Three Undiscovered Gems In The Middle East With Promising Potential

Reviewed by Simply Wall St

As the Middle East markets navigate a cautious landscape marked by mixed performances across Gulf bourses and ongoing global trade uncertainties, investors are keenly observing economic indicators that could influence small-cap stocks. Despite these challenges, the region's promising economic outlook and strategic developments present opportunities for discerning investors to identify potential growth stocks. In this context, identifying companies with strong fundamentals and innovative strategies becomes crucial for capitalizing on emerging market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 23.11% | 5.81% | 10.57% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 50.97% | 56.63% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Abu Dhabi Ship Building PJSC (ADX:ADSB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Abu Dhabi Ship Building PJSC, with a market cap of AED 1.87 billion, operates in the United Arab Emirates focusing on the construction, maintenance, repair, and overhaul of commercial and military ships and vessels.

Operations: ADSB generates revenue primarily from its New Build and Engineering segment, contributing AED 1.24 billion, followed by Military Repairs and Maintenance at AED 152.25 million. The company also earns from Small Boats, Mission Systems, and Commercial Repairs and Maintenance segments with smaller contributions.

Abu Dhabi Ship Building (ADSB) is making waves with its impressive growth and strategic moves. Earnings surged by 36.8% last year, outpacing the industry average of 9.6%, while its debt-to-equity ratio improved significantly from 161.5% to 30.4% over five years, showcasing financial prudence. The recent AED 7 billion contract for Falaj3-class missile boats with Kuwait Naval Forces highlights ADSB's robust order book and potential revenue boost, despite a volatile share price in recent months. With a price-to-earnings ratio of 28x, below the industry average of 55x, ADSB presents an intriguing opportunity in the defense sector.

- Click here and access our complete health analysis report to understand the dynamics of Abu Dhabi Ship Building PJSC.

Learn about Abu Dhabi Ship Building PJSC's historical performance.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Value Rating: ★★★★☆☆

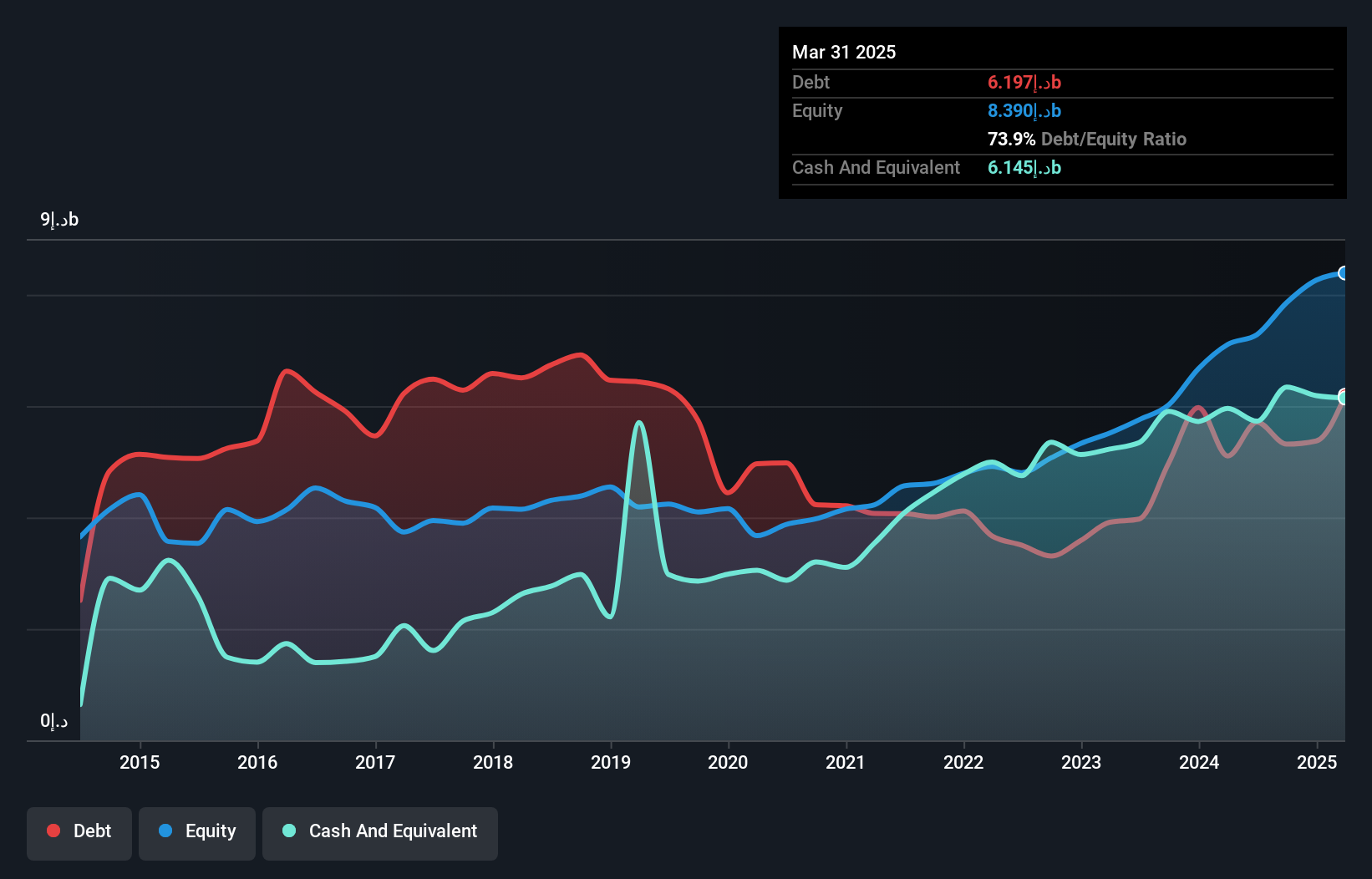

Overview: Al Waha Capital PJSC is a private equity firm that manages assets in sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate and capital markets with a market cap of AED2.93 billion.

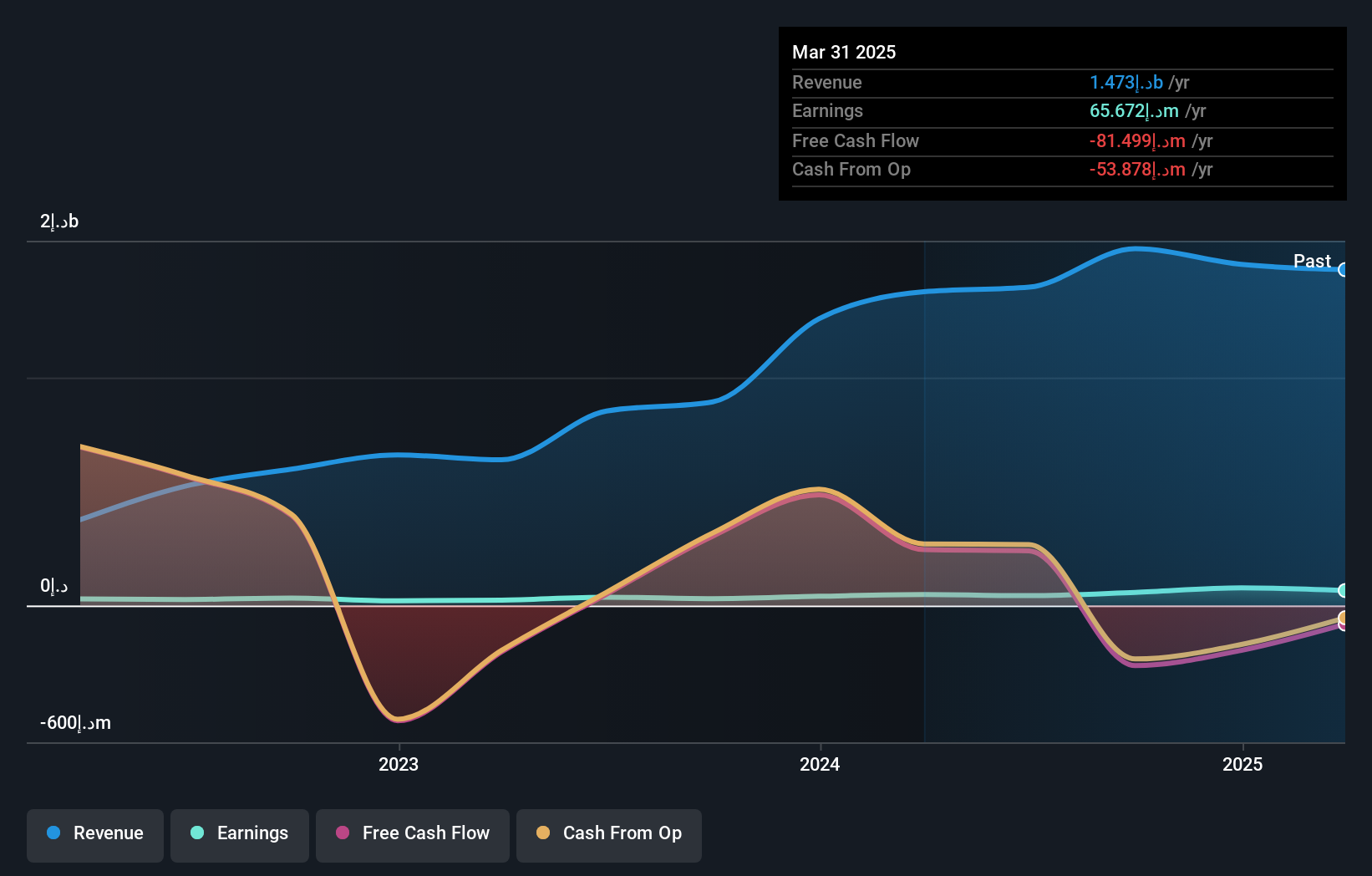

Operations: Revenue from private investments, excluding Waha Land, amounts to AED152.39 million.

Al Waha Capital, a notable player in the Middle East's investment landscape, has seen its debt to equity ratio improve significantly from 135.2% to 73.9% over five years, signaling better financial health. Despite a dip in earnings growth by 44.3%, which contrasts with the industry average of 2.2%, its price-to-earnings ratio of 9.9x remains attractive compared to the AE market's average of 12.9x, suggesting potential undervaluation. The company's recent board meeting focused on monetization strategies for assets within ALMARKAZ industrial development, indicating proactive management efforts to enhance value and address current challenges in revenue and net income performance.

- Take a closer look at Al Waha Capital PJSC's potential here in our health report.

Gain insights into Al Waha Capital PJSC's past trends and performance with our Past report.

Aksigorta (IBSE:AKGRT)

Simply Wall St Value Rating: ★★★★★★

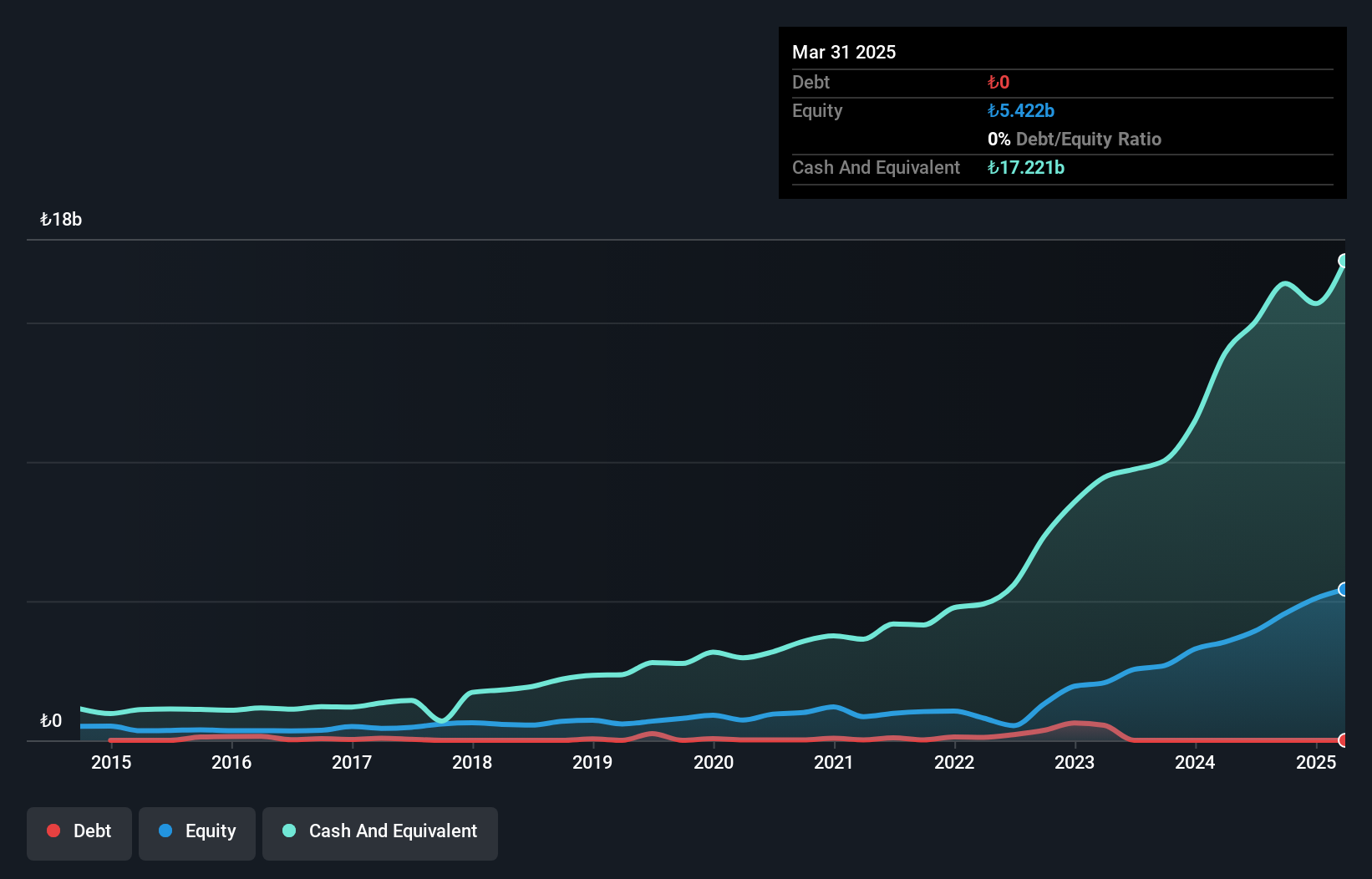

Overview: Aksigorta A.S. offers a range of life and non-life insurance products and services to both retail and business customers in Turkey, with a market capitalization of TRY10.64 billion.

Operations: Aksigorta's primary revenue streams include Motor Vehicles Insurance at TRY5.28 billion and Motor Vehicles Liability at TRY3.86 billion, supplemented by Fire and Other Accident insurance segments. The company also generates income from Health, Agriculture, Engineering, and Transportation insurance services.

In the bustling landscape of Middle Eastern stocks, Aksigorta stands out with its impressive growth and financial health. Over the past year, earnings surged by 45.5%, outpacing the insurance industry's 36.5% rise, showcasing its competitive edge. With a price-to-earnings ratio of 5.5x compared to Turkey's market average of 18.1x, it seems undervalued for potential investors seeking value opportunities. Aksigorta is debt-free now, a notable improvement from five years ago when it had a debt-to-equity ratio of 2%. Recent earnings reveal net income climbed to TRY 352 million from TRY 273 million last year, indicating robust performance and promising future prospects in this dynamic region.

- Navigate through the intricacies of Aksigorta with our comprehensive health report here.

Gain insights into Aksigorta's historical performance by reviewing our past performance report.

Next Steps

- Discover the full array of 217 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AKGRT

Aksigorta

Provides various life and non-life insurance products and services to retail and business customers in Turkey.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives