Verizon Communications (NYSE:VZ) Declares Consistent Quarterly Dividend of US$0.68 Per Share

Reviewed by Simply Wall St

Verizon Communications (NYSE:VZ) announced a quarterly dividend affirmation of 67.75 cents per share, maintaining stability in shareholder returns. The company's share price remained flat last week, despite broader positive movements in major U.S. stock indexes, which were bolstered by a strong May jobs report. This announcement reflects an ongoing commitment to shareholder value, offering a counterbalance to the generally buoyant market that saw indexes like the S&P 500 hit a milestone. As the overall market posted gains, Verizon's consistent dividend policy reinforced investor confidence, even as it did not translate into significant stock movement last week.

We've identified 2 risks for Verizon Communications that you should be aware of.

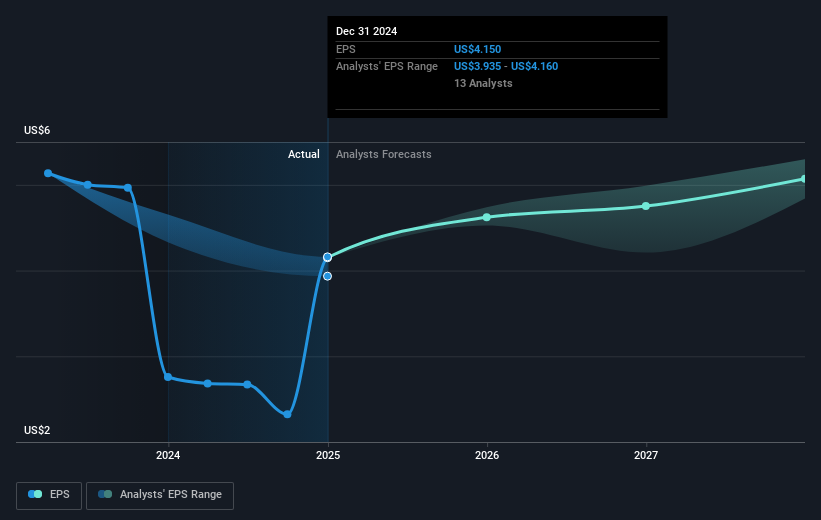

Verizon Communications' dividend affirmation at US$0.6775 per share highlights stability in shareholder returns, yet its share price remained flat while major U.S. indexes experienced gains. This announcement aligns with Verizon's focus on network convergence and customer retention, which is expected to positively influence subscriber growth and revenue over time. Analysts forecast Verizon's revenue to grow by 1.7% annually over the next three years, with earnings projected to reach US$21.7 billion by 2028. This outlook is supported by the company's initiatives, such as expanding fiber and C-Band networks, although intense competition and regulatory challenges may impact margins.

Verizon's share performance has faced challenges over the past year, underperforming the US market by returning only 11.82% in total shareholder returns, which includes both price and dividends. Comparatively, the US market returned 11% over this period. This performance context is essential given that the stock currently trades near US$44.15, which is a discount from the consensus price target of US$48.07. Despite the 8.1% gap to the price target, analysts maintain it does not present significant upside potential under current market conditions. Investor sentiment could be influenced by the stable dividend policy, yet market pressures and competition remain key considerations in predicting Verizon's trajectory.

Evaluate Verizon Communications' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives