Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Uni-Select Inc. (TSE:UNS) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Uni-Select

What Is Uni-Select's Net Debt?

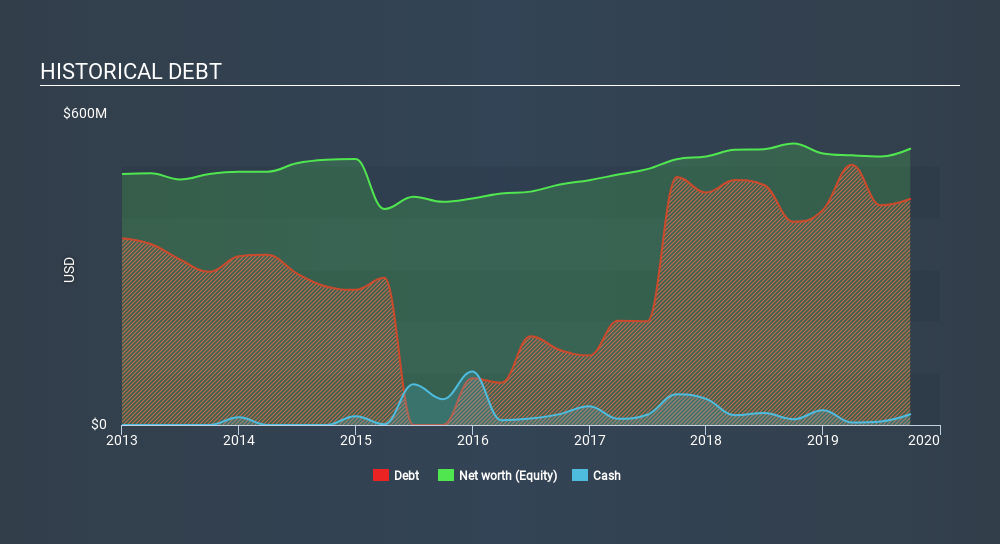

You can click the graphic below for the historical numbers, but it shows that as of September 2019 Uni-Select had US$436.0m of debt, an increase on US$404.6m, over one year. However, it also had US$20.8m in cash, and so its net debt is US$415.2m.

A Look At Uni-Select's Liabilities

Zooming in on the latest balance sheet data, we can see that Uni-Select had liabilities of US$526.6m due within 12 months and liabilities of US$569.7m due beyond that. Offsetting these obligations, it had cash of US$20.8m as well as receivables valued at US$302.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$773.6m.

This deficit casts a shadow over the US$333.8m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Uni-Select would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about Uni-Select's net debt to EBITDA ratio of 4.2, we think its super-low interest cover of 2.4 times is a sign of high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Worse, Uni-Select's EBIT was down 25% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Uni-Select's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Uni-Select recorded free cash flow worth a fulsome 98% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

On the face of it, Uni-Select's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Overall, it seems to us that Uni-Select's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Uni-Select's dividend history, without delay!

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:UNS

Uni-Select

Uni-Select Inc., together with its subsidiaries, distributes automotive refinish, and industrial coatings and related products in North America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives