- United Arab Emirates

- /

- Capital Markets

- /

- DFM:BHMCAPITAL

I Ran A Stock Scan For Earnings Growth And BH Mubasher Financial Services P.S.C (DFM:BHMUBASHER) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in BH Mubasher Financial Services P.S.C (DFM:BHMUBASHER). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for BH Mubasher Financial Services P.S.C

BH Mubasher Financial Services P.S.C's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that BH Mubasher Financial Services P.S.C grew its EPS from د.إ0.00062 to د.إ0.01, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

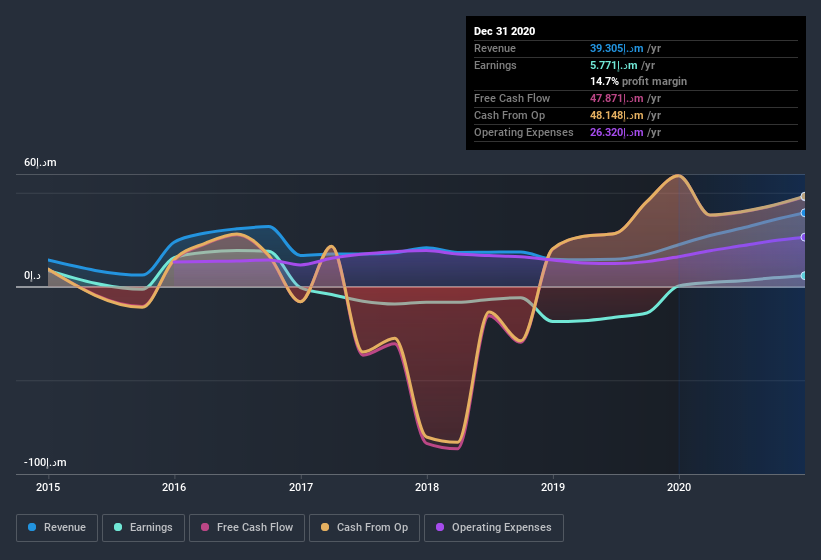

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that BH Mubasher Financial Services P.S.C's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. BH Mubasher Financial Services P.S.C maintained stable EBIT margins over the last year, all while growing revenue 76% to د.إ39m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since BH Mubasher Financial Services P.S.C is no giant, with a market capitalization of د.إ204m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are BH Mubasher Financial Services P.S.C Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that BH Mubasher Financial Services P.S.C insiders own a meaningful share of the business. In fact, they own 77% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about د.إ158m riding on the stock, at current prices. That's nothing to sneeze at!

Is BH Mubasher Financial Services P.S.C Worth Keeping An Eye On?

BH Mubasher Financial Services P.S.C's earnings per share have taken off like a rocket aimed right at the moon. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering BH Mubasher Financial Services P.S.C for a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for BH Mubasher Financial Services P.S.C (1 is a bit unpleasant!) that you need to be mindful of.

Although BH Mubasher Financial Services P.S.C certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading BH Mubasher Financial Services P.S.C or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BHM Capital Financial Services PSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DFM:BHMCAPITAL

BHM Capital Financial Services PSC

Together with its subsidiary, operates as an intermediary that deals in shares, stocks, debentures, and other securities in the United Arab Emirates, Kingdom of Saudi Arabia, the United States, the United Kingdom, Europe, and internationally.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives