- United Arab Emirates

- /

- Oil and Gas

- /

- ADX:DANA

Emerging Middle East Stocks With Potential For October 2025

Reviewed by Simply Wall St

As Gulf markets experience mixed outcomes amid fluctuating oil prices and anticipation of U.S. interest rate cuts, the Middle East's financial landscape is evolving with notable shifts in key indices. With investor sentiment buoyed by a positive growth outlook from the World Bank and strategic moves by regional players like ADNOC, identifying promising stocks requires a keen understanding of market dynamics and economic indicators that highlight resilience and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Rimoni Industries | NA | 1.42% | -1.24% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Terminal X Online | 14.88% | 12.11% | 41.14% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 29.00% | 42.23% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| C. Mer Industries | 96.50% | 13.91% | 71.62% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| Rotshtein Realestate | 142.50% | 22.29% | 13.79% | ★★★★☆☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Dana Gas PJSC (ADX:DANA)

Simply Wall St Value Rating: ★★★★★★

Overview: Dana Gas PJSC, along with its subsidiaries, operates in the exploration, production, transportation, processing, distribution, marketing, and sale of natural gas and petroleum-related products across the United Arab Emirates, Iraq, and Egypt with a market cap of AED5.62 billion.

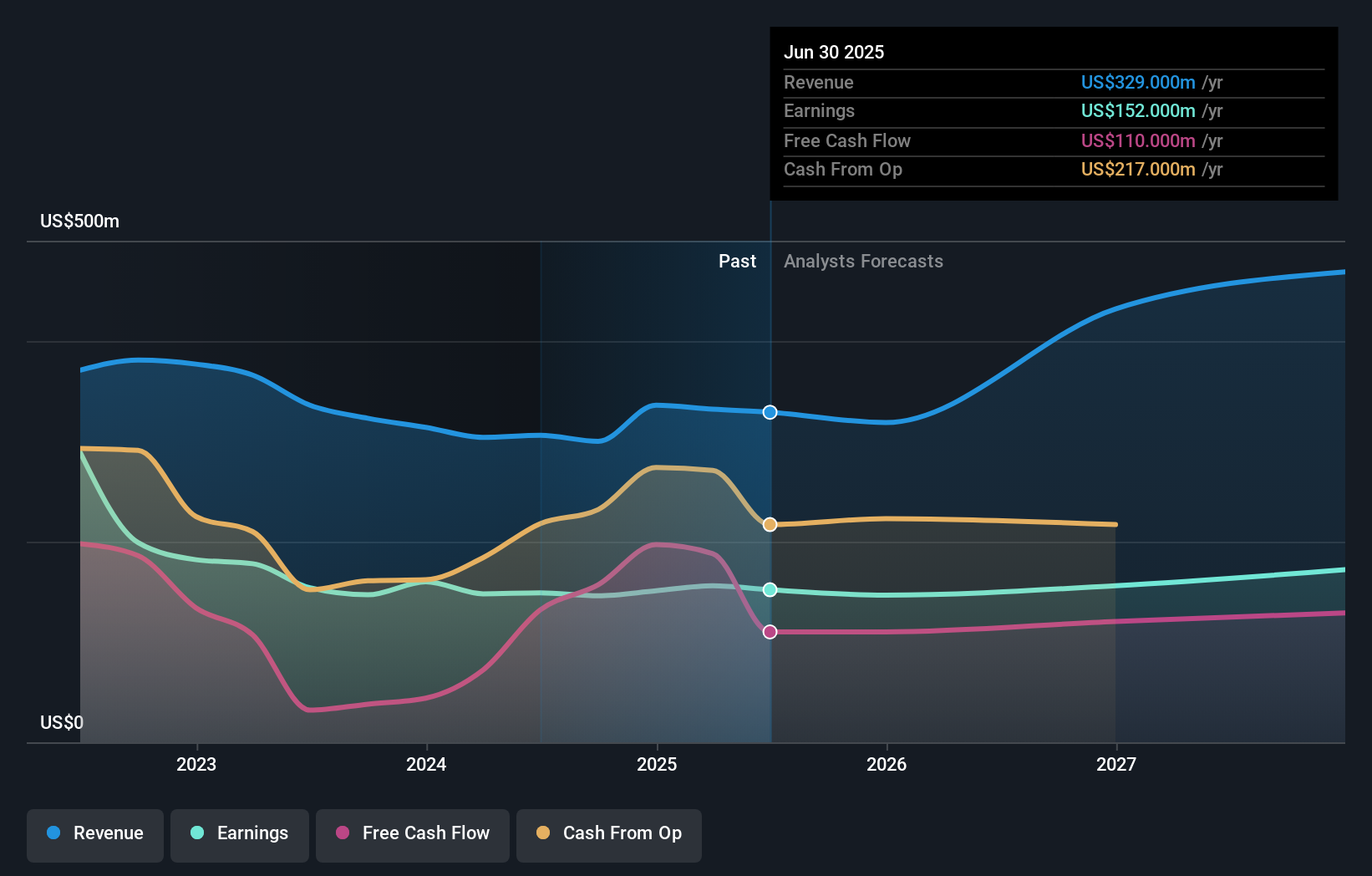

Operations: Dana Gas generates revenue primarily from its integrated oil and gas operations, amounting to $329 million. The company has a market capitalization of AED5.62 billion.

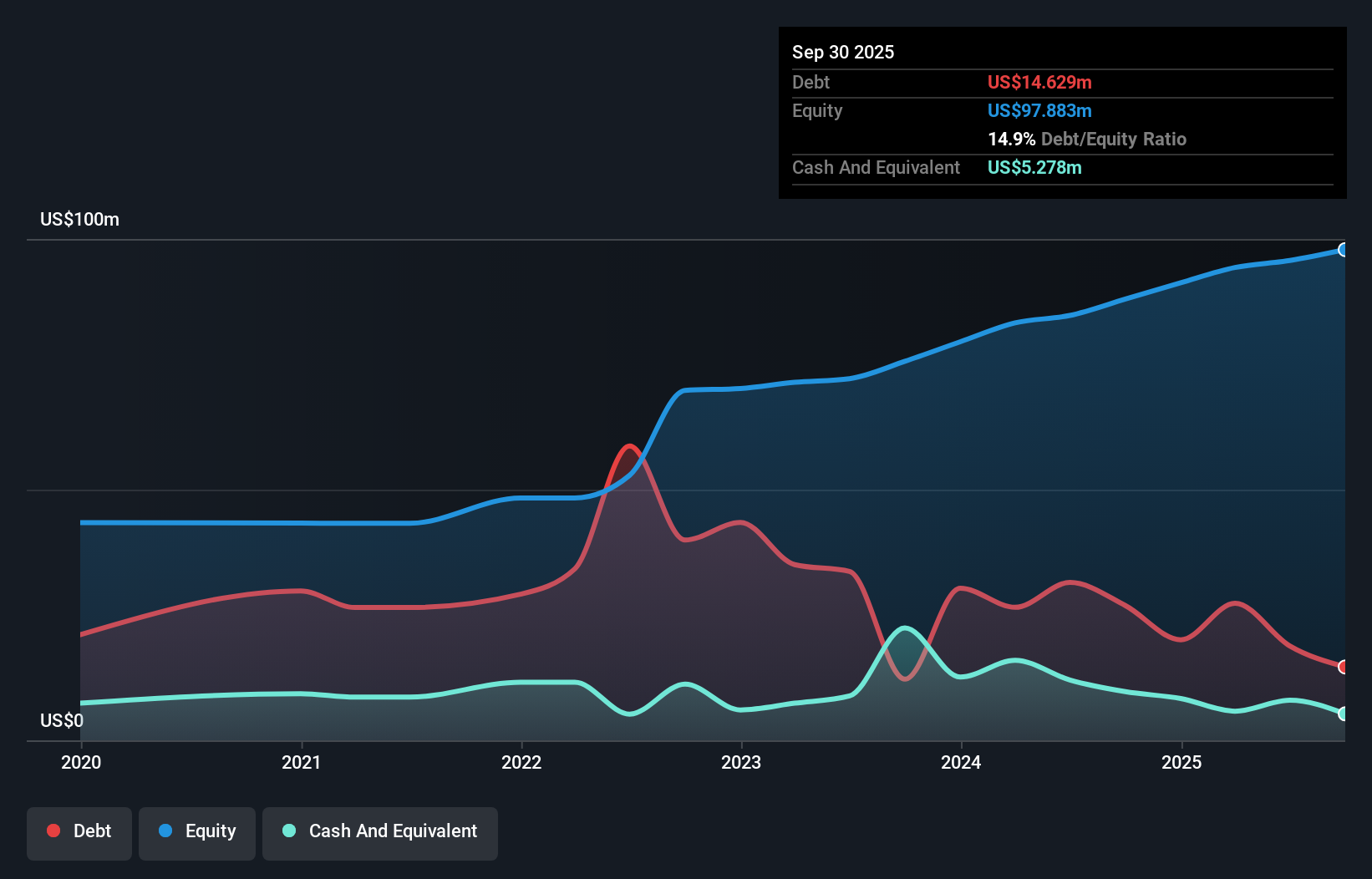

Dana Gas, a notable player in the Middle East energy sector, is trading at 21% below its estimated fair value and showcases high-quality earnings. The company has successfully reduced its debt to equity ratio from 18.1% to 9.1% over five years, maintaining a satisfactory net debt to equity ratio of 1.6%. Recent production averaged 51,000 boepd for the first half of 2025, down from last year's figures, yet it reported USD $73 million in net income for six months ended June. With ongoing investments like the $100 million program in Egypt's Nile Delta, Dana Gas aims to bolster long-term production and reserves significantly.

- Delve into the full analysis health report here for a deeper understanding of Dana Gas PJSC.

Evaluate Dana Gas PJSC's historical performance by accessing our past performance report.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ajman Bank PJSC operates as a financial institution offering a range of banking products and services to individuals, businesses, and government entities in the United Arab Emirates, with a market capitalization of AED3.88 billion.

Operations: Ajman Bank generates revenue primarily from its Wholesale Banking (AED395.46 million), Consumer Banking (AED302.69 million), and Treasury operations (AED139.57 million).

Ajman Bank, a smaller player in the Middle East banking sector, showcases a solid asset base of AED 26.6 billion with equity at AED 3.2 billion. Their funding primarily comes from low-risk customer deposits, accounting for 89% of liabilities, which provides stability despite their high non-performing loans at 9.8%. The bank's allowance for bad loans is relatively low at 46%, indicating room for improvement in risk management. Despite these challenges, Ajman Bank has recently turned profitable and offers value with a price-to-earnings ratio of 9x compared to the market's average of 12.4x, suggesting potential upside for investors seeking value opportunities in the region.

- Click here and access our complete health analysis report to understand the dynamics of Ajman Bank PJSC.

Examine Ajman Bank PJSC's past performance report to understand how it has performed in the past.

Hiper Global (TASE:HIPR)

Simply Wall St Value Rating: ★★★★★★

Overview: Hiper Global Ltd. specializes in offering computing solutions to OEM customers and has a market capitalization of ₪825.55 million.

Operations: Hiper Global Ltd. generates revenue primarily from its OEM activity, amounting to $270.11 million. The company's market capitalization is ₪825.55 million.

Hiper Global, a smaller player in the electronics sector, showcases a mixed financial picture. Over five years, debt to equity has impressively dropped from 58.6% to 19.6%, reflecting prudent financial management. Their net debt to equity ratio stands at a satisfactory 11.3%. Despite high-quality earnings and positive free cash flow, recent performance shows negative earnings growth of -9%, contrasting with the industry average of 3.6%. For Q2 2025, sales reached US$62.83 million while net income was US$2.99 million, slightly up from last year’s figures, indicating steady operations amid challenges in broader market conditions.

- Get an in-depth perspective on Hiper Global's performance by reading our health report here.

Review our historical performance report to gain insights into Hiper Global's's past performance.

Turning Ideas Into Actions

- Unlock our comprehensive list of 205 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:DANA

Dana Gas PJSC

Engages in the exploration, production, ownership, transportation, processing, distribution, marketing, and sale of natural gas and petroleum related products in the United Arab Emirates, Iraq, and Egypt.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026