- United Arab Emirates

- /

- Capital Markets

- /

- ADX:RAPCO

The 43% return this week takes Ras Al Khaimah Poultry & Feeding P.S.C's (ADX:RAPCO) shareholders one-year gains to 158%

When you buy shares in a company, there is always a risk that the price drops to zero. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example Ras Al Khaimah Poultry & Feeding Co. P.S.C. (ADX:RAPCO). Its share price is already up an impressive 158% in the last twelve months. On top of that, the share price is up 77% in about a quarter. Looking back further, the stock price is 76% higher than it was three years ago.

Since it's been a strong week for Ras Al Khaimah Poultry & Feeding P.S.C shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Ras Al Khaimah Poultry & Feeding P.S.C

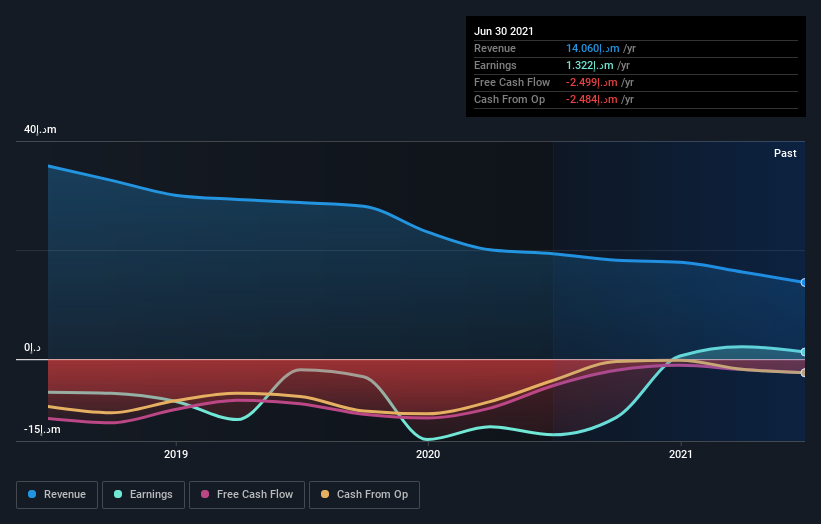

We don't think that Ras Al Khaimah Poultry & Feeding P.S.C's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year Ras Al Khaimah Poultry & Feeding P.S.C saw its revenue shrink by 27%. We're a little surprised to see the share price pop 158% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Ras Al Khaimah Poultry & Feeding P.S.C has rewarded shareholders with a total shareholder return of 158% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 7% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Ras Al Khaimah Poultry & Feeding P.S.C has 5 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AE exchanges.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ADX:RAPCO

RAPCO Investment PJSC

Engages in the commercial enterprise investment, institution, and management activities.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives