- United Arab Emirates

- /

- Banks

- /

- DFM:CBD

Middle Eastern Dividend Stocks Yielding Up To 5.3%

Reviewed by Simply Wall St

As Gulf markets experience a downturn with Saudi Arabia's index nearing a two-year low, investor optimism around potential U.S. rate cuts has waned, reflecting broader concerns about excess crude supplies and sectoral losses. In such uncertain times, dividend stocks can offer a degree of stability and income potential, making them an attractive option for investors looking to navigate the current market landscape in the Middle East.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Awwal Bank (SASE:1060) | 6.63% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.38% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.36% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.12% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.99% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 6.71% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.18% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.85% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.31% | ★★★★★☆ |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | 6.06% | ★★★★★☆ |

Click here to see the full list of 69 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, specializes in managing and developing motor vehicle driving training in the United Arab Emirates, with a market capitalization of AED3.40 billion.

Operations: Emirates Driving Company P.J.S.C. generates revenue primarily from its Car and Other Related Services segment, amounting to AED690.46 million.

Dividend Yield: 5.4%

Emirates Driving Company P.J.S.C. has shown robust earnings growth, with net income rising to AED 87.22 million in Q2 2025 from AED 55.33 million a year ago, yet its dividend yield of 5.38% lags behind the top quartile in the AE market. Despite this, dividends are well-covered by both earnings and cash flow, with payout ratios at reasonable levels (58.7% and 61.5%, respectively). However, its dividend history is marked by volatility and unreliability over the past decade.

- Click here to discover the nuances of Emirates Driving Company P.J.S.C with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Emirates Driving Company P.J.S.C is trading behind its estimated value.

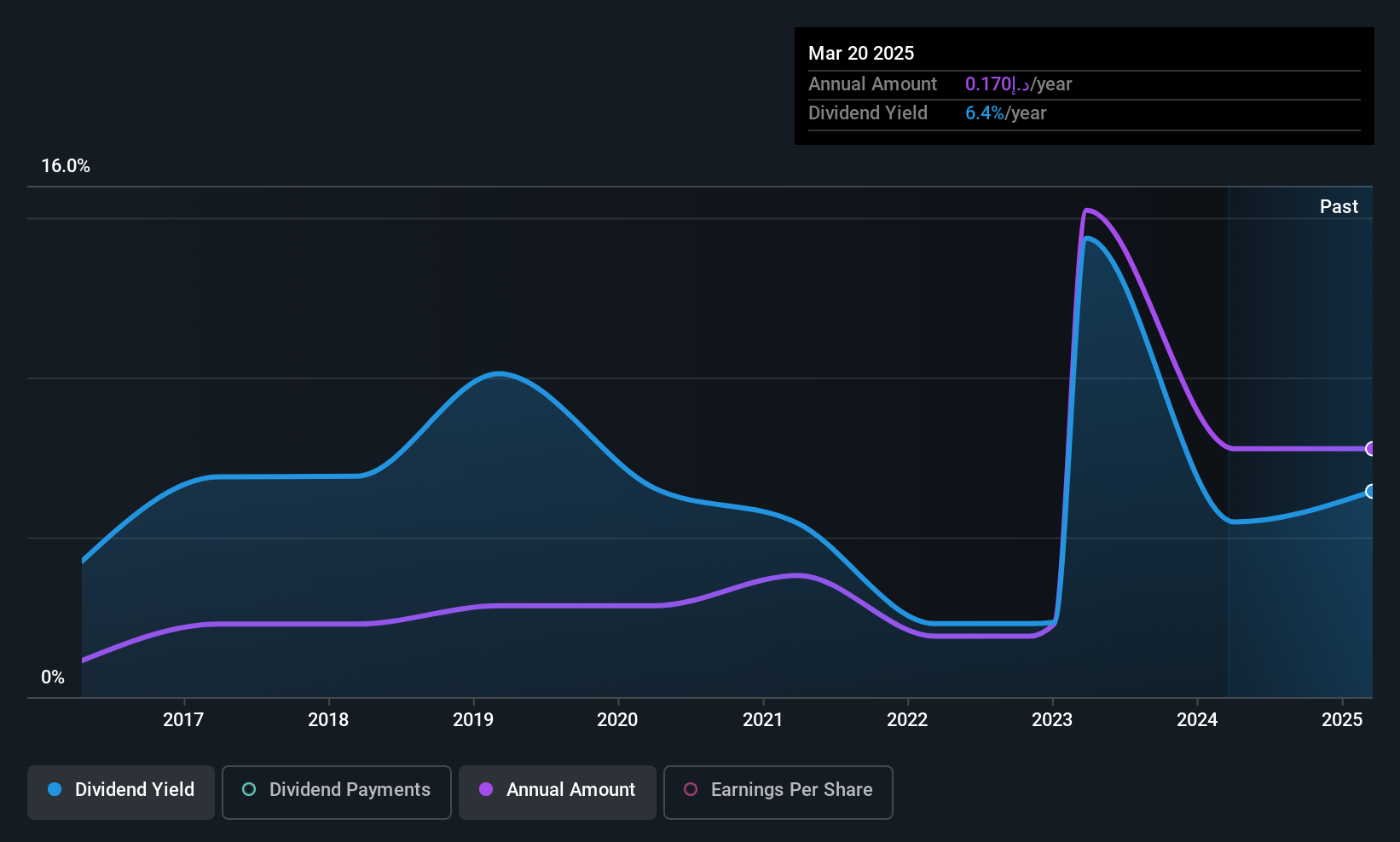

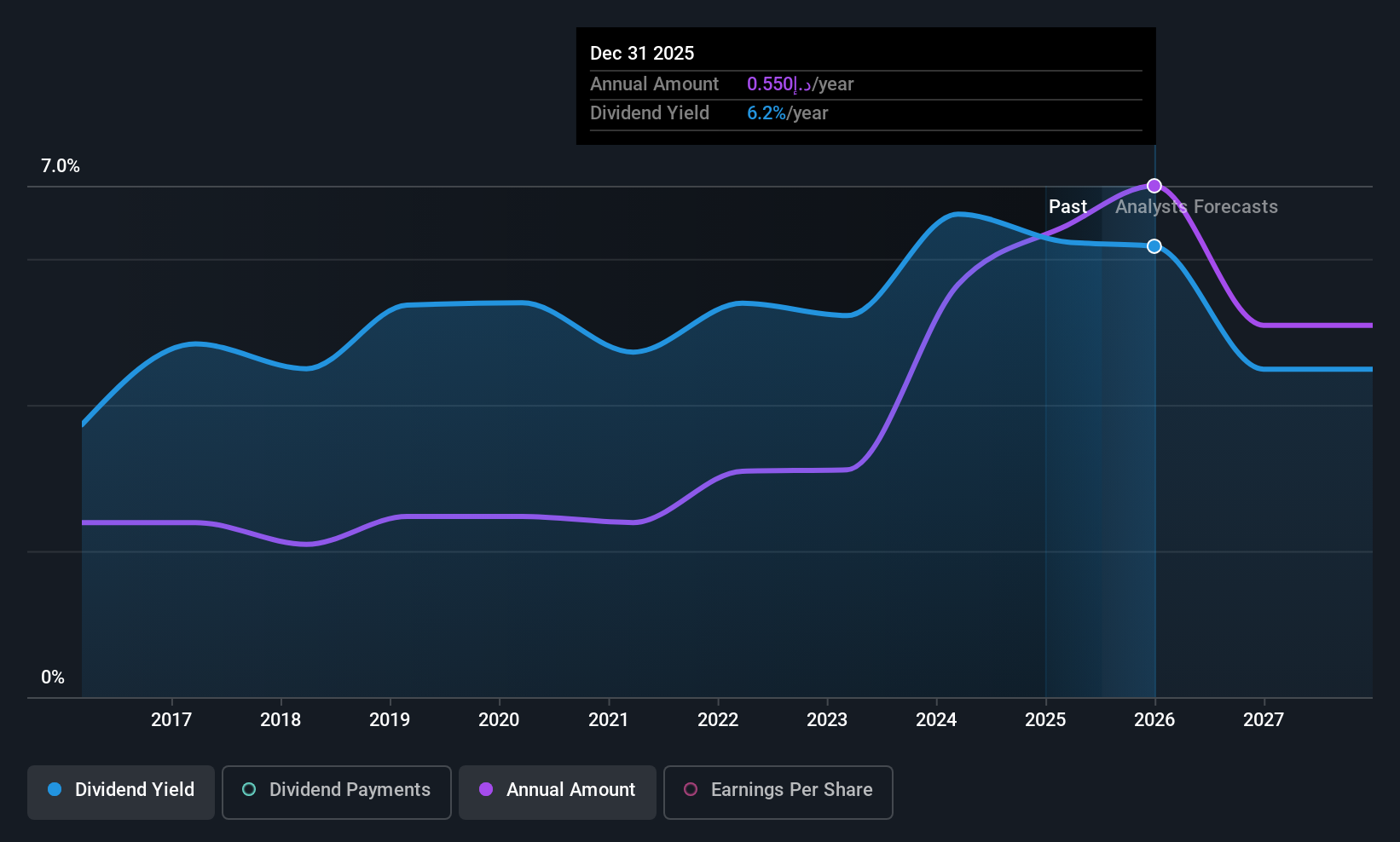

Commercial Bank of Dubai PSC (DFM:CBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Commercial Bank of Dubai PSC offers commercial and retail banking services in the United Arab Emirates and has a market cap of AED29.25 billion.

Operations: Commercial Bank of Dubai PSC's revenue is primarily derived from its Personal Banking segment at AED1.89 billion, followed by Corporate Banking at AED1.56 billion, and Institutional Banking at AED1.28 billion.

Dividend Yield: 5.2%

Commercial Bank of Dubai PSC offers a stable dividend history with consistent growth over the past decade. Its dividends are well-covered by earnings, evidenced by a current payout ratio of 48.2% and a forecasted reduction to 39.8% in three years. Despite its reliable dividend payments, the yield is relatively low at 5.18%, compared to top-tier payers in the AE market. The bank's financial health is underscored by solid earnings growth but tempered by high non-performing loans at 4.8%.

- Get an in-depth perspective on Commercial Bank of Dubai PSC's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Commercial Bank of Dubai PSC shares in the market.

Dubai Islamic Bank P.J.S.C (DFM:DIB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Islamic Bank P.J.S.C., along with its subsidiaries, operates in corporate, retail, and investment banking both in the United Arab Emirates and internationally, with a market capitalization of AED68.37 billion.

Operations: Dubai Islamic Bank P.J.S.C. generates revenue through several segments, including Consumer Banking (AED4.43 billion), Corporate Banking (AED3.37 billion), Treasury (AED2.76 billion), and Real Estate Development (AED773.96 million).

Dividend Yield: 4.8%

Dubai Islamic Bank P.J.S.C. presents a mixed dividend profile with a current payout ratio of 41.7%, indicating dividends are well-covered by earnings. However, its dividend yield of 4.76% is lower than top-tier AE market payers, and the bank's dividend history has been volatile over the past decade despite growth. Recent earnings showed an increase in net income to AED 1,858.03 million for Q2 2025, but non-performing loans remain high at 3.1%.

- Delve into the full analysis dividend report here for a deeper understanding of Dubai Islamic Bank P.J.S.C.

- Our comprehensive valuation report raises the possibility that Dubai Islamic Bank P.J.S.C is priced higher than what may be justified by its financials.

Make It Happen

- Investigate our full lineup of 69 Top Middle Eastern Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:CBD

Commercial Bank of Dubai PSC

Provides commercial and retail banking services in the United Arab Emirates.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives