- Poland

- /

- Real Estate

- /

- WSE:RNK

Vocento And 2 Other European Penny Stocks To Watch Closely

Reviewed by Simply Wall St

The European market has shown mixed performance recently, with the pan-European STOXX Europe 600 Index remaining flat over a four-day period, while major indexes such as France's CAC 40 and Italy's FTSE MIB posted modest gains. In this context, investors are often drawn to penny stocks for their potential to uncover growth opportunities in smaller or newer companies. Although the term "penny stocks" might seem outdated, it remains relevant as these investments can offer a unique blend of value and growth when backed by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Maps (BIT:MAPS) | €3.44 | €45.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.51 | RON17.25M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.82 | €59.48M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.73 | €17.69M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.50 | PLN12.13M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.47 | SEK2.36B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.62 | SEK220.24M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.135 | €294.77M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.964 | €32.51M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 323 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Vocento (BME:VOC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vocento, S.A. is a multimedia communications company operating in Spain with a market capitalization of €77.10 million.

Operations: Vocento's revenue is primarily derived from its regional newspapers (€188.31 million), ABC newspaper (€73.96 million), classified ads (€31.23 million), agency services (€25.42 million), gastronomy ventures (€17.04 million), digital services (€2.08 million), and supplements & magazines (€13.67 million).

Market Cap: €77.1M

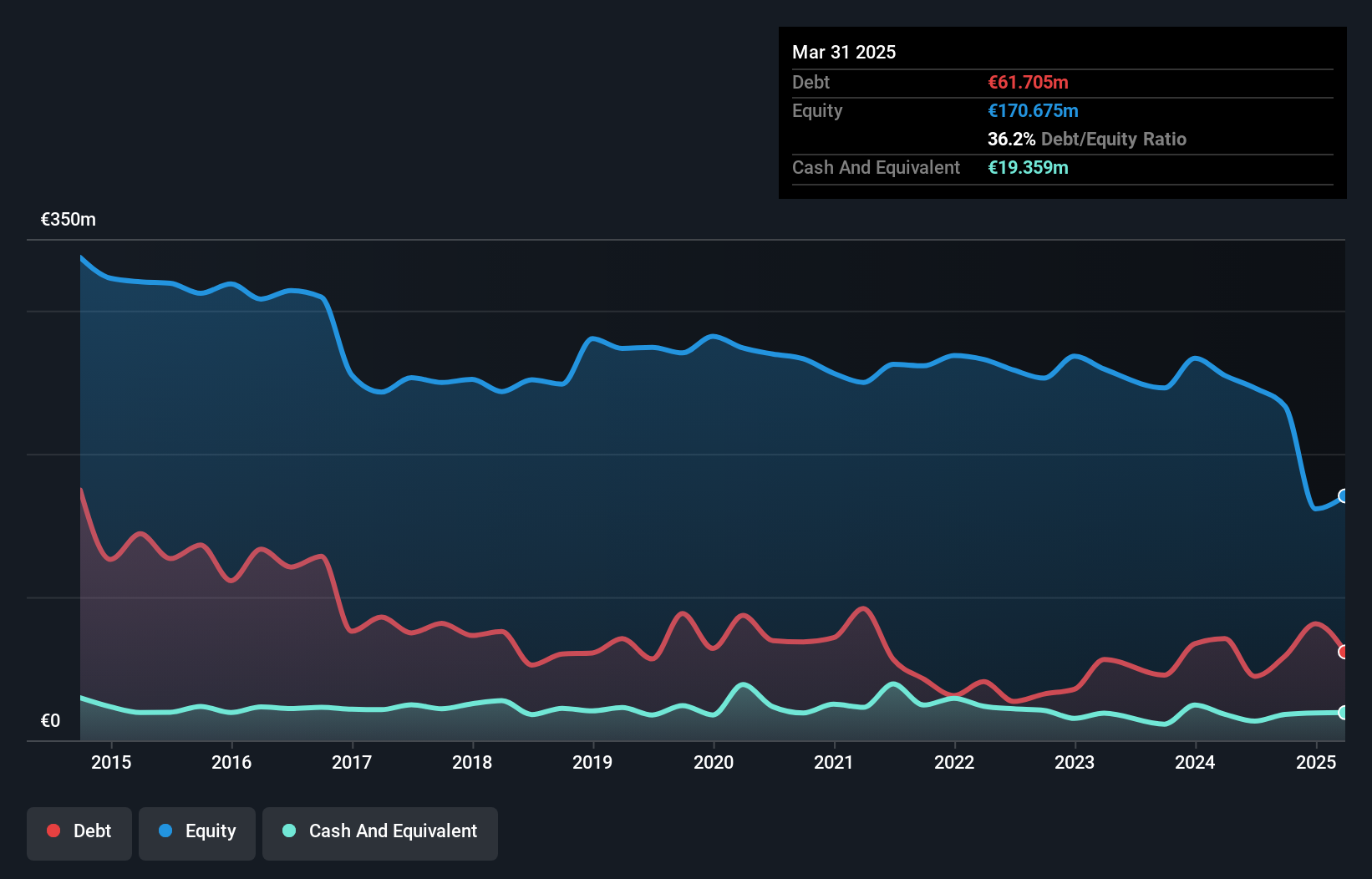

Vocento, S.A., a multimedia communications company in Spain, presents a complex picture for penny stock investors. Despite being unprofitable with losses increasing over the past five years, the company reported a net income of €8.39 million for Q1 2025, marking an improvement from a net loss previously. Vocento trades significantly below its estimated fair value and analysts expect its stock price to rise substantially. The company's short-term assets exceed both its short and long-term liabilities, offering some financial stability. However, the dividend is not well-supported by earnings or free cash flows.

- Dive into the specifics of Vocento here with our thorough balance sheet health report.

- Evaluate Vocento's prospects by accessing our earnings growth report.

Medivir (OM:MVIR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Medivir AB (publ) is a pharmaceutical company that develops and commercializes cancer treatments in the Nordic region, Europe, and internationally, with a market cap of SEK207.51 million.

Operations: The company generates revenue from its Pharmaceuticals segment, totaling SEK3.58 million.

Market Cap: SEK207.51M

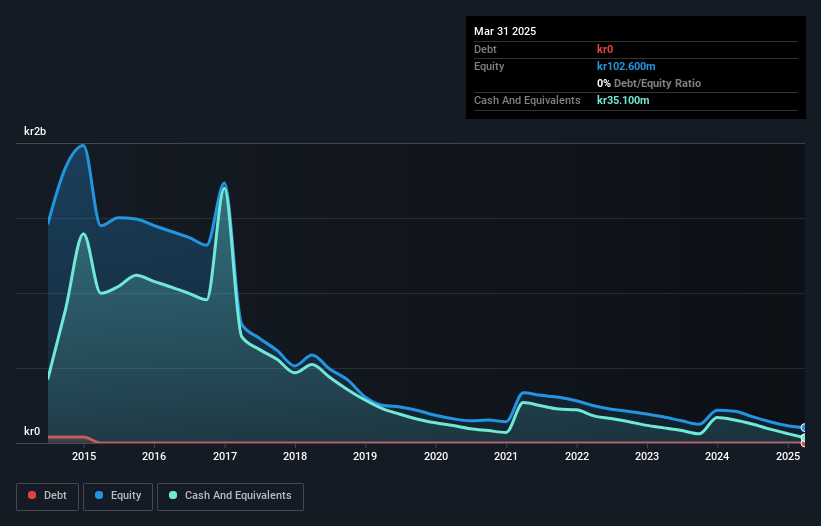

Medivir AB, a pharmaceutical company focused on cancer treatments, presents both opportunities and challenges for penny stock investors. The company is pre-revenue with less than US$1 million in earnings and remains unprofitable, having reported a net loss of SEK 13.3 million for Q1 2025. Despite its financial struggles, Medivir has no debt and its short-term assets surpass both short-term and long-term liabilities, providing some financial cushion. However, the company's cash runway is under a year based on current free cash flow levels. Additionally, the board's inexperience may impact strategic decisions moving forward.

- Click here to discover the nuances of Medivir with our detailed analytical financial health report.

- Gain insights into Medivir's future direction by reviewing our growth report.

Rank Progress (WSE:RNK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Rank Progress S.A. is involved in investing in, developing, renting, and selling commercial real estate properties both in Poland and internationally, with a market cap of PLN151.23 million.

Operations: The company's revenue is derived from leasing property (PLN41.95 million), selling real estate (PLN16.33 million), and providing construction services (PLN7.35 million).

Market Cap: PLN151.23M

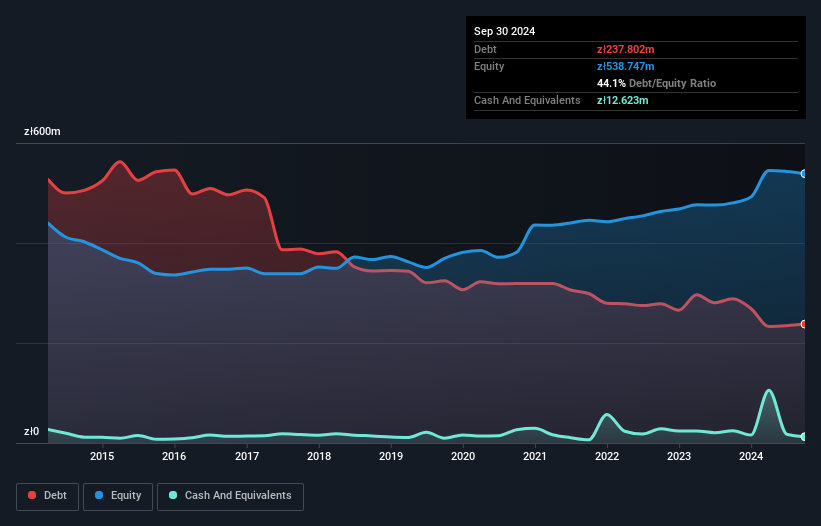

Rank Progress S.A., involved in commercial real estate, offers a mixed outlook for penny stock investors. Despite a market cap of PLN151.23 million and revenue streams from leasing, sales, and construction services totaling PLN65.63 million last year, the company is currently unprofitable with a recent net loss of PLN5.48 million in Q1 2025. Positively, it has reduced its debt-to-equity ratio to 43% over five years and maintains short-term assets exceeding both short- and long-term liabilities. However, negative cash flow challenges its ability to cover debt effectively while interest coverage remains weak at 1.4 times EBIT.

- Take a closer look at Rank Progress' potential here in our financial health report.

- Gain insights into Rank Progress' past trends and performance with our report on the company's historical track record.

Taking Advantage

- Access the full spectrum of 323 European Penny Stocks by clicking on this link.

- Interested In Other Possibilities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:RNK

Rank Progress

Invests in, develops, rents, and sells commercial real estate properties in Poland and internationally.

Adequate balance sheet very low.

Market Insights

Community Narratives