- Belgium

- /

- Wireless Telecom

- /

- ENXTBR:OBEL

What Type Of Returns Would Orange Belgium's(EBR:OBEL) Shareholders Have Earned If They Purchased Their SharesYear Ago?

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the Orange Belgium S.A. (EBR:OBEL) share price is down 27% in the last year. That contrasts poorly with the market decline of 20%. Zooming out, the stock is down 26% in the last three years. The good news is that the stock is up 2.0% in the last week.

View our latest analysis for Orange Belgium

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Orange Belgium share price fell, it actually saw its earnings per share (EPS) improve by 26%. It could be that the share price was previously over-hyped.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's well worth checking out some other metrics, too.

Orange Belgium managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

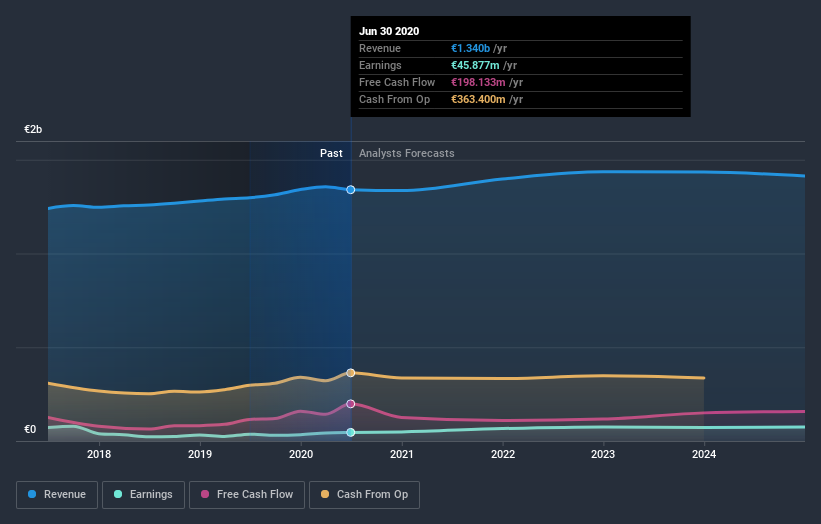

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Orange Belgium is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Orange Belgium's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Orange Belgium's TSR, which was a 25% drop over the last year, was not as bad as the share price return.

A Different Perspective

We regret to report that Orange Belgium shareholders are down 25% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 20%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2.7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Orange Belgium that you should be aware of.

But note: Orange Belgium may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

If you decide to trade Orange Belgium, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTBR:OBEL

Orange Belgium

Engages in the provision of telecommunication services in Belgium and Luxembourg.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives