- United Arab Emirates

- /

- Banks

- /

- DFM:EMIRATESNBD

The total return for Emirates NBD Bank PJSC (DFM:EMIRATESNBD) investors has risen faster than earnings growth over the last five years

Stock pickers are generally looking for stocks that will outperform the broader market. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the Emirates NBD Bank PJSC share price has climbed 63% in five years, easily topping the market return of 26% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 22% , including dividends .

While the stock has fallen 5.5% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Emirates NBD Bank PJSC

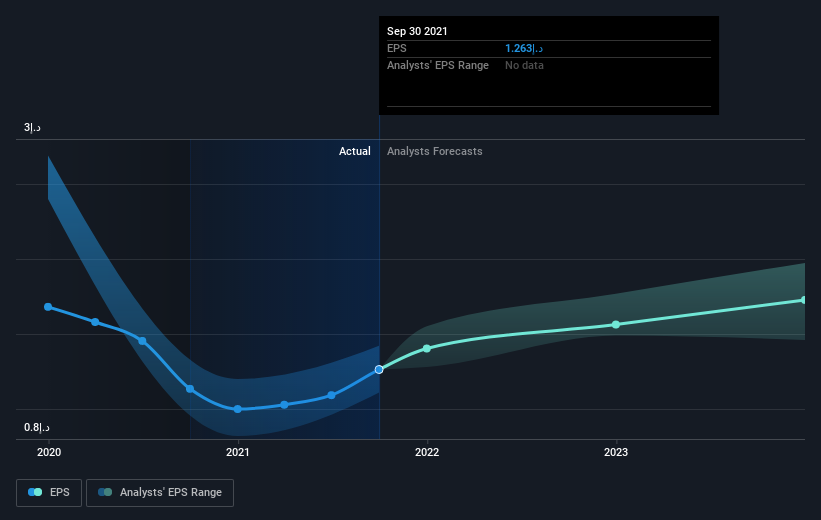

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over half a decade, Emirates NBD Bank PJSC managed to grow its earnings per share at 0.3% a year. This EPS growth is lower than the 10% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Emirates NBD Bank PJSC has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Emirates NBD Bank PJSC's TSR for the last 5 years was 103%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Emirates NBD Bank PJSC shareholders gained a total return of 22% during the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 15% per year over five year. It is possible that returns will improve along with the business fundamentals. Keeping this in mind, a solid next step might be to take a look at Emirates NBD Bank PJSC's dividend track record. This free interactive graph is a great place to start.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AE exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Emirates NBD Bank PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DFM:EMIRATESNBD

Emirates NBD Bank PJSC

Provides corporate, institutional, retail, treasury, and Islamic banking services.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success