David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Unifi, Inc. (NYSE:UFI) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Unifi

What Is Unifi's Net Debt?

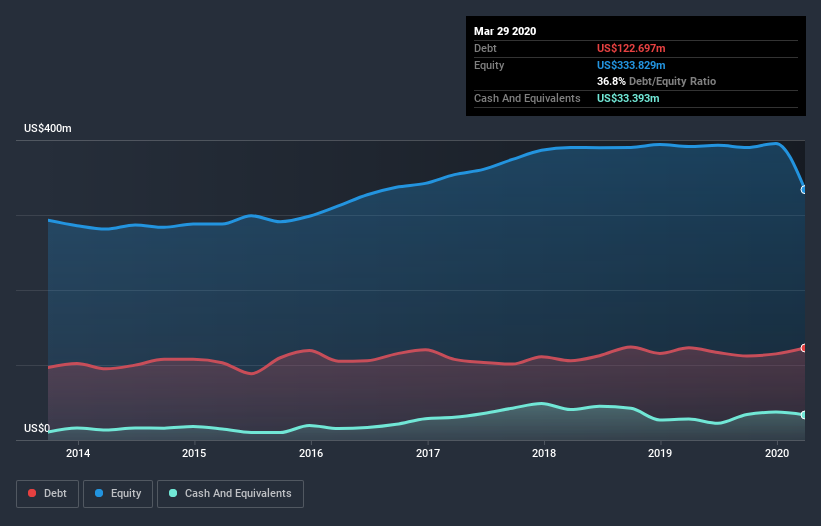

As you can see below, Unifi had US$122.7m of debt, at March 2020, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has US$33.4m in cash leading to net debt of about US$89.3m.

How Strong Is Unifi's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Unifi had liabilities of US$77.9m due within 12 months and liabilities of US$131.3m due beyond that. On the other hand, it had cash of US$33.4m and US$100.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$75.5m.

This deficit isn't so bad because Unifi is worth US$228.6m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Unifi's net debt is sitting at a very reasonable 2.2 times its EBITDA, while its EBIT covered its interest expense just 4.4 times last year. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. One way Unifi could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 15%, as it did over the last year. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Unifi can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, Unifi recorded free cash flow of 34% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

When it comes to the balance sheet, the standout positive for Unifi was the fact that it seems able to grow its EBIT confidently. However, our other observations weren't so heartening. For instance it seems like it has to struggle a bit to convert EBIT to free cash flow. When we consider all the factors mentioned above, we do feel a bit cautious about Unifi's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - Unifi has 1 warning sign we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Unifi, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:UFI

Unifi

Engages in the manufacture and sale of recycled and synthetic products in North America, Central America, South America, Asia, and Europe.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives