- Hong Kong

- /

- Semiconductors

- /

- SEHK:968

Viva Goods And 2 Other Promising Asian Penny Stocks To Consider

Reviewed by Simply Wall St

The Asian markets have been navigating a complex landscape, with global trade tensions and economic data influencing investor sentiment. In this context, identifying promising investment opportunities requires a keen eye for stocks that balance potential growth with financial stability. While the term "penny stocks" may seem outdated, it still captures the essence of smaller or newer companies that offer affordable entry points and significant upside potential when backed by strong fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.20 | THB4.15B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.44 | HK$908.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.12 | HK$3.66B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.42 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.54 | SGD218.86M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.84 | SGD11.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB1.01 | THB1.49B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.88 | THB9.86B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.63 | SGD995.89M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 980 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Viva Goods (SEHK:933)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Viva Goods Company Limited, with a market cap of HK$5.58 billion, is an investment holding company that supplies apparel and footwear across the United Kingdom, Republic of Ireland, United States, People's Republic of China, Asia, Europe, the Middle East and Africa.

Operations: The company generates revenue from its Sports Experience segment, which contributes HK$559.30 million, and its Multi-Brand Apparel and Footwear segment, accounting for HK$9.87 billion.

Market Cap: HK$5.58B

Viva Goods Company Limited, with a market cap of HK$5.58 billion, is currently unprofitable but has shown financial resilience through reduced debt levels and strong asset coverage. Its cash exceeds total debt, and operating cash flow covers 83.6% of its liabilities. Recent strategic moves include appointing Victor Herrero as Co-CEO to leverage his extensive industry experience and initiating a significant share buyback program aimed at enhancing shareholder value. The management team and board are seasoned, with an average tenure exceeding five years. Despite challenges in profitability, these steps may position Viva Goods for future growth opportunities in the competitive apparel sector.

- Click to explore a detailed breakdown of our findings in Viva Goods' financial health report.

- Understand Viva Goods' track record by examining our performance history report.

Xinyi Solar Holdings (SEHK:968)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xinyi Solar Holdings Limited is an investment holding company that produces, sells, and trades solar glass products across Mainland China, the rest of Asia, North America, Europe, and internationally with a market cap of HK$28.23 billion.

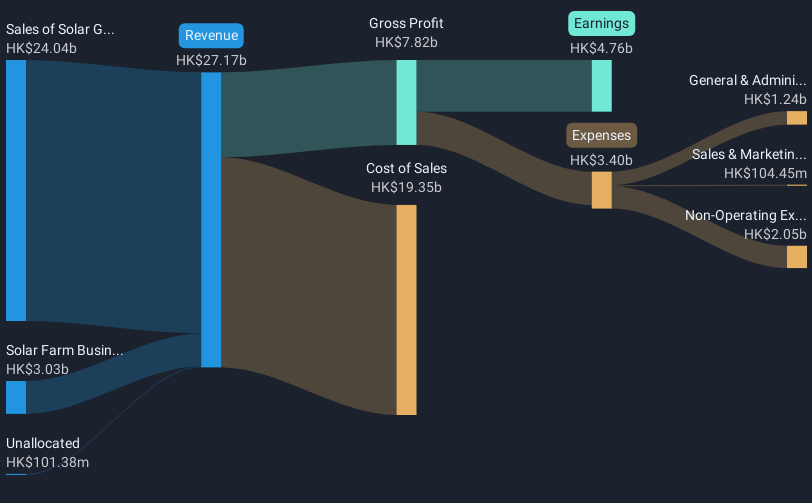

Operations: The company's revenue is primarily derived from the sales of solar glass, which generated CN¥18.07 billion, and its solar farm business including EPC services, contributing CN¥3.03 billion.

Market Cap: HK$28.23B

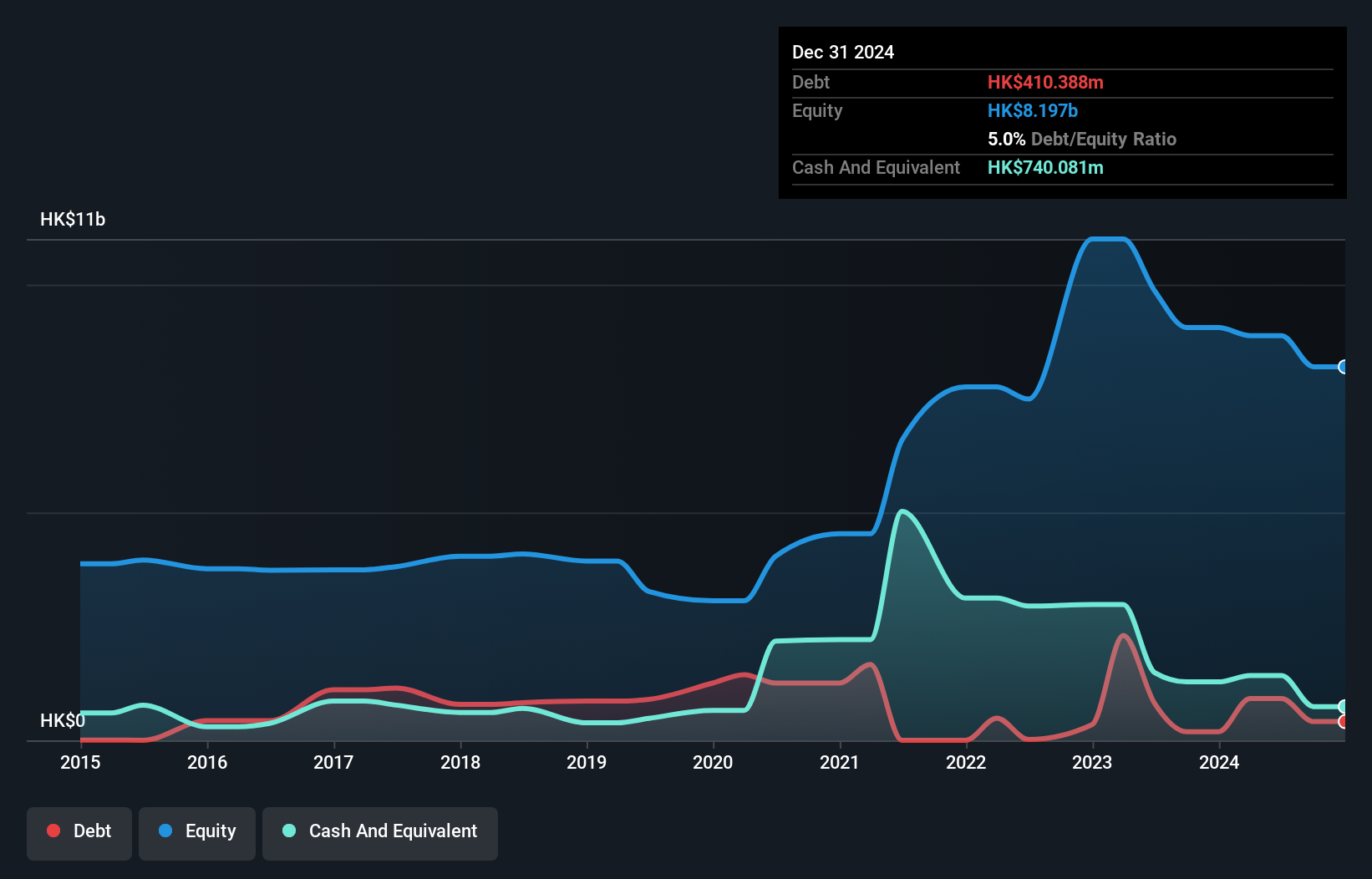

Xinyi Solar Holdings, with a market cap of HK$28.23 billion, faces challenges as recent earnings reflect a decline in net income to CN¥745.76 million for the first half of 2025 due to oversupply and reduced solar glass prices. Despite this, the company maintains strong asset coverage with short-term assets exceeding both short and long-term liabilities. The board is experienced, averaging 11.9 years in tenure, which may provide stability during downturns. Although currently unprofitable with negative return on equity, Xinyi Solar's debt management remains satisfactory after reducing its debt-to-equity ratio over five years and completing a Panda Bonds issuance of RMB 800 million at favorable terms.

- Dive into the specifics of Xinyi Solar Holdings here with our thorough balance sheet health report.

- Gain insights into Xinyi Solar Holdings' outlook and expected performance with our report on the company's earnings estimates.

Geo Energy Resources (SGX:RE4)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Geo Energy Resources Limited is an investment holding company involved in the mining, production, and trading of coal, with a market capitalization of SGD530.78 million.

Operations: Geo Energy Resources Limited does not report specific revenue segments.

Market Cap: SGD530.78M

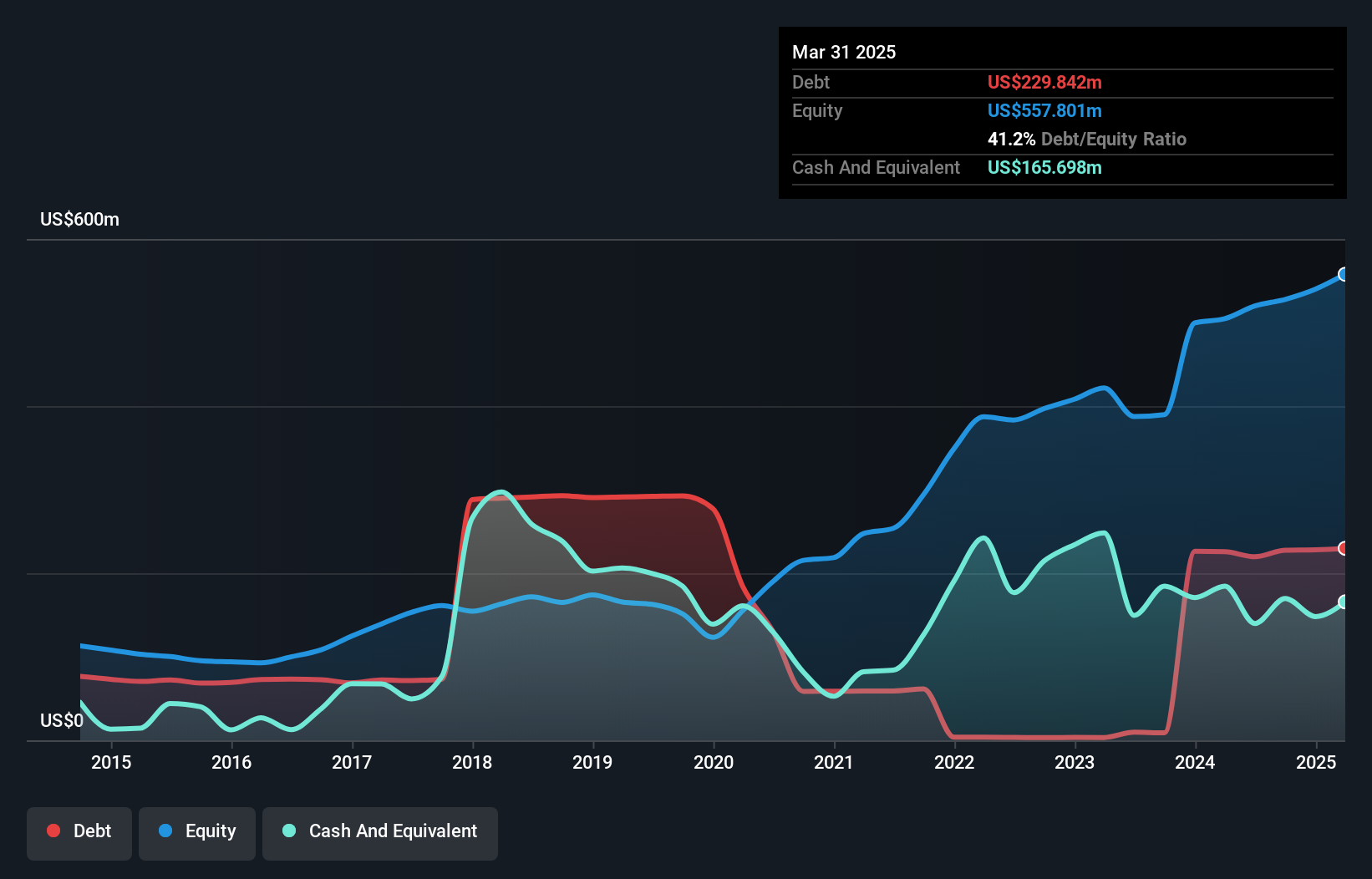

Geo Energy Resources Limited, with a market capitalization of SGD530.78 million, has shown significant revenue growth, reporting US$166.41 million in sales for Q1 2025 compared to US$98.96 million the previous year. Despite this progress, its earnings growth remains negative over the past year and its return on equity is low at 7.7%. The company’s debt management has improved significantly, reducing its debt-to-equity ratio from 118.2% to 41.2% over five years, and operating cash flow covers debt well at 30.8%. However, interest payments are not fully covered by EBIT and dividend sustainability is unstable.

- Take a closer look at Geo Energy Resources' potential here in our financial health report.

- Understand Geo Energy Resources' earnings outlook by examining our growth report.

Where To Now?

- Investigate our full lineup of 980 Asian Penny Stocks right here.

- Seeking Other Investments? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:968

Xinyi Solar Holdings

An investment holding company, produces, sells, and trades in solar glass products in Mainland China, rest of Asia, North America, Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives