- United Arab Emirates

- /

- Banks

- /

- ADX:RAKBANK

National Bank of Ras Al-Khaimah (P.S.C.) And 2 Reliable Dividend Stocks For Steady Income

Reviewed by Simply Wall St

In a landscape marked by fluctuating global markets, where U.S. stocks have experienced volatility due to AI competition fears and political tariff risks, investors are increasingly looking for stability in their portfolios. Dividend stocks often provide a reliable income stream amid such uncertainty, as they tend to offer consistent returns through regular payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.66% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.70% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.56% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The National Bank of Ras Al-Khaimah (P.S.C.) offers retail, Islamic, and commercial banking products and services to individuals and businesses in the United Arab Emirates, with a market cap of AED13.28 billion.

Operations: The National Bank of Ras Al-Khaimah (P.S.C.) generates revenue through its diverse offerings in retail, Islamic, and commercial banking services aimed at both individual and corporate clients throughout the United Arab Emirates.

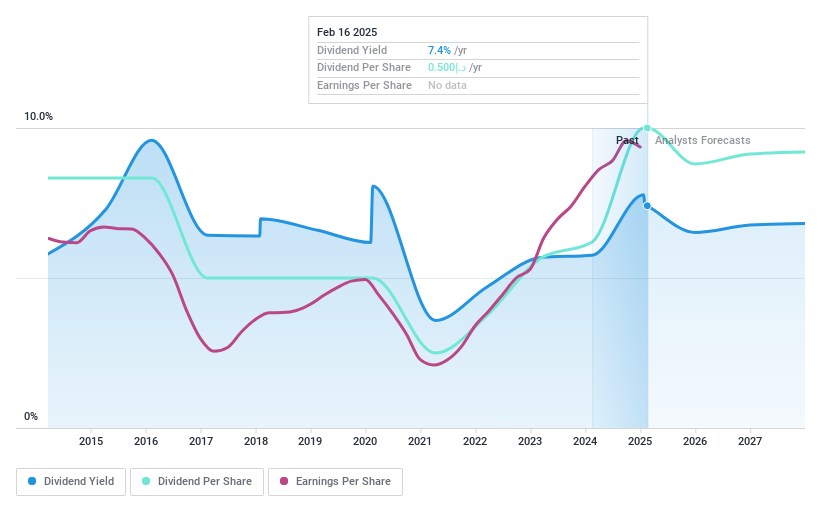

Dividend Yield: 7.5%

RAKBANK offers a compelling dividend yield of 7.45%, ranking in the top 25% within the AE market. The bank's dividends are well-covered by earnings, with a payout ratio of 48.4%. However, its dividend history is marked by volatility and unreliability over the past decade. Despite recent earnings growth of 16.4%, future earnings are expected to decline slightly by an average of 1% annually over the next three years, which may affect dividend stability.

- Unlock comprehensive insights into our analysis of National Bank of Ras Al-Khaimah (P.S.C.) stock in this dividend report.

- According our valuation report, there's an indication that National Bank of Ras Al-Khaimah (P.S.C.)'s share price might be on the cheaper side.

Univanich Palm Oil (SET:UVAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Univanich Palm Oil Public Company Limited operates oil palm plantations, crushing mills, and engages in oil palm research and seed businesses in Thailand, with a market cap of THB9.07 billion.

Operations: Univanich Palm Oil's revenue segments include oil palm plantations, crushing mills, and oil palm research and seed businesses in Thailand.

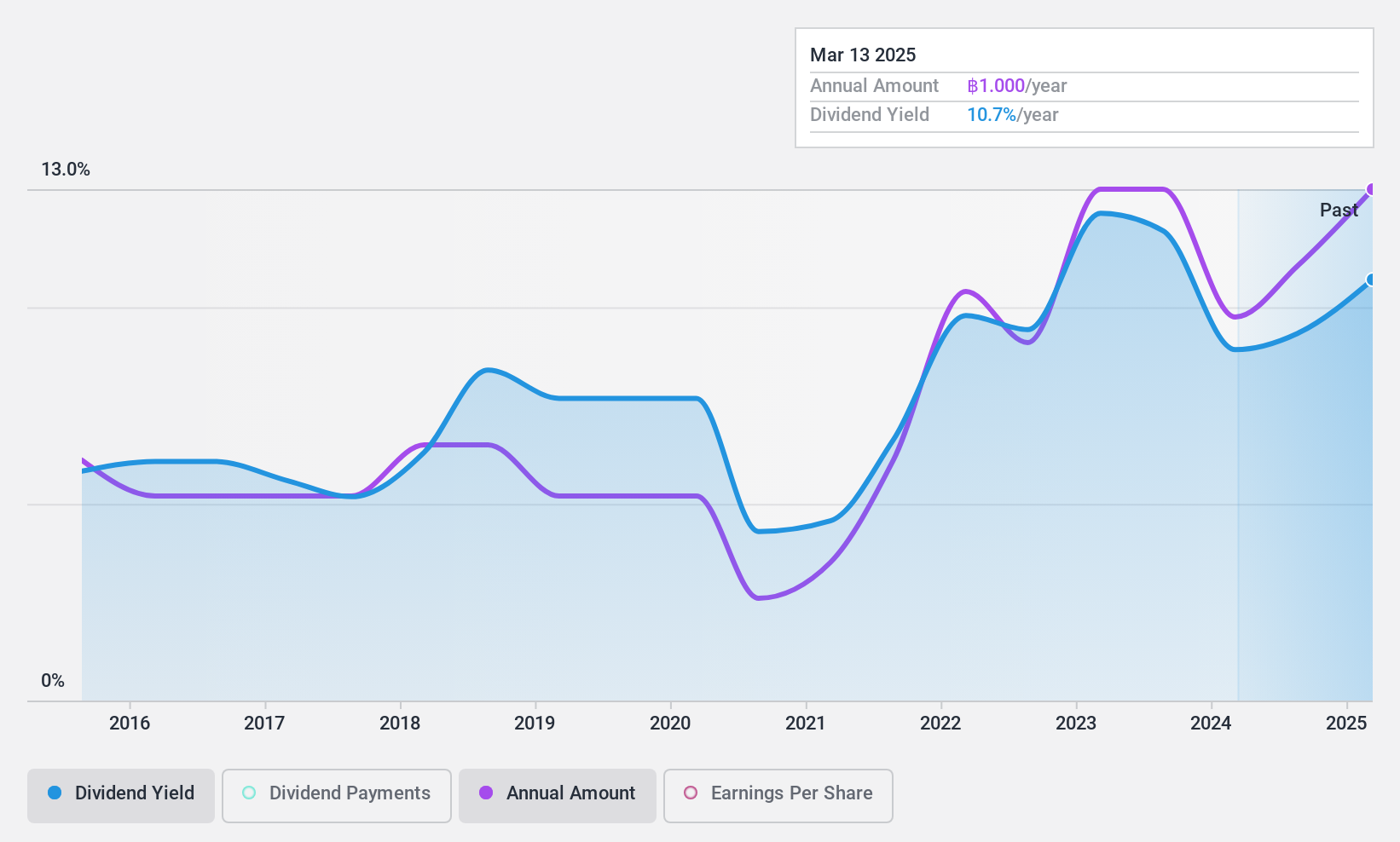

Dividend Yield: 7.6%

Univanich Palm Oil offers a strong dividend yield of 7.61%, placing it in the top 25% of Thai dividend payers. The dividends are well-supported by both earnings and cash flows, with payout ratios of 59.1% and 60.9%, respectively. However, its dividend history is marked by volatility and unreliability over the past decade, despite recent growth in payments. Earnings have shown robust growth recently, with significant increases reported for the third quarter of 2024.

- Get an in-depth perspective on Univanich Palm Oil's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Univanich Palm Oil's share price might be too pessimistic.

KandenkoLtd (TSE:1942)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kandenko Co., Ltd., along with its subsidiaries, functions as a general infrastructure company in Japan and has a market cap of ¥528.37 billion.

Operations: Kandenko Co., Ltd. generates revenue through its operations as a general infrastructure company in Japan.

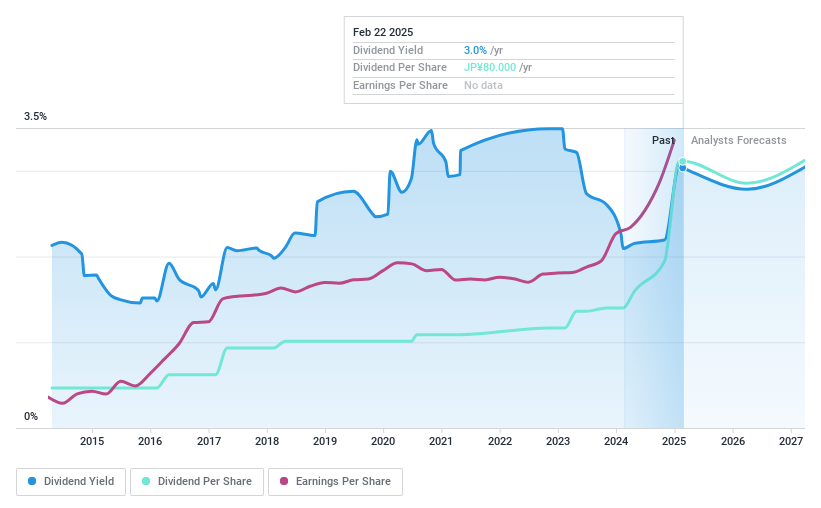

Dividend Yield: 3.2%

Kandenko Ltd. recently increased its dividend guidance, projecting JPY 82 per share, up from JPY 25 due to strong private construction investment and productivity gains. The company’s dividends are well-covered by earnings with a payout ratio of 25% and cash flows at a 68.8% cash payout ratio. Although its dividend yield of 3.18% is below the top tier in Japan, Kandenko's dividends have been reliable and stable over the past decade, supported by robust earnings growth.

- Delve into the full analysis dividend report here for a deeper understanding of KandenkoLtd.

- Our valuation report here indicates KandenkoLtd may be undervalued.

Make It Happen

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1977 more companies for you to explore.Click here to unveil our expertly curated list of 1980 Top Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Ras Al-Khaimah (P.S.C.) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:RAKBANK

National Bank of Ras Al-Khaimah (P.S.C.)

Engages in providing retail, Islamic, and commercial banking products, and services to individuals and businesses in the United Arab Emirates.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives