- United States

- /

- Banks

- /

- NasdaqGS:FIBK

Why First Interstate BancSystem, Inc.'s (NASDAQ:FIBK) High P/E Ratio Isn't Necessarily A Bad Thing

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll look at First Interstate BancSystem, Inc.'s (NASDAQ:FIBK) P/E ratio and reflect on what it tells us about the company's share price. First Interstate BancSystem has a P/E ratio of 15.20, based on the last twelve months. That is equivalent to an earnings yield of about 6.6%.

View our latest analysis for First Interstate BancSystem

How Do You Calculate A P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for First Interstate BancSystem:

P/E of 15.20 = USD41.12 ÷ USD2.70 (Based on the trailing twelve months to September 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each USD1 the company has earned over the last year. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

How Does First Interstate BancSystem's P/E Ratio Compare To Its Peers?

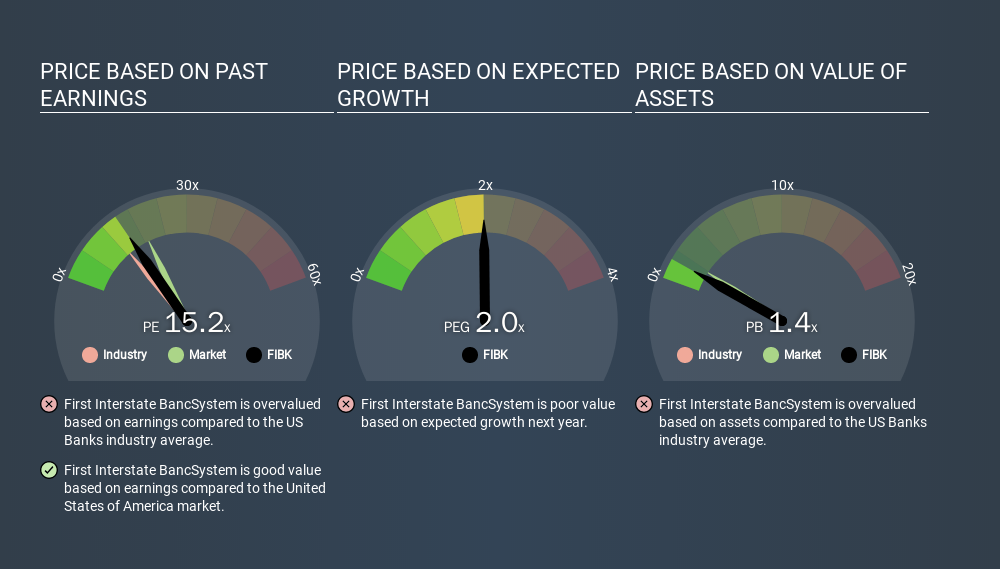

We can get an indication of market expectations by looking at the P/E ratio. As you can see below, First Interstate BancSystem has a higher P/E than the average company (12.8) in the banks industry.

That means that the market expects First Interstate BancSystem will outperform other companies in its industry. Shareholders are clearly optimistic, but the future is always uncertain. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. Earnings growth means that in the future the 'E' will be higher. That means unless the share price increases, the P/E will reduce in a few years. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

First Interstate BancSystem maintained roughly steady earnings over the last twelve months. But EPS is up 7.7% over the last 5 years.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. So it won't reflect the advantage of cash, or disadvantage of debt. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

How Does First Interstate BancSystem's Debt Impact Its P/E Ratio?

With net cash of US$589m, First Interstate BancSystem has a very strong balance sheet, which may be important for its business. Having said that, at 22% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Verdict On First Interstate BancSystem's P/E Ratio

First Interstate BancSystem trades on a P/E ratio of 15.2, which is below the US market average of 19.0. EPS was up modestly better over the last twelve months. Also positive, the relatively strong balance sheet will allow for investment in growth. In contrast, the P/E indicates shareholders doubt that will happen! Since analysts are predicting growth will continue, one might expect to see a higher P/E so it may be worth looking closer.

Investors have an opportunity when market expectations about a stock are wrong. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:FIBK

First Interstate BancSystem

Operates as the bank holding company for First Interstate Bank that provides a range of banking products and services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Valuation Analysis of Palantir Technologies: Growth Assumptions and Market Expectations

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Asset-Light but Valuation-Heavy: A Fundamental Breakdown of Marriott ($MAR)

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks