We Think Garware Technical Fibres (NSE:GARFIBRES) Can Stay On Top Of Its Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Garware Technical Fibres Limited (NSE:GARFIBRES) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Garware Technical Fibres

How Much Debt Does Garware Technical Fibres Carry?

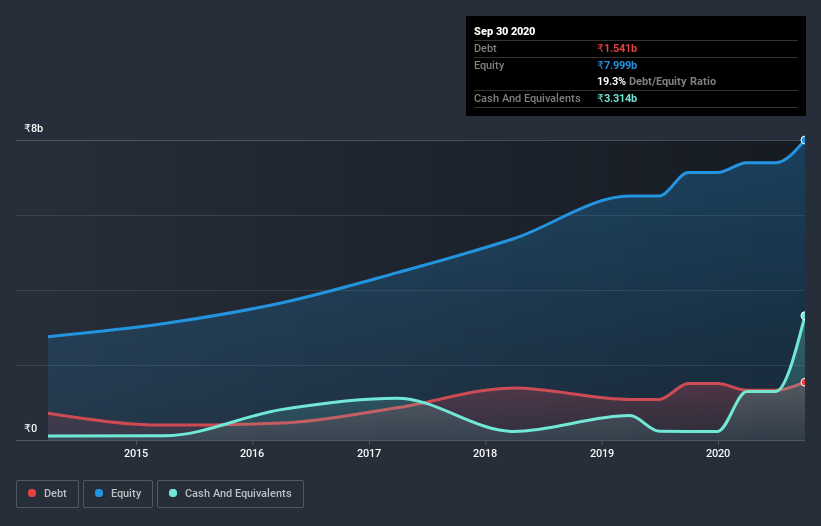

The chart below, which you can click on for greater detail, shows that Garware Technical Fibres had ₹1.54b in debt in September 2020; about the same as the year before. But on the other hand it also has ₹3.31b in cash, leading to a ₹1.77b net cash position.

How Strong Is Garware Technical Fibres's Balance Sheet?

The latest balance sheet data shows that Garware Technical Fibres had liabilities of ₹4.48b due within a year, and liabilities of ₹452.3m falling due after that. Offsetting this, it had ₹3.31b in cash and ₹2.23b in receivables that were due within 12 months. So it can boast ₹608.1m more liquid assets than total liabilities.

Having regard to Garware Technical Fibres's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the ₹44.8b company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, Garware Technical Fibres boasts net cash, so it's fair to say it does not have a heavy debt load!

But the other side of the story is that Garware Technical Fibres saw its EBIT decline by 6.5% over the last year. That sort of decline, if sustained, will obviously make debt harder to handle. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Garware Technical Fibres can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Garware Technical Fibres may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the most recent three years, Garware Technical Fibres recorded free cash flow worth 75% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While it is always sensible to investigate a company's debt, in this case Garware Technical Fibres has ₹1.77b in net cash and a decent-looking balance sheet. And it impressed us with free cash flow of ₹1.4b, being 75% of its EBIT. So is Garware Technical Fibres's debt a risk? It doesn't seem so to us. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Garware Technical Fibres's earnings per share history for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Garware Technical Fibres, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:GARFIBRES

Garware Technical Fibres

Manufactures and sells various technical textile products in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026