The Middle Eastern stock markets have recently experienced mixed performances, with Dubai's index declining due to pressures from banking and industrial stocks, while Abu Dhabi's market remained relatively stable. In such a fluctuating environment, identifying promising investment opportunities requires a keen eye for companies with strong financials and growth potential. Penny stocks, though an older term, still represent an intriguing area for investors interested in smaller or newer companies that may offer significant value and growth prospects when backed by sound financial health.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.96 | SAR1.6B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR4.45 | SAR540M | ✅ 2 ⚠️ 3 View Analysis > |

| E.E.A.M.I (TASE:EEAM-M) | ₪0.087 | ₪8.53M | ✅ 0 ⚠️ 5 View Analysis > |

| Tectona (TASE:TECT) | ₪3.274 | ₪75.91M | ✅ 1 ⚠️ 6 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.483 | ₪172.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.911 | ₪2.83B | ✅ 1 ⚠️ 2 View Analysis > |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.68 | ₪17.83M | ✅ 0 ⚠️ 6 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.149 | ₪159.76M | ✅ 1 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.685 | AED416.65M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.32 | AED9.82B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 101 stocks from our Middle Eastern Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Hily Holding PJSC (ADX:HH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hily Holding PJSC, along with its subsidiaries, manages securities portfolios in the United Arab Emirates and has a market capitalization of AED334.80 million.

Operations: Hily Holding PJSC does not report any specific revenue segments.

Market Cap: AED334.8M

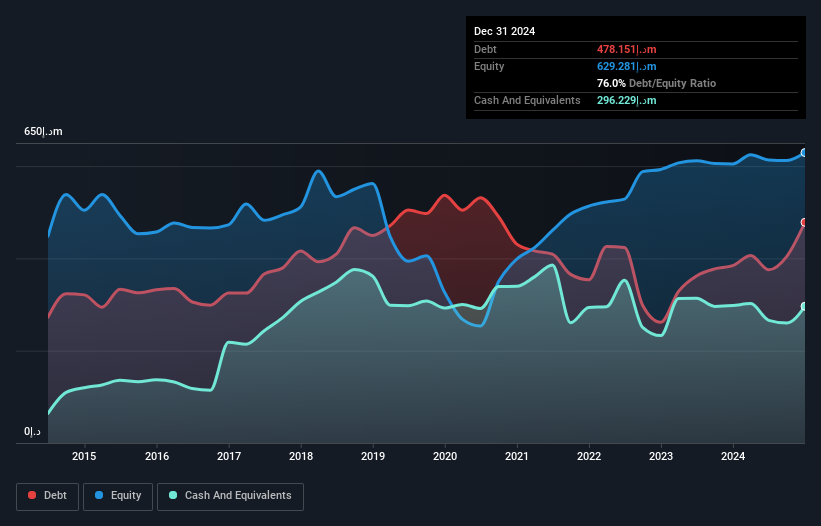

Hily Holding PJSC has shown significant earnings growth, with a 285.4% increase over the past year, outpacing the Industrials industry. The company reported AED 110.99 million in revenue for 2024, up from AED 70.48 million the previous year, and achieved a net income of AED 25.15 million compared to AED 6.53 million last year. Despite this growth, its operating cash flow remains negative and interest coverage is weak at only 0.4 times EBIT, indicating potential financial strain if not addressed. However, Hily's debt levels have improved significantly over five years and short-term assets cover both short- and long-term liabilities comfortably.

- Dive into the specifics of Hily Holding PJSC here with our thorough balance sheet health report.

- Gain insights into Hily Holding PJSC's past trends and performance with our report on the company's historical track record.

Human Xtensions (TASE:HUMX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Human Xtensions Ltd. is a medical robotics company that develops, manufactures, markets, and sells modular medical devices for minimally invasive surgical operations in Israel with a market cap of ₪8.11 million.

Operations: Human Xtensions Ltd. has not reported any revenue segments.

Market Cap: ₪8.11M

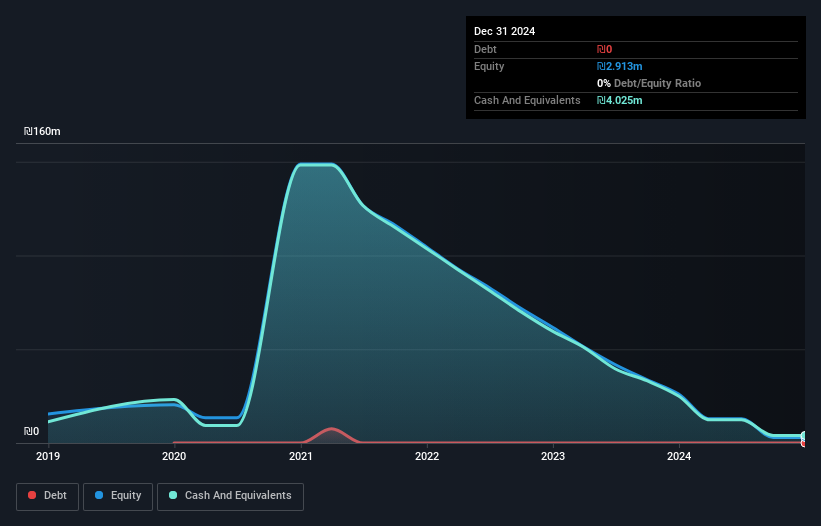

Human Xtensions Ltd., a medical robotics company in Israel, is pre-revenue with less than US$1 million in revenue (₪665K) and remains unprofitable. Despite reducing losses by 6.5% annually over five years, the company's financial position is precarious with less than a year of cash runway at current free cash flow rates. The firm benefits from being debt-free and having short-term assets (₪6.6M) that exceed liabilities (₪3.7M), yet its share price has been highly volatile recently, reflecting market uncertainty about its future prospects amidst limited revenue generation capabilities.

- Jump into the full analysis health report here for a deeper understanding of Human Xtensions.

- Understand Human Xtensions' track record by examining our performance history report.

Sonovia (TASE:SONO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sonovia Ltd. is an Israeli company focused on developing and producing anti-bacterial textile products, with a market cap of ₪10.59 million.

Operations: Sonovia Ltd. does not have any reported revenue segments at this time.

Market Cap: ₪10.59M

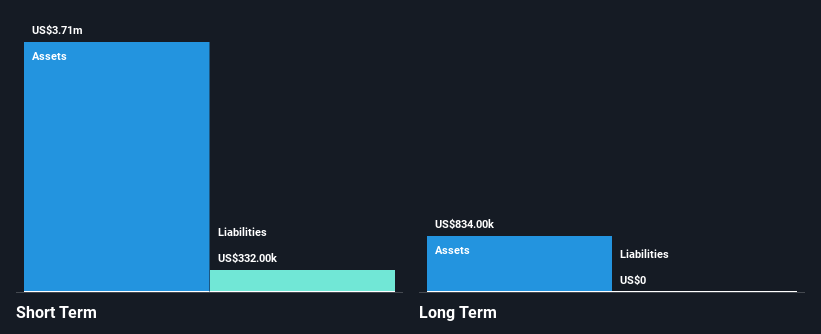

Sonovia Ltd., an Israeli company, is pre-revenue with no significant revenue streams and remains unprofitable. Despite a reduction in net loss from US$3.84 million to US$2.86 million over the past year, the company's financial stability is challenged by a cash runway of less than one year if current free cash flow trends persist. The firm benefits from having no debt and short-term assets (US$3.7 million) that comfortably cover its liabilities (US$332K). However, its share price has been highly volatile recently, reflecting investor uncertainty amidst ongoing losses and limited revenue generation capabilities.

- Unlock comprehensive insights into our analysis of Sonovia stock in this financial health report.

- Evaluate Sonovia's historical performance by accessing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 101 Middle Eastern Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:SONO

Sonovia

Engages in the development and production of anti-bacterial textile products in Israel.

Excellent balance sheet moderate.

Market Insights

Community Narratives