- United States

- /

- Pharma

- /

- OTCPK:ELTP

Uncovering Hidden Gems: Penny Stocks To Consider In June 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a modest uptick amid ongoing trade discussions between President Trump and China's Xi Jinping, investors are keenly observing economic indicators like the upcoming jobs report. In such a climate, penny stocks—often representing smaller or newer companies—still capture attention for their potential to offer growth at accessible price points. Despite being an older term, these stocks remain relevant as they can provide unique opportunities when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.02 | $104.28M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $0.97 | $28.55M | ✅ 4 ⚠️ 5 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.02 | $36.88M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.05 | $174.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.80 | $183.33M | ✅ 4 ⚠️ 0 View Analysis > |

| Table Trac (TBTC) | $4.8375 | $22.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Flexible Solutions International (FSI) | $4.36 | $57.04M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.84 | $5.96M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.40 | $79.12M | ✅ 3 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $2.86 | $396.56M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 715 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Sagimet Biosciences (SGMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sagimet Biosciences Inc. is a clinical-stage biopharmaceutical company focused on developing novel therapeutics known as fatty acid synthase (FASN) inhibitors to treat diseases stemming from dysfunctional metabolic pathways, with a market cap of $116.87 million.

Operations: Sagimet Biosciences does not have any reported revenue segments.

Market Cap: $116.87M

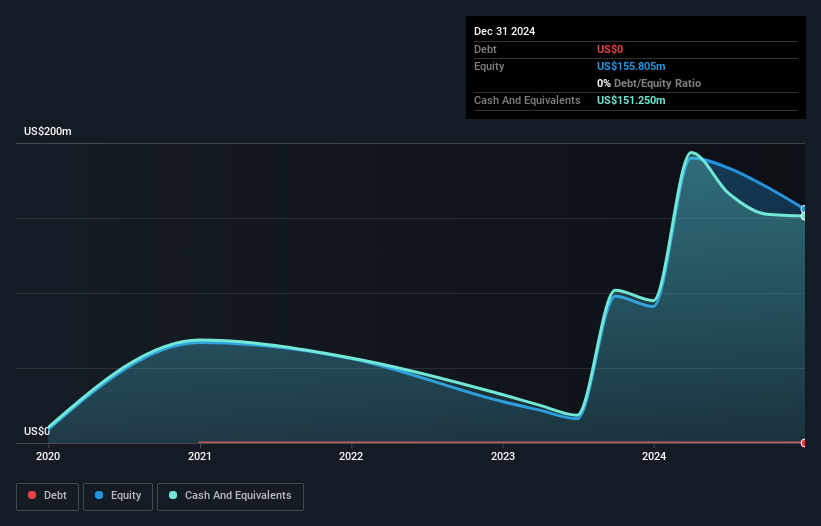

Sagimet Biosciences, with a market cap of US$116.87 million, is pre-revenue and focuses on developing FASN inhibitors for metabolic diseases. The company recently reported successful Phase 3 trial results in China for its acne treatment denifanstat, meeting all primary and secondary endpoints. This positions Sagimet to capitalize on the large US acne market as it initiates a Phase 1 trial with TVB-3567. Despite being unprofitable with increasing losses over five years, Sagimet remains debt-free and has sufficient cash runway for more than a year based on current free cash flow trends.

- Click here to discover the nuances of Sagimet Biosciences with our detailed analytical financial health report.

- Evaluate Sagimet Biosciences' prospects by accessing our earnings growth report.

Elite Pharmaceuticals (ELTP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elite Pharmaceuticals, Inc. is a specialty pharmaceutical company focused on developing, manufacturing, and selling oral controlled-release and generic pharmaceuticals with a market cap of $576.65 million.

Operations: Elite Pharmaceuticals generates revenue from its Abbreviated New Drug Applications (ANDA) segment, amounting to $70.00 million.

Market Cap: $576.65M

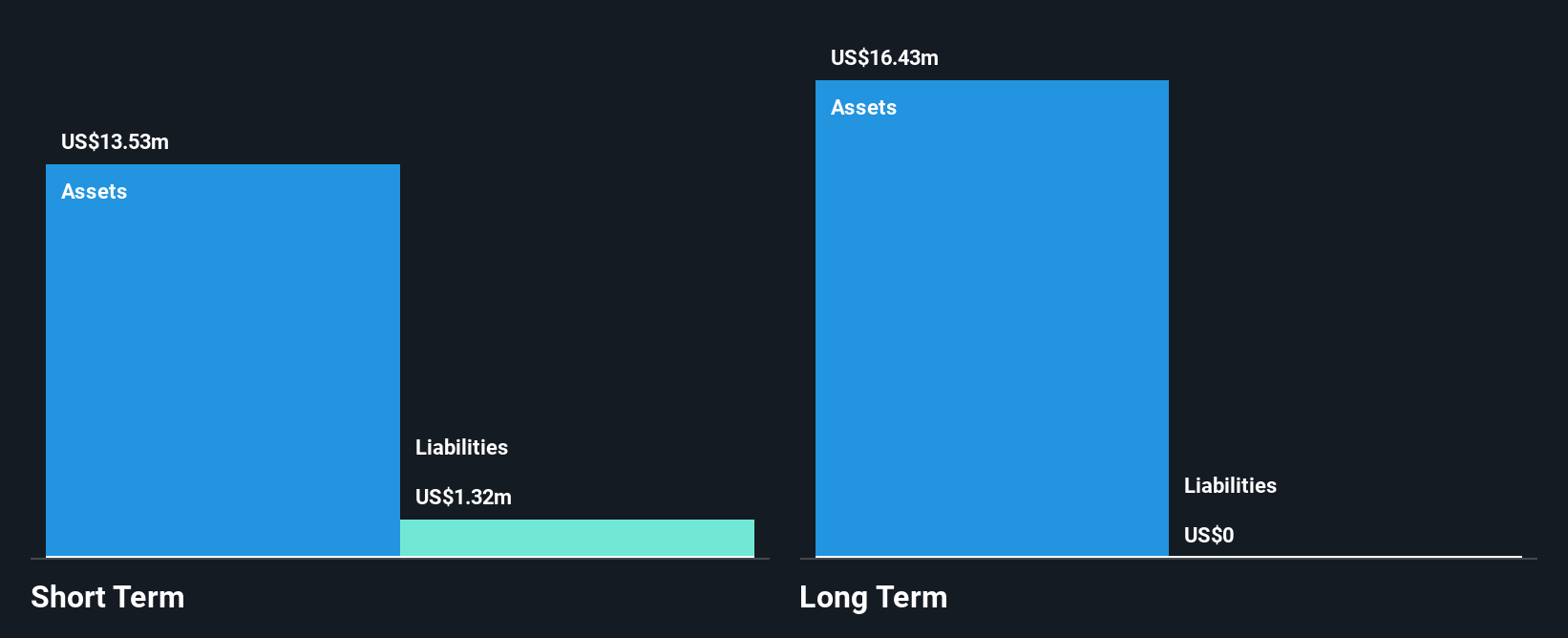

Elite Pharmaceuticals, with a market cap of US$576.65 million, generates US$70 million in revenue from its ANDA segment despite being unprofitable. The company has effectively reduced its losses over the past five years by 14.5% annually and maintains a stable financial position with more cash than debt. Its seasoned management and board, averaging tenures of 11.3 and 13.8 years respectively, contribute to strategic stability. Elite's short-term assets exceed both short- and long-term liabilities, providing a solid foundation for future growth while maintaining positive free cash flow sufficient for over three years of operations without additional funding needs.

- Navigate through the intricacies of Elite Pharmaceuticals with our comprehensive balance sheet health report here.

- Gain insights into Elite Pharmaceuticals' historical outcomes by reviewing our past performance report.

Liquidmetal Technologies (LQMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liquidmetal Technologies, Inc. is a materials technology company that designs, develops, and sells custom products and parts made from bulk amorphous alloys to various industries globally, with a market cap of approximately $93.56 million.

Operations: The company generates revenue primarily from developing and manufacturing products and applications using amorphous alloys, totaling $0.97 million.

Market Cap: $93.56M

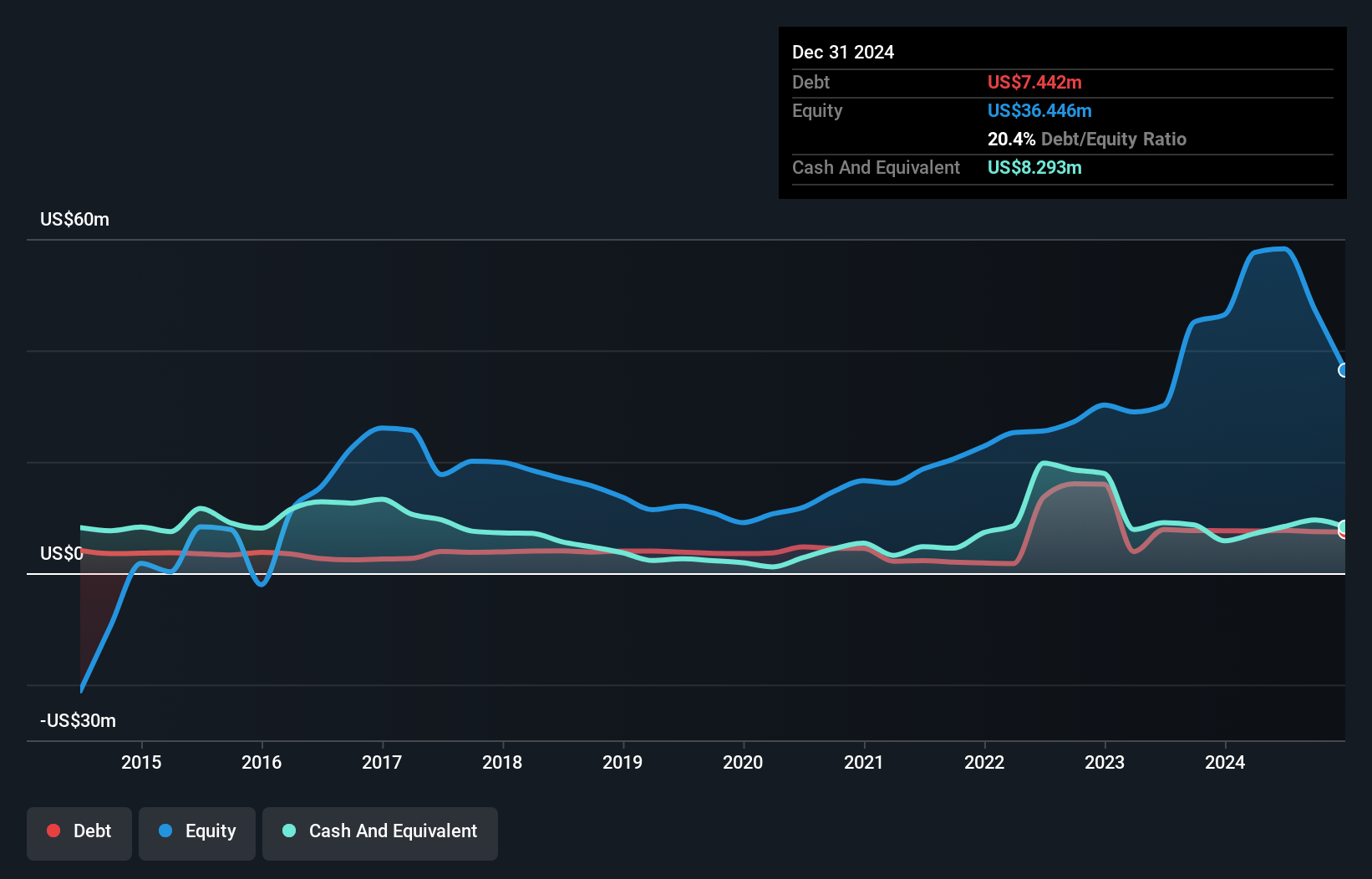

Liquidmetal Technologies, with a market cap of US$93.56 million, is pre-revenue, generating less than US$1 million annually. Despite being unprofitable, the company has reduced its losses by 21.1% per year over the past five years and maintains a debt-free status with sufficient cash runway for over three years based on current free cash flow trends. The board's average tenure of 8.7 years suggests experienced oversight. Recent earnings reports show revenue growth from US$0.173 million to US$0.282 million year-over-year for Q1 2025, though net losses have increased to US$0.568 million from US$0.314 million in the same period last year.

- Jump into the full analysis health report here for a deeper understanding of Liquidmetal Technologies.

- Review our historical performance report to gain insights into Liquidmetal Technologies' track record.

Key Takeaways

- Jump into our full catalog of 715 US Penny Stocks here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elite Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:ELTP

Elite Pharmaceuticals

A specialty pharmaceutical company, engages in the development, manufacture, and sale of oral, controlled-release products, and generic pharmaceuticals.

Flawless balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives