- United Arab Emirates

- /

- Banks

- /

- ADX:NBQ

Positive earnings growth hasn't been enough to get National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ) shareholders a favorable return over the last five years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ), since the last five years saw the share price fall 32%.

While the last five years has been tough for National Bank of Umm Al-Qaiwain (PSC) shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for National Bank of Umm Al-Qaiwain (PSC)

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

While the share price declined over five years, National Bank of Umm Al-Qaiwain (PSC) actually managed to increase EPS by an average of 1.5% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

Based on these numbers, we'd venture that the market may have been over-optimistic about forecast growth, half a decade ago. Looking to other metrics might better explain the share price change.

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. It could be that the revenue decline of 5.5% per year is viewed as evidence that National Bank of Umm Al-Qaiwain (PSC) is shrinking. With revenue weak, and increased payouts of cash, the market might be taking the view that its best days are behind it.

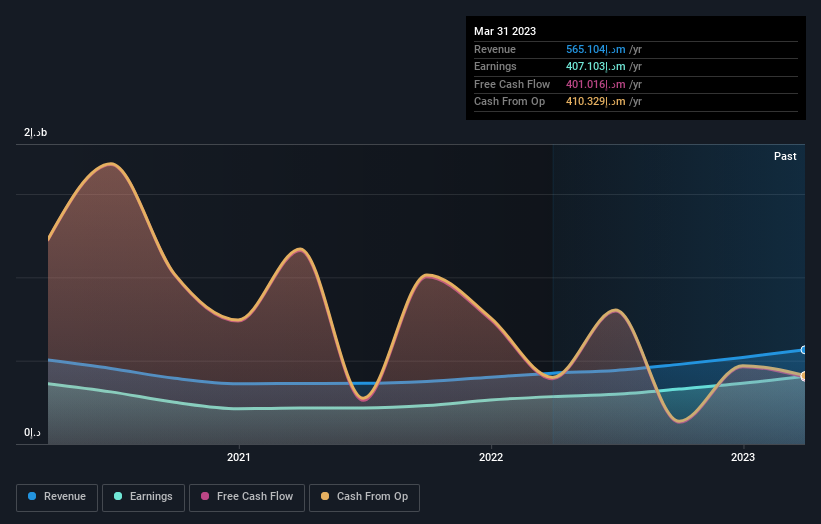

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on National Bank of Umm Al-Qaiwain (PSC)'s balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, National Bank of Umm Al-Qaiwain (PSC)'s TSR for the last 5 years was -13%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Investors in National Bank of Umm Al-Qaiwain (PSC) had a tough year, with a total loss of 6.1% (including dividends), against a market gain of about 21%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand National Bank of Umm Al-Qaiwain (PSC) better, we need to consider many other factors. For example, we've discovered 2 warning signs for National Bank of Umm Al-Qaiwain (PSC) (1 is significant!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Emirian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Umm Al-Qaiwain (PSC) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ADX:NBQ

National Bank of Umm Al-Qaiwain (PSC)

Engages in the provision of retail and corporate banking services in the United Arab Emirates.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026