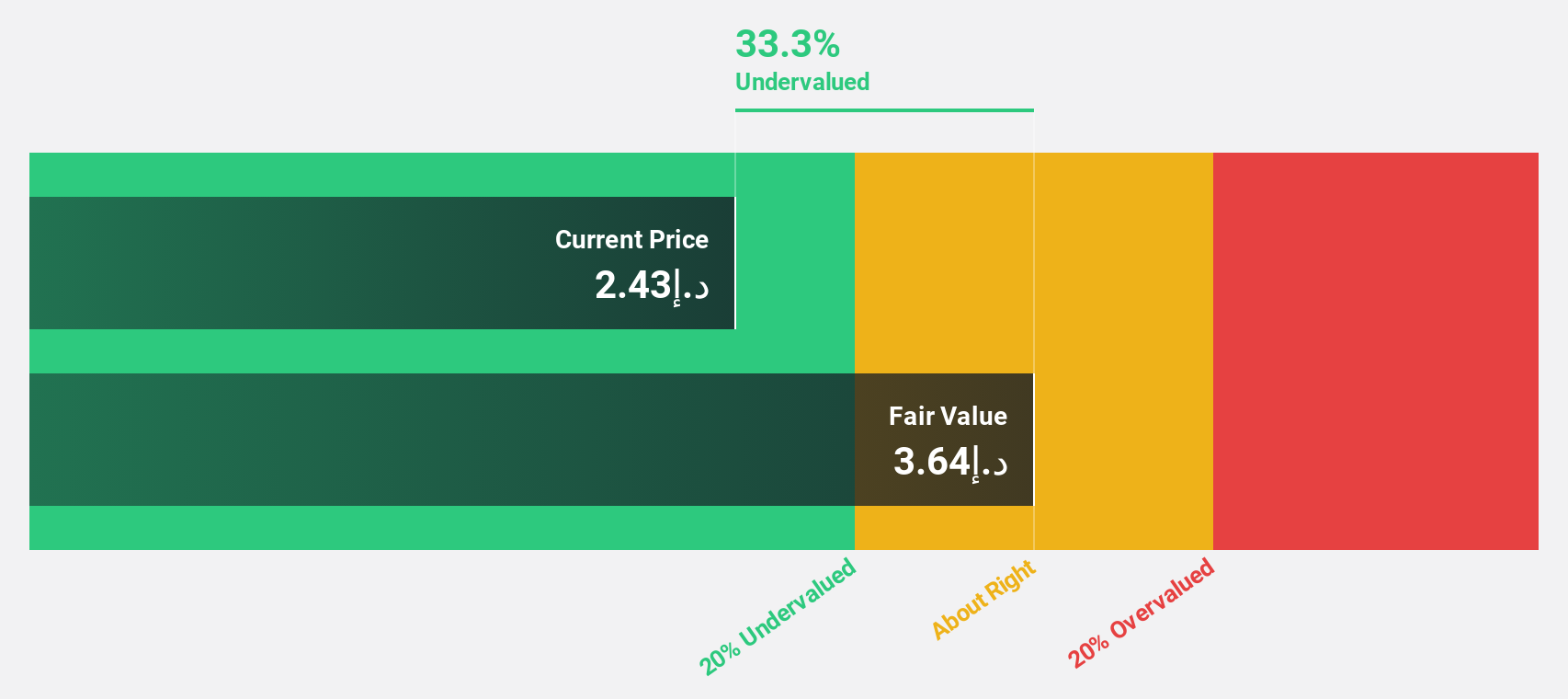

Estimated Discount To Fair Value: 14.9%

Pure Health Holding PJSC is trading at AED 2.9, approximately 14.9% below its estimated fair value of AED 3.41, suggesting it may be undervalued based on cash flows despite not being significantly so. The company reported strong financial performance with sales of AED 25.85 billion and net income of AED 1.71 billion for the year ending December 2024, reflecting a substantial profit growth of over 77%. Earnings are projected to grow annually by over 20%, outpacing the broader AE market's growth rate.

- The analysis detailed in our Pure Health Holding PJSC growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Pure Health Holding PJSC.

Megacable Holdings S. A. B. de C. V (BMV:MEGA CPO)

Overview: Megacable Holdings S. A. B. de C. V., along with its subsidiaries, operates in the cable television, internet, and telephone signal distribution sectors with a market cap of MX$41.56 billion.

Operations: Revenue Segments (in millions of MX$): Cable television: MX$10,500; Internet: MX$8,750; Telephone signal distribution: MX$4,200.

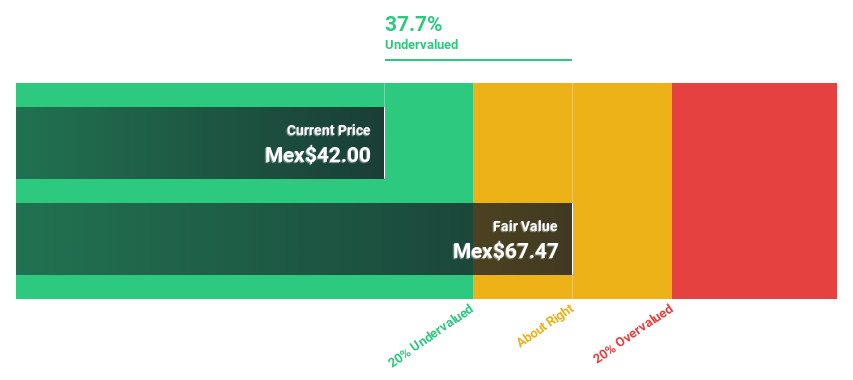

Estimated Discount To Fair Value: 34.2%

Megacable Holdings S. A. B. de C. V., trading at MX$48.42, is significantly undervalued based on cash flows with an estimated fair value of MX$73.54, exceeding a 20% discount to its intrinsic value estimate. Despite recent earnings showing a decline in net income to MXN 723.3 million for Q1 2025, the company's earnings are forecasted to grow substantially at 24.1% annually, surpassing the broader market growth rate and indicating potential long-term value for investors focused on cash flow metrics.

- In light of our recent growth report, it seems possible that Megacable Holdings S. A. B. de C. V's financial performance will exceed current levels.

- Take a closer look at Megacable Holdings S. A. B. de C. V's balance sheet health here in our report.

Hiwin Technologies (TWSE:2049)

Overview: Hiwin Technologies Corporation manufactures and sells motion control and systematic technology products, with a market cap of NT$70.76 billion.

Operations: The company's revenue primarily comes from its Ball Screw segment at NT$4.84 billion and Linear Guideway segment at NT$15.50 billion.

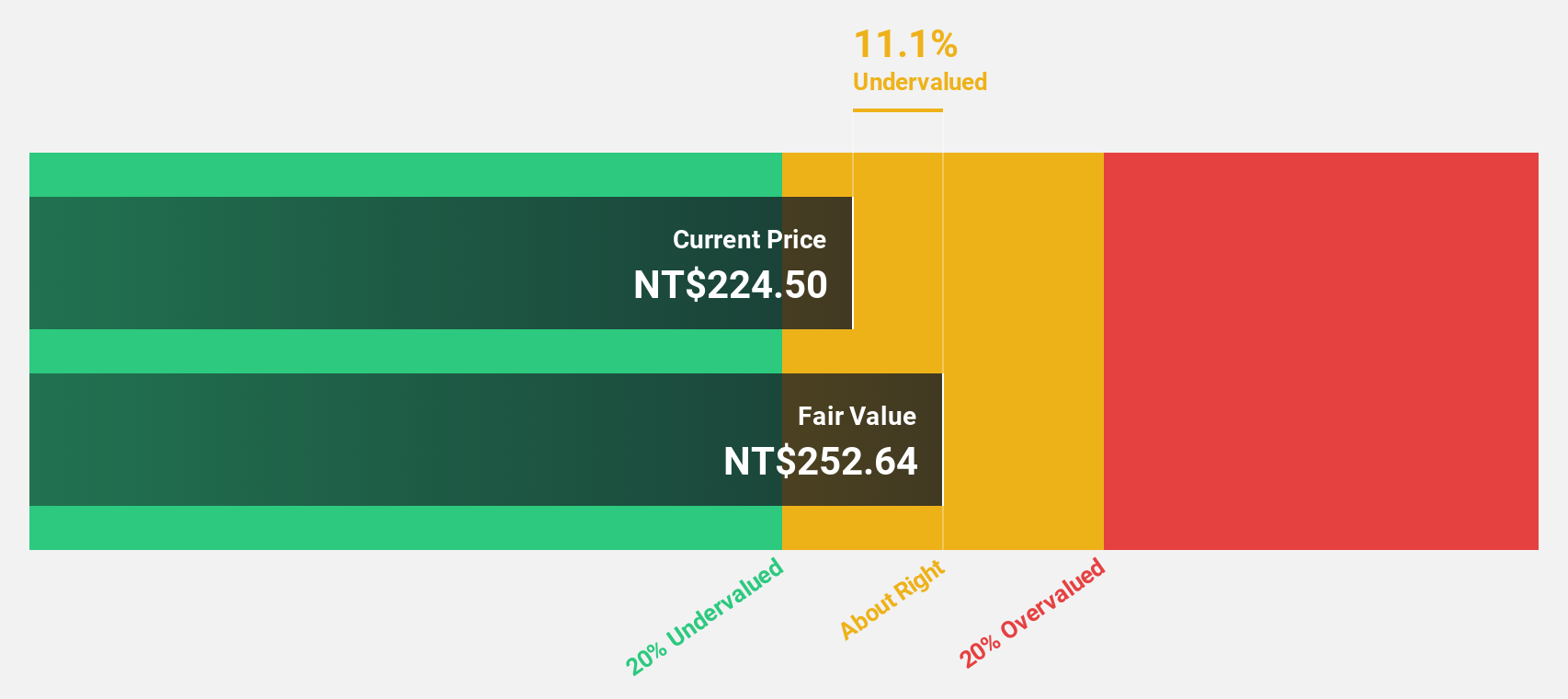

Estimated Discount To Fair Value: 19.1%

Hiwin Technologies, trading at NT$201.5, is undervalued based on cash flows with a fair value estimate of NT$249.08, though not by a significant margin. Despite stable earnings results for 2024 with net income slightly declining to TWD 1,971.95 million, the company's earnings are projected to grow significantly at 24.37% annually over the next three years, outpacing market growth and offering potential value for investors focused on cash flow metrics.

- Our earnings growth report unveils the potential for significant increases in Hiwin Technologies' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Hiwin Technologies.

Taking Advantage

- Get an in-depth perspective on all 454 Undervalued Global Stocks Based On Cash Flows by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:PUREHEALTH

Pure Health Holding PJSC

Provides healthcare services in the United Arab Emirates.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives