As global markets navigate a mix of rising stock indices and declining consumer confidence, investors are increasingly focused on strategies that offer stability amidst economic uncertainty. In this environment, dividend stocks can provide a reliable income stream, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.85% | ★★★★★★ |

Click here to see the full list of 1942 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Dubai Refreshment (P.J.S.C.) (DFM:DRC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Refreshment (P.J.S.C.) is involved in the bottling and selling of Pepsi Cola International products across Dubai, Sharjah, and the Northern Emirates of the UAE, with a market cap of AED2.16 billion.

Operations: The company's revenue primarily comes from the wholesale of groceries, amounting to AED808.51 million.

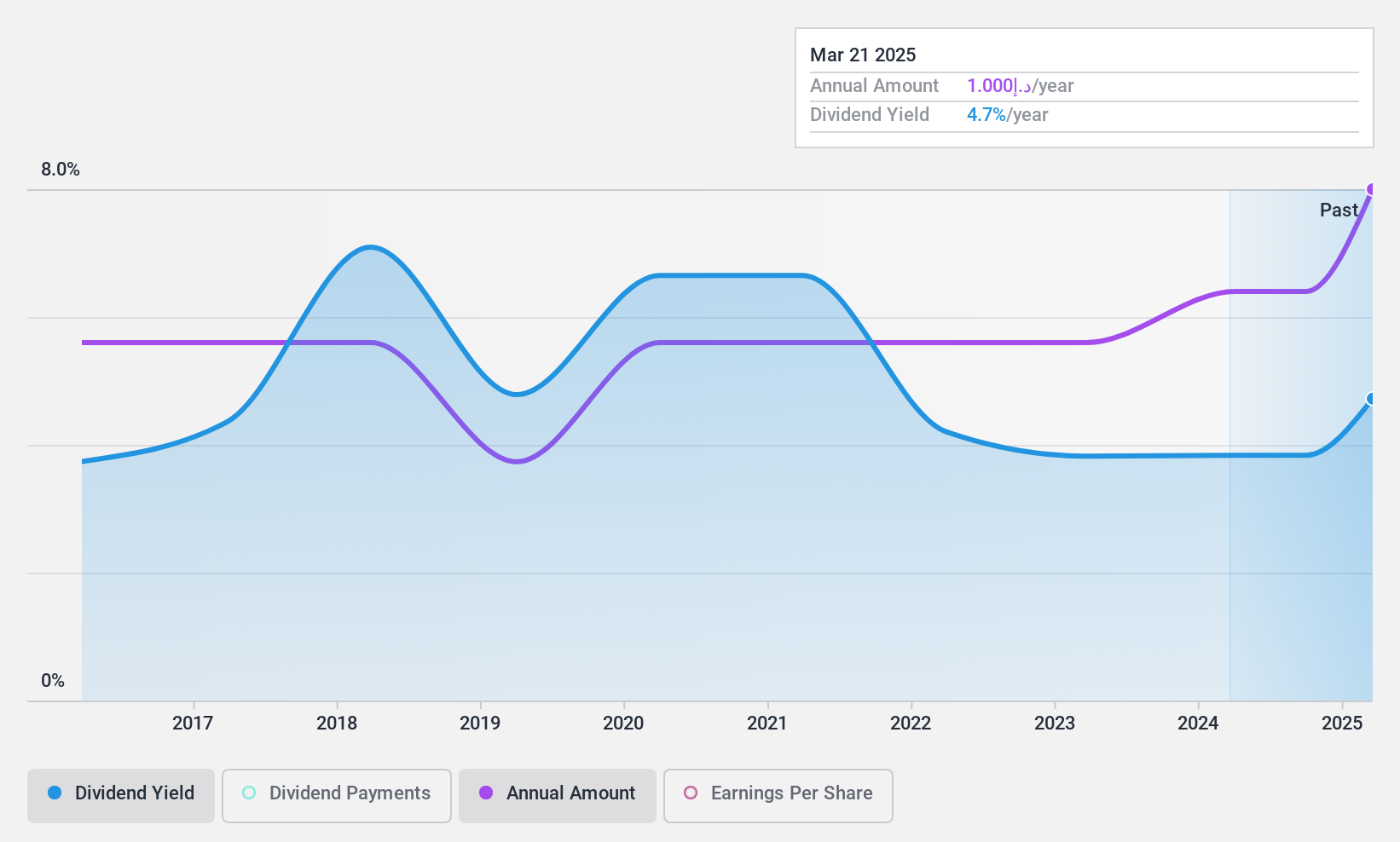

Dividend Yield: 3.3%

Dubai Refreshment (P.J.S.C.) presents a mixed dividend picture. While dividends are covered by earnings and cash flows with payout ratios at 56.6% and 45.1%, respectively, the dividend yield of 3.33% is below top-tier levels in the AE market. The company's dividend payments have been volatile over the past decade but show growth trends despite an unreliable track record. Recent earnings showed a decline in net income, impacting potential future payouts amidst illiquid shares and internal discussions underway.

- Take a closer look at Dubai Refreshment (P.J.S.C.)'s potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Dubai Refreshment (P.J.S.C.) is priced higher than what may be justified by its financials.

BioGaia (OM:BIOG B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB (publ) is a healthcare company that offers probiotic products globally, with a market cap of SEK11.32 billion.

Operations: BioGaia AB (publ) generates revenue primarily from its Pediatrics segment, which accounts for SEK1.04 billion, and its Adult Health segment, contributing SEK306.08 million.

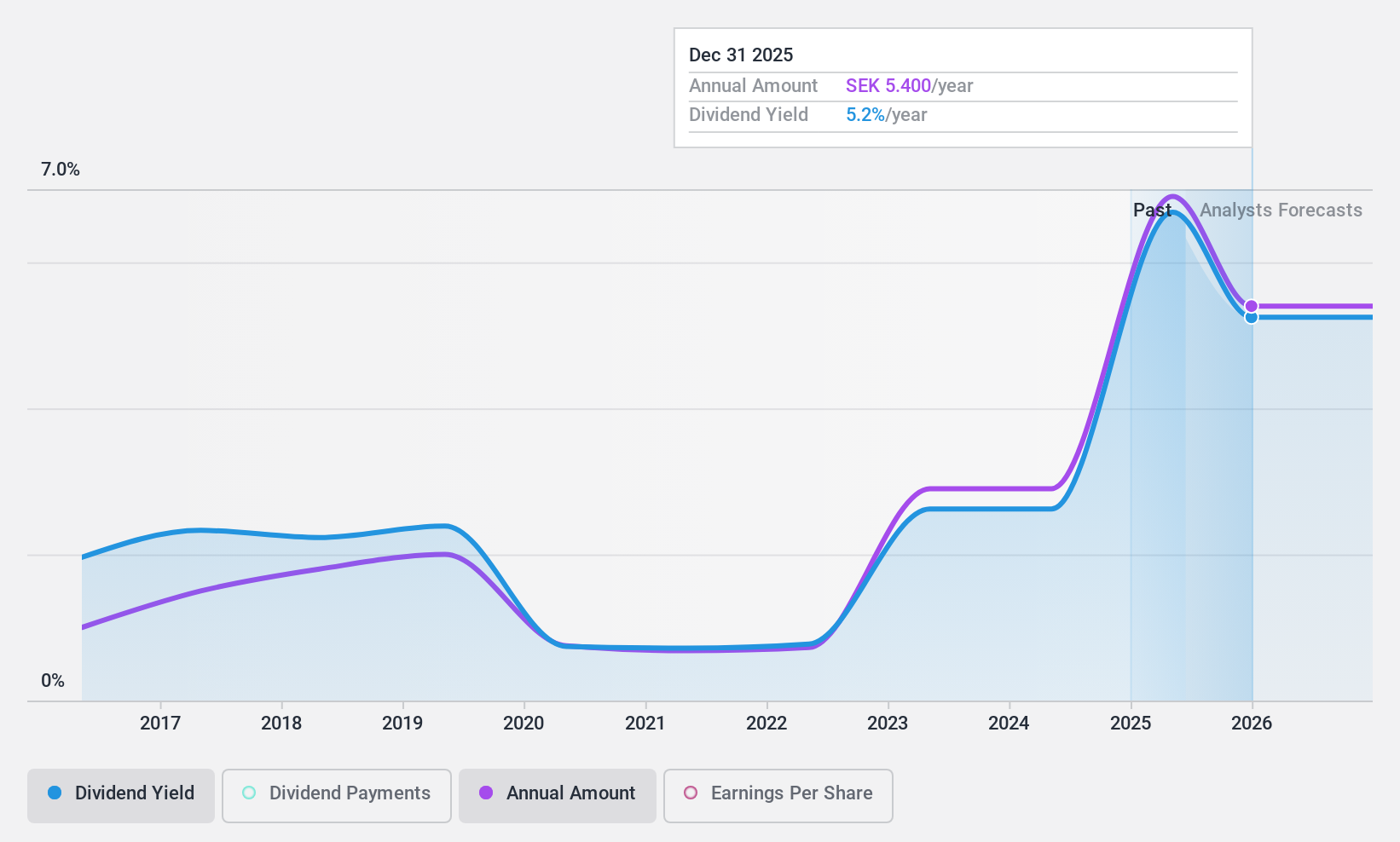

Dividend Yield: 6.2%

BioGaia's dividend yield is among the top 25% in Sweden, yet its sustainability is questionable due to high cash payout ratios of 191.2%, indicating dividends aren't well-covered by cash flows. Despite a reasonable earnings payout ratio of 57%, past decade payments have been volatile and unreliable. Recent earnings reveal decreased net income, which may affect future payouts despite ongoing product innovations like BioGaia® Gastrus® PURE ACTION aimed at expanding market reach and improving digestive health solutions.

- Click here to discover the nuances of BioGaia with our detailed analytical dividend report.

- Our expertly prepared valuation report BioGaia implies its share price may be too high.

Oriental Shiraishi (TSE:1786)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oriental Shiraishi Corporation operates in Japan, focusing on the production, construction, and sale of prestressed concrete products and structures, with a market cap of ¥51.82 billion.

Operations: Oriental Shiraishi Corporation's revenue is primarily derived from its Construction Business, which accounts for ¥57.30 billion, followed by the Steel Structure Business at ¥9.27 billion and the Port Business at ¥3.31 billion.

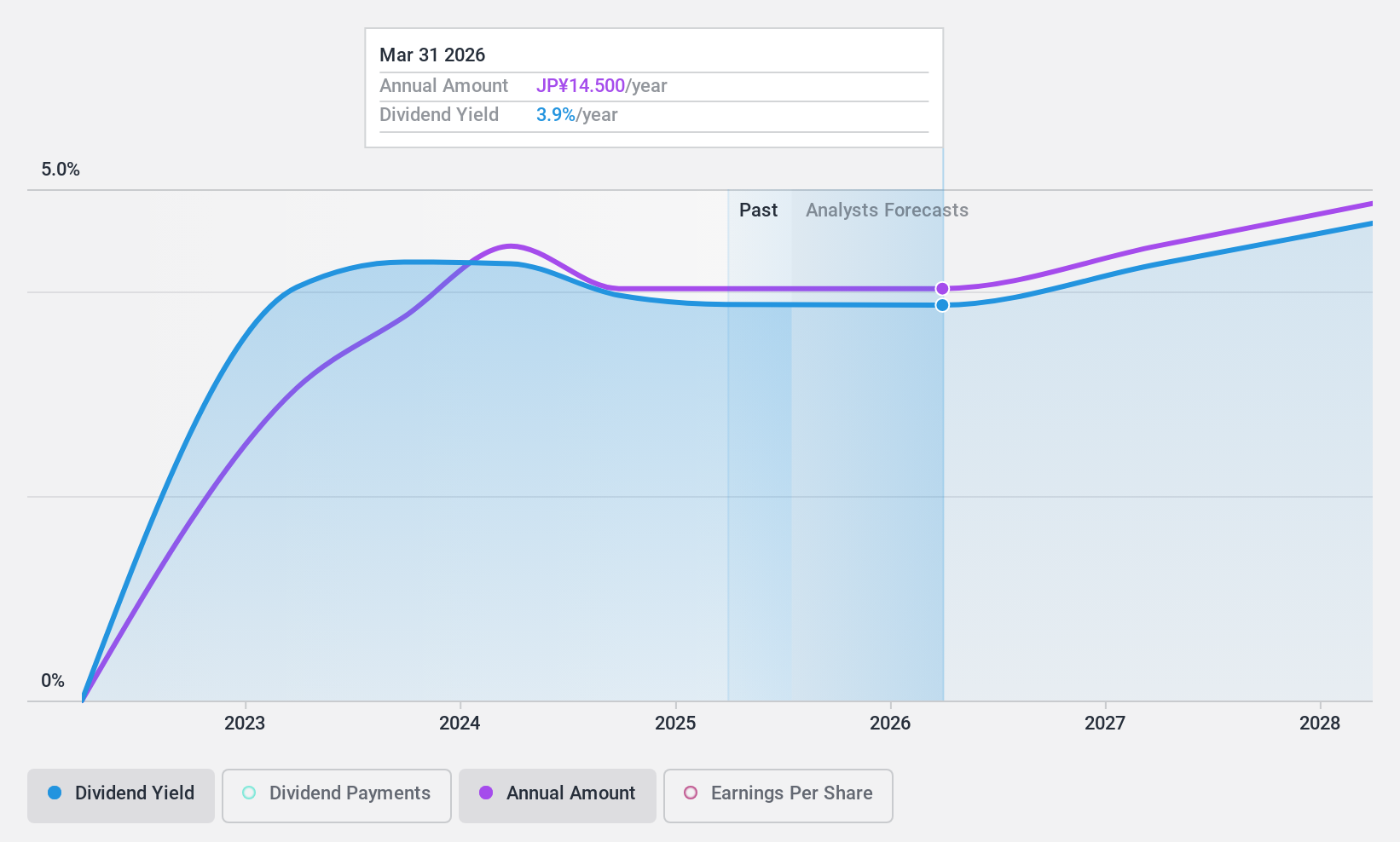

Dividend Yield: 3.8%

Oriental Shiraishi's dividend yield is in the top 25% of Japan's market, supported by a low payout ratio of 34.9%, indicating dividends are well-covered by earnings and cash flows. However, its track record is unstable with volatile payments over the past three years despite recent increases to JPY 7.00 per share for Q2 FY2025. The stock trades below estimated fair value, yet forecasted earnings decline may impact future dividend stability.

- Unlock comprehensive insights into our analysis of Oriental Shiraishi stock in this dividend report.

- Upon reviewing our latest valuation report, Oriental Shiraishi's share price might be too pessimistic.

Where To Now?

- Dive into all 1942 of the Top Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioGaia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOG B

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives