- United Arab Emirates

- /

- Capital Markets

- /

- ADX:WAHA

3 Middle Eastern Penny Stocks With Market Caps Up To US$2B

Reviewed by Simply Wall St

The Middle Eastern markets have recently experienced a downturn, with Gulf indices sliding amid fears of a global recession sparked by escalating trade tensions. Despite these challenges, investors continue to explore opportunities in various segments, including penny stocks. Although the term "penny stock" is somewhat outdated, it still represents smaller or less-established companies that can offer significant value when backed by strong financials and growth potential.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.90 | SAR1.56B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR3.89 | SAR466.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.379 | ₪164.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.894 | ₪2.78B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.158 | ₪160.43M | ✅ 1 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.512 | AED2.23B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.757 | AED445.85M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Ansari Financial Services PJSC (DFM:ALANSARI) | AED0.93 | AED7.17B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.00 | AED2.02B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.31 | AED9.91B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 98 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm managing assets in sectors like financial services, fintech, healthcare, energy, infrastructure, industrial real estate and capital markets with a market cap of AED2.65 billion.

Operations: The company generates revenue from its Private Investments segment, excluding Waha Land, amounting to AED150.11 million.

Market Cap: AED2.65B

Al Waha Capital PJSC, with a market cap of AED2.65 billion, showcases a mixed financial landscape. Its Price-To-Earnings ratio of 6.9x is attractive compared to the AE market average, yet its dividend yield of 7.04% isn't well covered by free cash flows. The company has reduced its debt-to-equity ratio significantly over five years and possesses more cash than total debt, but negative operating cash flow raises concerns about debt coverage. Recent earnings revealed a decline in net income to AED381.28 million for 2024 from AED440.1 million in the previous year, highlighting challenges in profit growth amidst stable volatility and experienced management oversight.

- Jump into the full analysis health report here for a deeper understanding of Al Waha Capital PJSC.

- Assess Al Waha Capital PJSC's previous results with our detailed historical performance reports.

Al Ansari Financial Services PJSC (DFM:ALANSARI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Ansari Financial Services PJSC, along with its subsidiaries, functions as an integrated financial services company in the United Arab Emirates and internationally, with a market cap of AED7.17 billion.

Operations: No specific revenue segments are reported for Al Ansari Financial Services PJSC.

Market Cap: AED7.17B

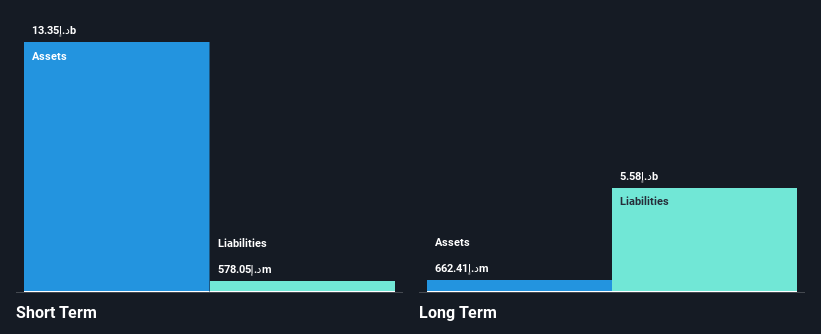

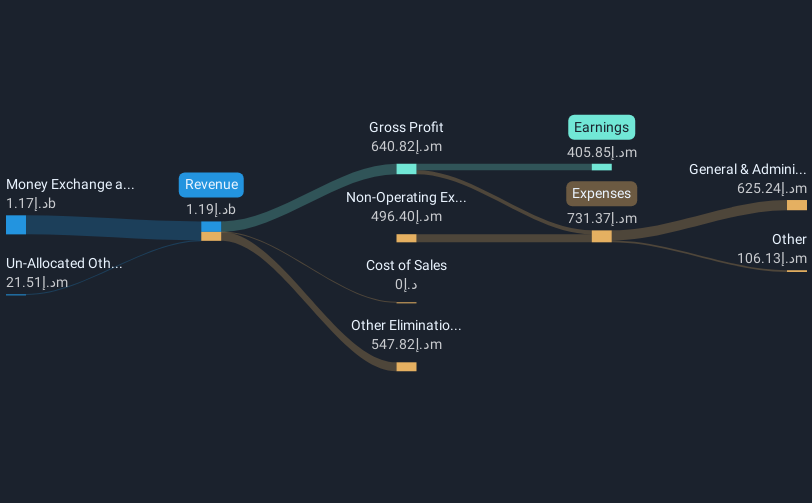

Al Ansari Financial Services PJSC, with a market cap of AED7.17 billion, presents a complex picture in the penny stock landscape. Its earnings have grown modestly by 3.7% annually over five years, yet recent net income fell to AED405.85 million from AED495.19 million the previous year, indicating challenges in profit growth despite high-quality earnings and stable volatility (1%). The company maintains more cash than total debt and its operating cash flow comfortably covers debt obligations (321.8%), but its dividend yield of 4.38% isn't well covered by earnings, while short-term assets exceed both short- and long-term liabilities significantly.

- Unlock comprehensive insights into our analysis of Al Ansari Financial Services PJSC stock in this financial health report.

- Understand Al Ansari Financial Services PJSC's earnings outlook by examining our growth report.

Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dubai National Insurance & Reinsurance (P.S.C.) operates in the insurance and reinsurance sector, providing a range of insurance products and services, with a market cap of AED398.48 million.

Operations: The company's revenue is derived from two main segments: Underwriting, which contributes AED269.43 million, and Investments, generating AED37.56 million.

Market Cap: AED398.48M

Dubai National Insurance & Reinsurance (P.S.C.) shows mixed signals in the penny stock arena, with a market cap of AED398.48 million. The company has no debt and its short-term assets far exceed liabilities, indicating financial stability. Earnings grew by 13.6% over the past year, surpassing industry averages, yet five-year earnings have declined by 6.1% annually and recent profit margins decreased slightly from last year. Despite these challenges, the firm reported a net income increase to AED53.54 million for 2024 and announced an annual dividend of AED0.15 per share, reflecting shareholder value focus amidst board inexperience concerns with a tenure average of 2.8 years.

- Dive into the specifics of Dubai National Insurance & Reinsurance (P.S.C.) here with our thorough balance sheet health report.

- Gain insights into Dubai National Insurance & Reinsurance (P.S.C.)'s past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 95 Middle Eastern Penny Stocks now.

- Seeking Other Investments? We've found 27 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:WAHA

Al Waha Capital PJSC

A private equity firm which manages assets across several sectors, including financial services and fintech, healthcare, energy, infrastructure, industrial real estate and capital markets.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives