What Did Great Wall Motor's (HKG:2333) CEO Take Home Last Year?

This article will reflect on the compensation paid to Feng Ying Wang who has served as CEO of Great Wall Motor Company Limited (HKG:2333) since 2002. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Great Wall Motor.

Check out our latest analysis for Great Wall Motor

Comparing Great Wall Motor Company Limited's CEO Compensation With the industry

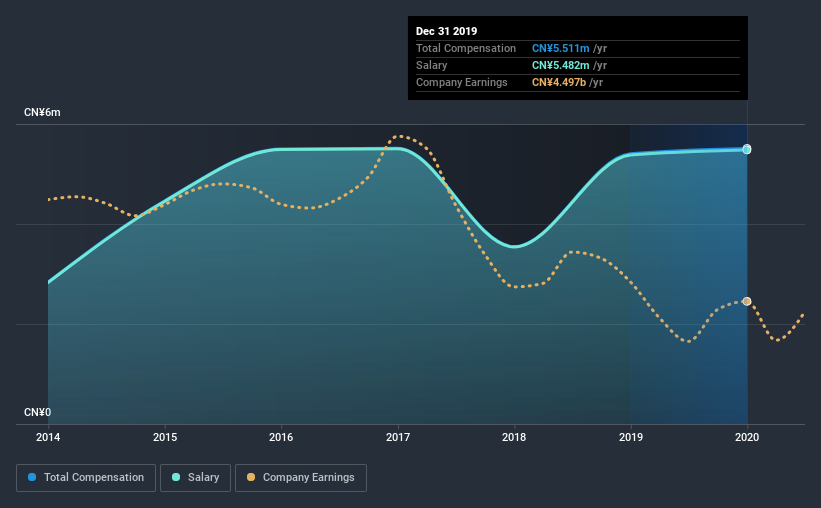

At the time of writing, our data shows that Great Wall Motor Company Limited has a market capitalization of HK$165b, and reported total annual CEO compensation of CN¥5.5m for the year to December 2019. This means that the compensation hasn't changed much from last year. Notably, the salary which is CN¥5.48m, represents most of the total compensation being paid.

On comparing similar companies in the industry with market capitalizations above HK$62b, we found that the median total CEO compensation was CN¥7.4m. So it looks like Great Wall Motor compensates Feng Ying Wang in line with the median for the industry.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CN¥5.5m | CN¥5.4m | 99% |

| Other | CN¥29k | CN¥24k | 1% |

| Total Compensation | CN¥5.5m | CN¥5.4m | 100% |

Speaking on an industry level, nearly 80% of total compensation represents salary, while the remainder of 20% is other remuneration. Great Wall Motor is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Great Wall Motor Company Limited's Growth Numbers

Great Wall Motor Company Limited has reduced its earnings per share by 20% a year over the last three years. In the last year, its revenue is down 1.3%.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Great Wall Motor Company Limited Been A Good Investment?

With a total shareholder return of 16% over three years, Great Wall Motor Company Limited shareholders would, in general, be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

Feng Ying receives almost all of their compensation through a salary. As we touched on above, Great Wall Motor Company Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. According to our analysis, Great Wall Motor is suffering from uninspiring EPS growth, and even though shareholder returns are stable, they are hardly impressive. These figures do not go well against CEO compensation, which is more or less equal to the industry median. We wouldn't go as far as saying CEO compensation is inappropriate, but we don't think the executive is underpaid.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 2 warning signs for Great Wall Motor that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Great Wall Motor or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:2333

Great Wall Motor

Engages in the manufacture and sale of automobiles, and automotive parts and components in the People's Republic of China, Europe, ASEAN countries, Latin America, the Middle East, Australia, South Africa, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives