- United States

- /

- Healthcare Services

- /

- NYSE:UNH

UnitedHealth Group (UNH) Reports US$3,406 Million Net Income For Second Quarter 2025

Reviewed by Simply Wall St

UnitedHealth Group (UNH) reported a decline in net income and diluted EPS for the second quarter, though it showed growth for the first half of 2025. This earnings announcement coincided with a 8.4% drop in the company's share price over the last week, which may have been influenced by these mixed financial results. Despite a generally positive market environment, with indices like the S&P 500 experiencing volatility and focusing on technology earnings and Federal Reserve rate decisions, UnitedHealth's financial performance possibly added weight to its downward price movement, diverging from market trends.

We've spotted 1 possible red flag for UnitedHealth Group you should be aware of.

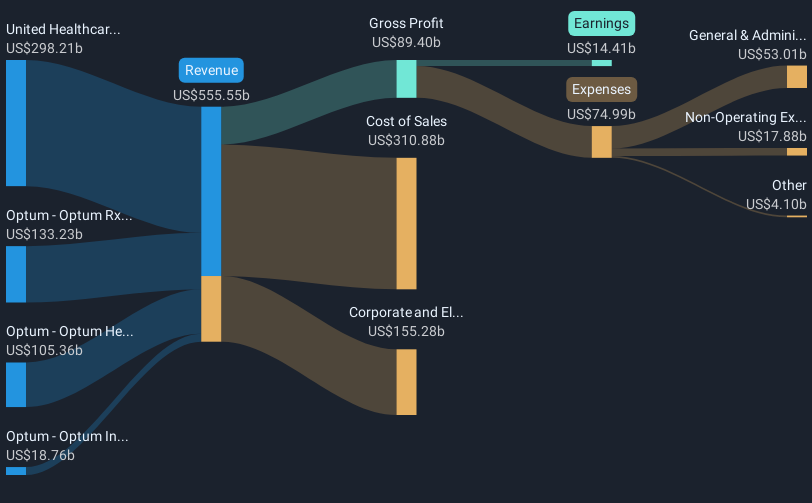

The recent decline in UnitedHealth Group's (UNH) share price, potentially due to mixed second-quarter results, underscores ongoing challenges within their Medicare strategy and CMS risk model execution. Though UNH's revenue of US$422.82 billion and earnings of US$21.30 billion suggest a substantial operational scale, the financial results drew market attention, impacting its shares. A five-year total return of 7.47% highlights some underperformance, especially contrasting its -36% return against the US Healthcare industry over the past year.

As analysts predict a 7.8% annual revenue growth with a slight profit margin contraction from 5.4% to 4.9% over the next three years, the current market response could pressure these forecasts. The mixed performance has brought shares to a level of US$261.07, which is significantly below the analyst consensus price target of US$363.54, reflecting a potential opportunity if revenue stabilizes and earnings meet expectations. Nonetheless, with only a quarter of analyst forecasts aligning within a statistically confident range, considerable uncertainty persists. This market perspective may catalyze increased focus on UNH's planned technological investments and Medicare adjustments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives