- United States

- /

- Machinery

- /

- NasdaqGM:PFIN

We Wouldn't Rely On P&F Industries's (NASDAQ:PFIN) Statutory Earnings As A Guide

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing P&F Industries (NASDAQ:PFIN).

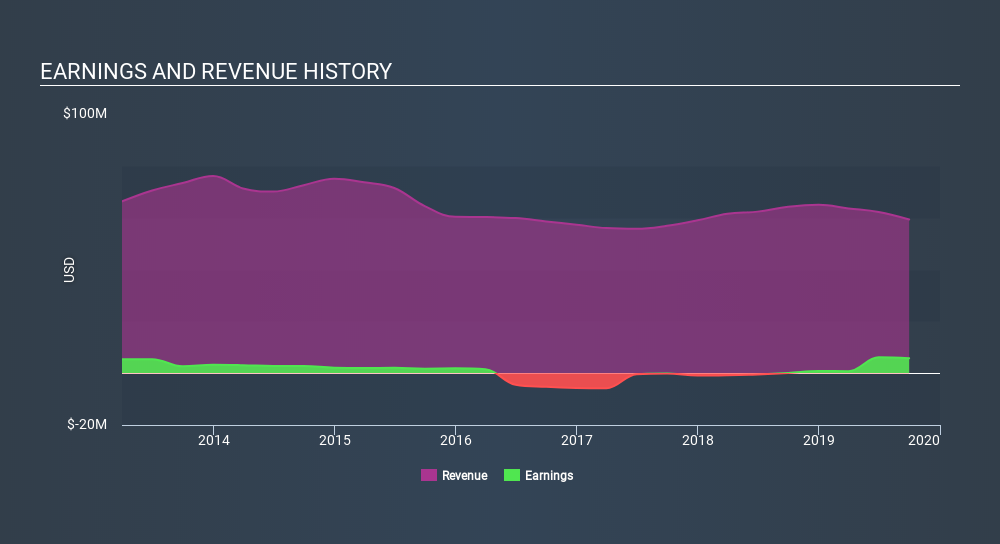

It's good to see that over the last twelve months P&F Industries made a profit of US$5.74m on revenue of US$59.3m. Even though revenue has remained steady over the last three years, you can see in the chart below that the company has moved from loss-making to profitable.

See our latest analysis for P&F Industries

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. This article will discuss how unusual items have impacted P&F Industries's most recent profit results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of P&F Industries.

How Do Unusual Items Influence Profit?

Importantly, our data indicates that P&F Industries's profit received a boost of US$7.7m in unusual items, over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. We can see that P&F Industries's positive unusual items were quite significant relative to its profit in the year to September 2019. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On P&F Industries's Profit Performance

As previously mentioned, P&F Industries's large boost from unusual items won't be there indefinitely, so its statutory earnings are probably a poor guide to its underlying profitability. As a result, we think it may well be the case that P&F Industries's underlying earnings power is lower than its statutory profit. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. At Simply Wall St, we found 3 warning signs for P&F Industries and we think they deserve your attention.

This note has only looked at a single factor that sheds light on the nature of P&F Industries's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:PFIN

P&F Industries

P&F Industries, Inc., through its subsidiaries, designs, imports, manufactures, and sells pneumatic hand tools primarily to the retail, industrial, automotive, and aerospace markets primarily in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives